Assessing BASF (XTRA:BAS) Valuation as Shares Rebound and Cost-Cutting Plans Take Shape

Reviewed by Simply Wall St

BASF (XTRA:BAS) has steadily drawn attention among investors curious about the trajectory of the stock after recent performance data. With returns fluctuating over the month and past 3 months, market watchers are assessing BASF’s direction in today's environment.

See our latest analysis for BASF.

BASF’s share price has regained some ground recently, with a 3.82% jump over the last week hinting at renewed interest following months of mixed momentum. Over the past year, however, the 1-year total shareholder return is slightly negative, and longer-term returns remain modest. This reflects a gradual rather than explosive trajectory for investors.

If you’re weighing your next move, this could be a smart moment to broaden your horizons and discover fast growing stocks with high insider ownership

With BASF’s valuation metrics showing a notable discount to analyst targets, the question remains: is the market underestimating future growth, or is the stock already reflecting all known opportunities?

Most Popular Narrative: 12% Undervalued

The most closely watched narrative points to a fair value noticeably above BASF’s last close. The numbers imply that recent price dips have not kept pace with the company’s evolving fundamentals. Here is a key quote shaping this view:

Significant cost-savings programs (targeting €2.1 billion annual savings by end of 2026), alongside the completion of the major China Verbund investment (with project costs under budget and CapEx falling below depreciation from 2026), will meaningfully improve operating leverage and free cash flow, with cost competitiveness directly supporting improved net margins.

Is BASF about to gain an edge thanks to bold cost cuts and a China play? The narrative hinges on just how high future margins and earnings could climb. Want to discover what earnings leap and profit multiples make this target so ambitious? See the full narrative for the real story behind the math.

Result: Fair Value of $49.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low margins in Europe or execution missteps on key business sales could quickly cast doubt on these optimistic assumptions for BASF.

Find out about the key risks to this BASF narrative.

Another View: Market Ratios Point to Caution

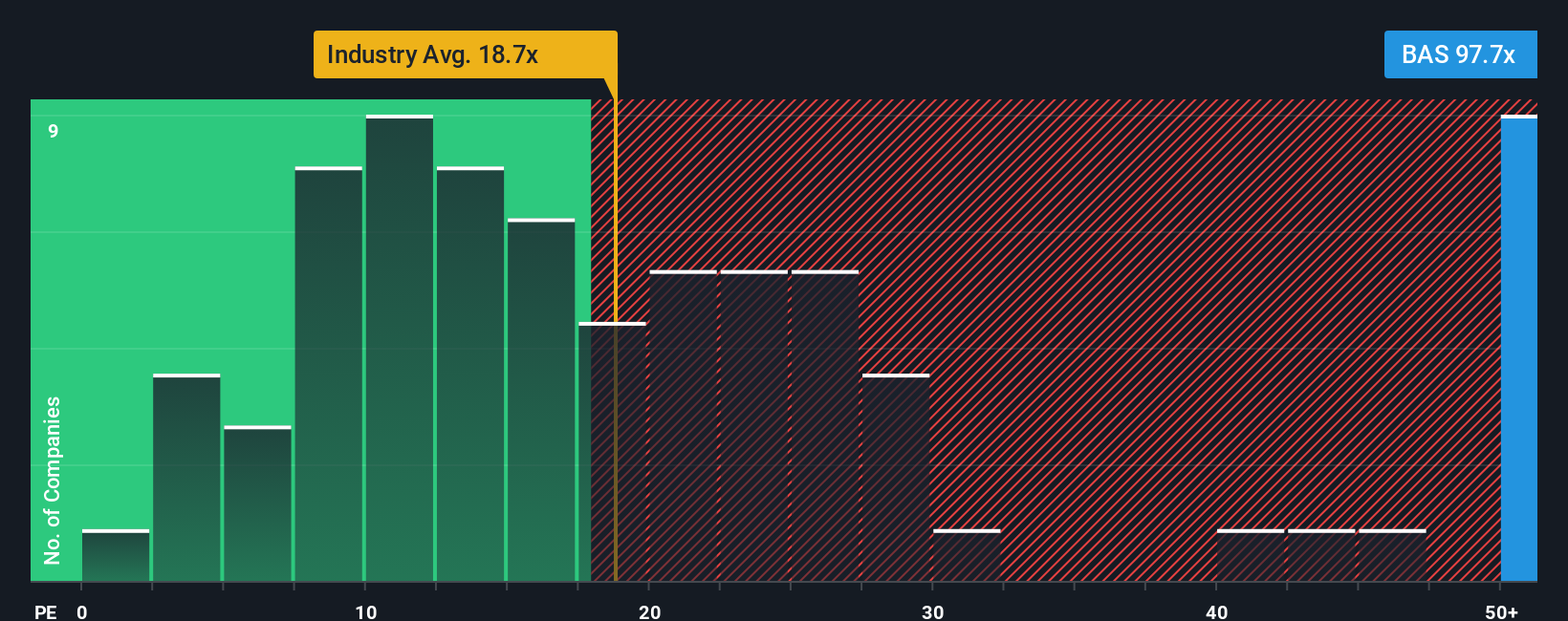

While the narrative suggests BASF is undervalued, taking a look at its price-to-earnings ratio tells a different story. BASF trades at 99.3x earnings, which is much higher than both the sector average of 18.7x and the European industry average of 17.4x. Even compared to a fair ratio of 37.4x, BASF looks expensive. This raises questions about whether investors are overpaying for future growth or overlooking potential risks. Could the multiples be signalling a valuation trap, or is the market betting on a surprise turnaround?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BASF Narrative

Keep in mind that if this view does not align with yours, or if you want to dive into the data and form your own narrative, you can do so yourself in just a few minutes: Do it your way

A great starting point for your BASF research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors know that the right research tools can uncover exciting opportunities others miss. Give yourself the edge and set yourself up for your next big win.

- Target long-term gains by capitalizing on hidden value with these 874 undervalued stocks based on cash flows, which are trading below their true worth.

- Boost your passive income strategy by checking out these 17 dividend stocks with yields > 3%, offering yields above 3% and robust payout histories.

- Seize your chance in tomorrow’s tech by exploring these 24 AI penny stocks, working at the cutting edge of artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BASF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAS

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives