A Piece Of The Puzzle Missing From BRAIN Biotech AG's (ETR:BNN) 38% Share Price Climb

BRAIN Biotech AG (ETR:BNN) shares have had a really impressive month, gaining 38% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 21% is also fairly reasonable.

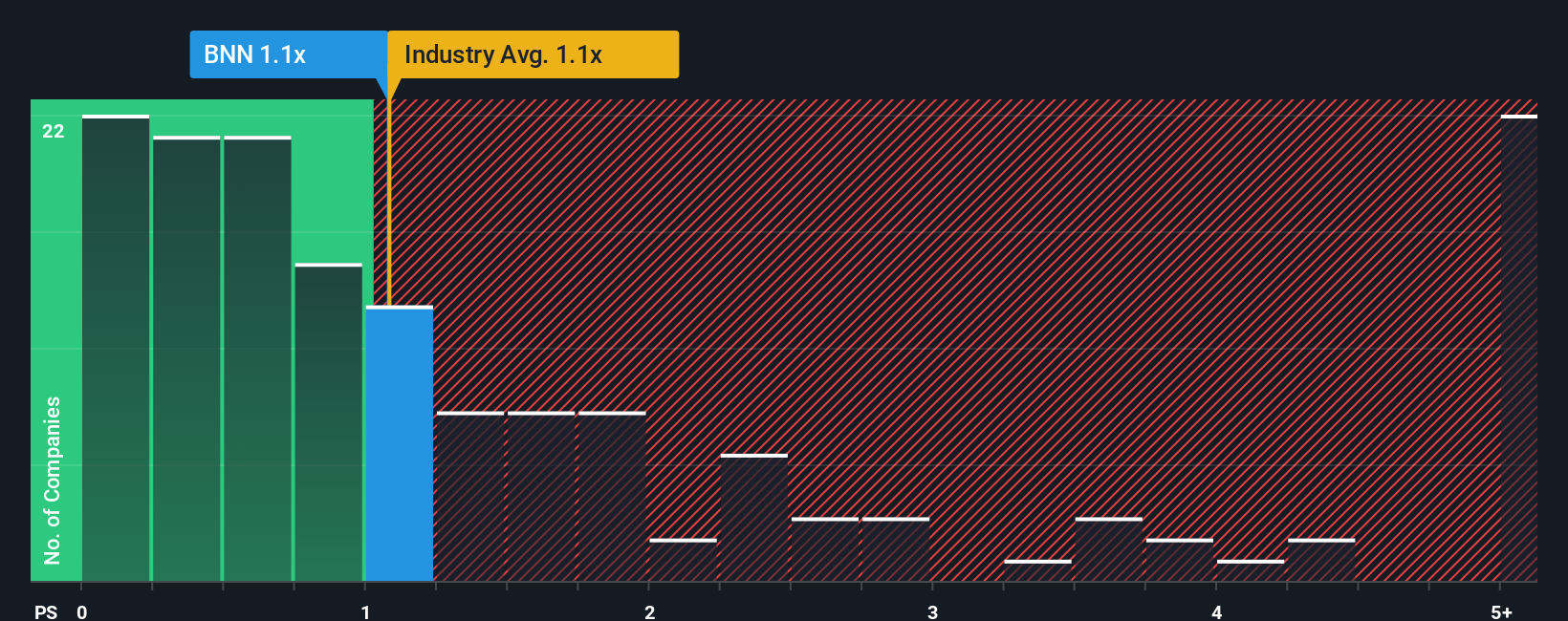

Even after such a large jump in price, it's still not a stretch to say that BRAIN Biotech's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Chemicals industry in Germany, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for BRAIN Biotech

What Does BRAIN Biotech's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, BRAIN Biotech has been very sluggish. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BRAIN Biotech.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like BRAIN Biotech's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.9% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 20% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 10.0% each year over the next three years. That's shaping up to be materially higher than the 2.9% per annum growth forecast for the broader industry.

With this information, we find it interesting that BRAIN Biotech is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From BRAIN Biotech's P/S?

BRAIN Biotech appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, BRAIN Biotech's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with BRAIN Biotech, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if BRAIN Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:BNN

BRAIN Biotech

Provides bio-based products and solutions in Germany, the United States, France, the Netherlands, and the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026