If we're looking to avoid a business that is in decline, what are the trends that can warn us ahead of time? A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. This reveals that the company isn't compounding shareholder wealth because returns are falling and its net asset base is shrinking. Having said that, after a brief look, BASF (ETR:BAS) we aren't filled with optimism, but let's investigate further.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for BASF, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

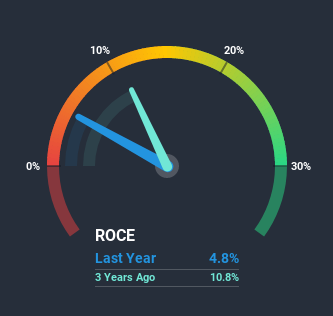

0.048 = €3.1b ÷ (€80b - €16b) (Based on the trailing twelve months to December 2020).

Therefore, BASF has an ROCE of 4.8%. In absolute terms, that's a low return and it also under-performs the Chemicals industry average of 6.4%.

See our latest analysis for BASF

Above you can see how the current ROCE for BASF compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering BASF here for free.

What Can We Tell From BASF's ROCE Trend?

There is reason to be cautious about BASF, given the returns are trending downwards. About five years ago, returns on capital were 12%, however they're now substantially lower than that as we saw above. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. Companies that exhibit these attributes tend to not be shrinking, but they can be mature and facing pressure on their margins from competition. If these trends continue, we wouldn't expect BASF to turn into a multi-bagger.

The Bottom Line On BASF's ROCE

In summary, it's unfortunate that BASF is generating lower returns from the same amount of capital. Investors must expect better things on the horizon though because the stock has risen 31% in the last five years. Either way, we aren't huge fans of the current trends and so with that we think you might find better investments elsewhere.

One more thing: We've identified 2 warning signs with BASF (at least 1 which is potentially serious) , and understanding these would certainly be useful.

While BASF isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you decide to trade BASF, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BASF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:BAS

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives