Assessing Symrise’s Valuation After 7% Jump and Expansion News in 2025

Reviewed by Bailey Pemberton

If you’ve been watching Symrise stock lately, you’re not alone in wondering whether now is the right time to make a move. After all, the company’s share price has jumped 3.0% in the last week and 7.2% over the past month. Yet, when you zoom out, the bigger picture is more complex. Year to date, Symrise is down about 20.8%, and over the last five years, it has slipped by more than 20%. These numbers might make you pause and ask what’s really driving the stock’s story right now.

Some of this recent momentum can be linked to news around Symrise’s expansion efforts in key growth markets and its strategic investments in natural ingredients. Investors seem to be warming up to the long-term vision the company has outlined, even if risk factors like market volatility have not entirely faded. In this context, judging the stock’s true value becomes especially important.

If you’re curious about the numbers behind the narrative, our valuation score for Symrise sits at 2 out of 6. This means Symrise is currently undervalued in two of the six key valuation checks we analyze, hinting at both opportunities and limitations for those eyeing an entry point.

So, how do these valuation checks work, and what do they really tell us about Symrise’s outlook? Let’s dig into the different methods for valuing the stock. Stick around, because we’ll finish with a smarter, more comprehensive way to think about company value that goes far beyond the usual metrics.

Symrise scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Symrise Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates what Symrise is worth today by projecting its future cash flows and then discounting those cash flows back to the present using a required rate of return. This method is widely used to capture the intrinsic value of a business based on how much cash it is expected to generate.

Symrise’s current Free Cash Flow stands at €576.2 million. Analyst estimates suggest Free Cash Flow will reach €689 million by 2029, and projections for the next ten years anticipate a gradual increase, with future years extrapolated based on past trends. These forecasts, converted into today’s money using a discount rate, help provide a clearer picture of what the company is fundamentally worth.

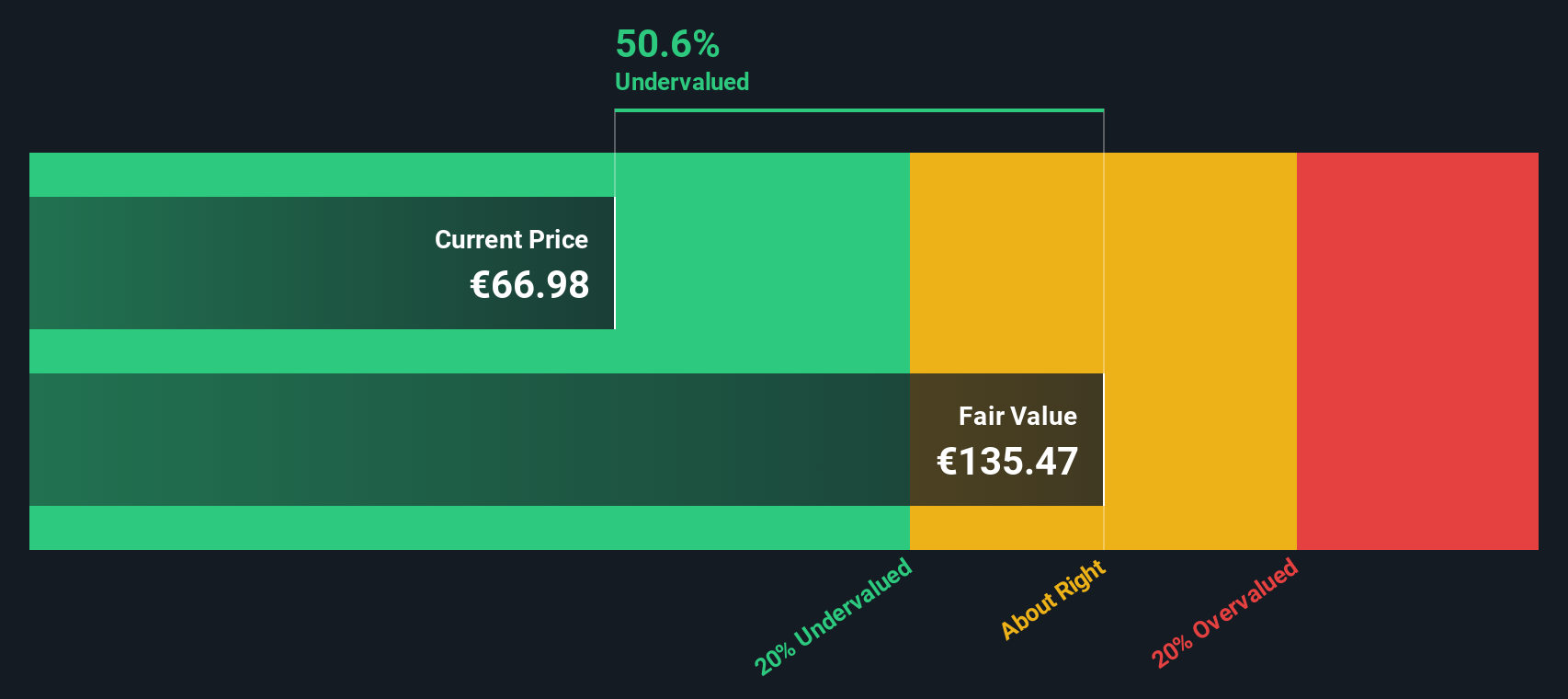

Based on the 2 Stage Free Cash Flow to Equity model, Symrise’s intrinsic value is calculated at €121.49 per share. This is 33.2% above where the stock is currently trading, indicating the market may be undervaluing Symrise compared to the company’s long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Symrise is undervalued by 33.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Symrise Price vs Earnings (PE)

The price-to-earnings (PE) ratio is a common metric for profitable companies because it lets investors see how much they are paying for each euro of earnings. For companies like Symrise that generate consistent profits, the PE ratio helps highlight how the market values its current and future earnings power.

Growth expectations and perceived risk play significant roles in determining what a “fair” PE should be. Companies with faster growth and lower risk usually command higher multiples, while those facing more uncertainty or slower expansion trade at lower ones.

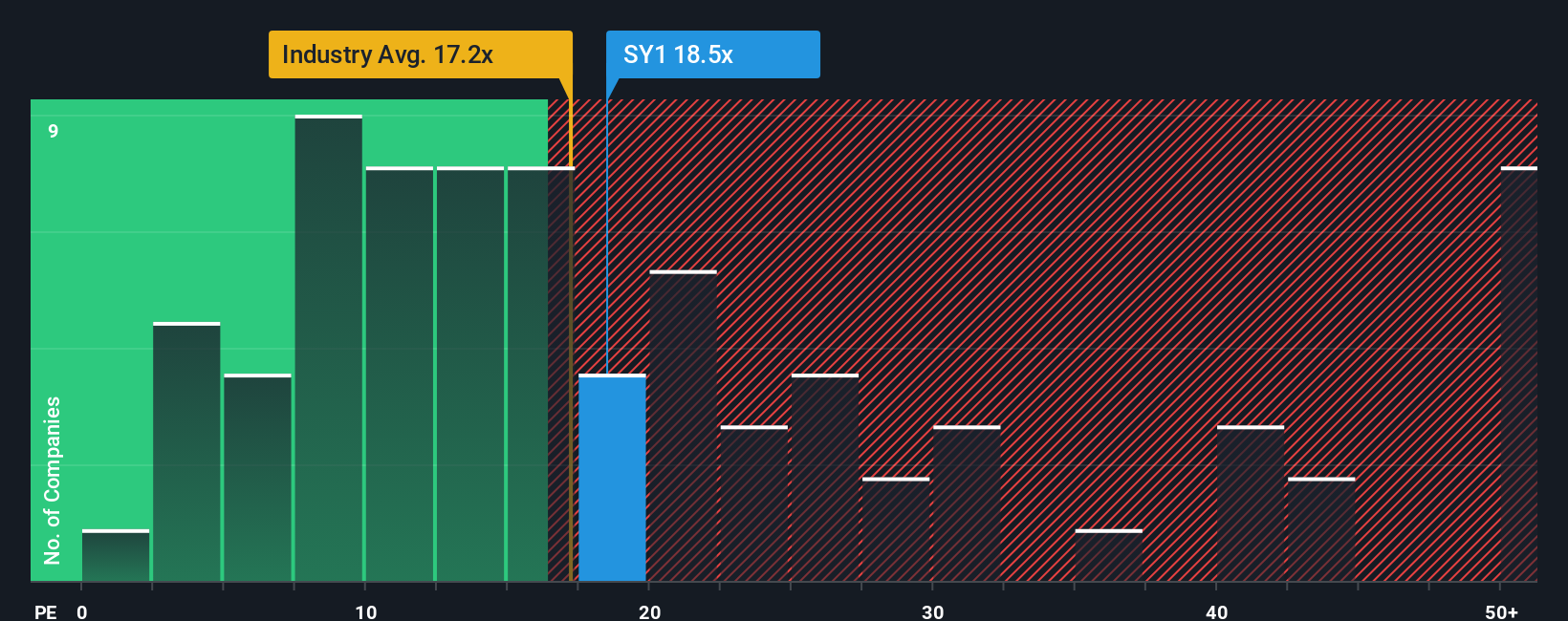

Symrise currently trades on a PE ratio of 22.4x. This is nearly in line with the Chemicals industry average of 22.6x and slightly above the peer group average of 20.2x. While industry and peer averages offer useful reference points, they only provide part of the picture.

This is where Simply Wall St’s proprietary “Fair Ratio” is relevant. The Fair Ratio for Symrise is 19.6x, which reflects not only its sector but also the company’s specific growth, profitability, risk profile, and size. Unlike a simple comparison to peers or sector averages, the Fair Ratio aims to give a more precise benchmark tailored to the company’s individual characteristics.

Comparing Symrise’s current PE of 22.4x to the Fair Ratio of 19.6x, the stock appears somewhat overvalued, with the actual ratio sitting above what would be justified given its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Symrise Narrative

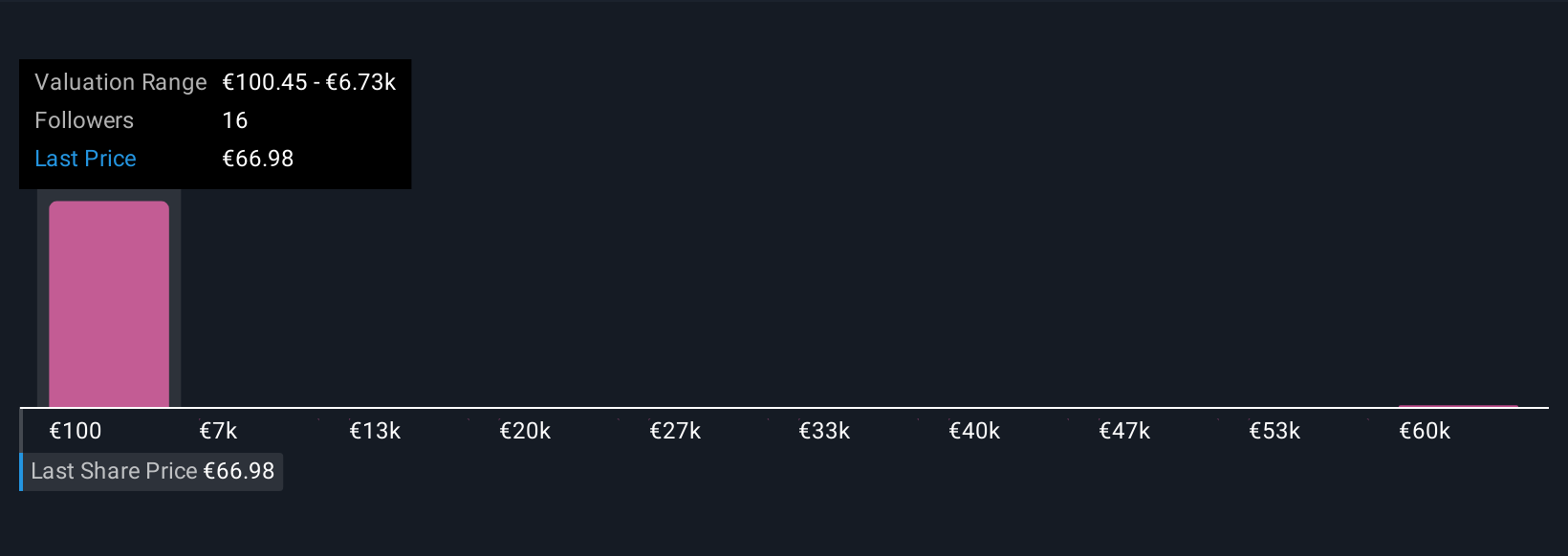

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative lets you connect your personal beliefs about Symrise’s future, including how it will grow, what risks shape its journey, and the milestones you expect, to a specific financial forecast and a fair value for the stock. In simple terms, a Narrative is the story you believe about a company brought to life by numbers: your views on revenue, earnings, profit margins, and the share price all combined.

On Simply Wall St’s Community page, millions of investors use Narratives to make smarter, quicker decisions. Narratives make complex analysis approachable, letting you see at a glance if the numbers back up your investment story and whether Symrise’s current price is above or below your fair value. In addition, as new news or earnings updates arrive, Narratives are automatically refreshed to help you stay ahead without any extra work.

For example, with Symrise, some investors see emerging market expansion and premium pricing power driving a price target as high as €130, while others, concerned about cost pressures and slower growth, set their sights closer to €90. Narratives help you compare these perspectives and decide what makes sense for you.

Do you think there's more to the story for Symrise? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SY1

Symrise

Operates as a supplier of fragrances, flavorings, cosmetic base materials and active ingredients, and functional ingredients and solutions in Europe, Africa, the Middle East, North America, the Asia Pacific, and Latin America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026