Assessing BASF (XTRA:BAS) Valuation as Battery Metals Strategy Takes Center Stage at Key Industry Conferences

Reviewed by Simply Wall St

BASF (XTRA:BAS) is back in the spotlight as battery metals lead Matthew Burford heads to the Resourcing Tomorrow conference in London, putting the companys long term electrification strategy under closer investor scrutiny.

See our latest analysis for BASF.

The upcoming conference appearances have caught investors attention, but BASF is still treading water, with a modestly positive year to date share price return and a relatively muted 1 year total shareholder return. This suggests momentum is only just starting to rebuild.

If electrification and battery demand are on your radar, this is also a good moment to scan the wider market and discover aerospace and defense stocks as another theme worth watching.

With earnings recovering, a sizeable intrinsic value discount and only modest recent gains, is BASF still an underappreciated electrification play, or are markets already pricing in the next leg of its battery driven growth?

Most Popular Narrative: 10.9% Undervalued

With BASF last closing at €42.77 against a narrative fair value of €48.03, the story leans toward upside if execution goes to plan.

Significant cost savings programs, targeting €2.1 billion annual savings by end of 2026, alongside the completion of the major China Verbund investment, with project costs under budget and CapEx falling below depreciation from 2026, will meaningfully improve operating leverage and free cash flow, with cost competitiveness directly supporting improved net margins.

Want to see how modest revenue growth, sharper margins and a re rated earnings multiple combine into this upside case? The full narrative reveals the math.

Result: Fair Value of €48.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent European weakness and prolonged low base chemical margins could derail the recovery story and challenge expectations for a smooth margin inflection.

Find out about the key risks to this BASF narrative.

Another Angle on Valuation

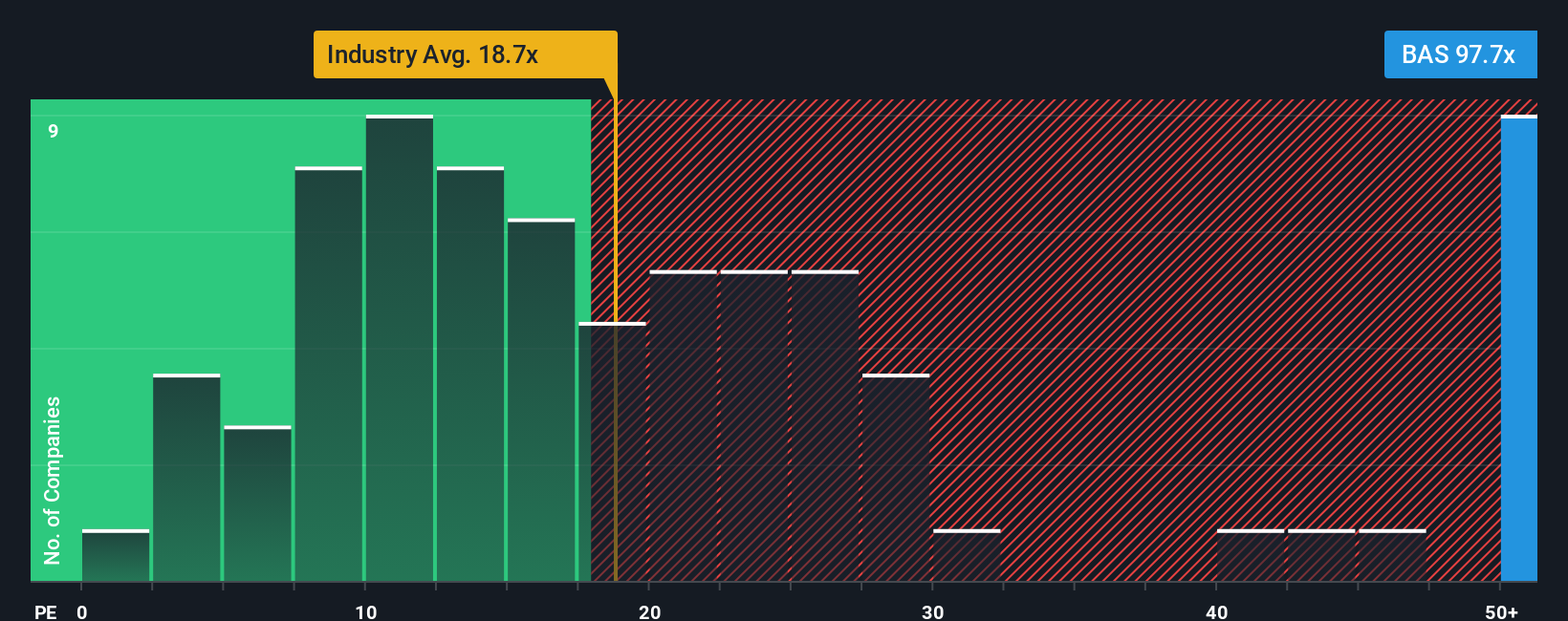

Multiples tell a very different story. BASF trades on a steep 123.2x price to earnings ratio versus 18x for the European chemicals industry, a 35.2x fair ratio and 30x for peers, which implies the market already bakes in a lot of recovery risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BASF Narrative

If you see BASF differently or want to test your own assumptions against the numbers, you can build a custom narrative in minutes, Do it your way.

A great starting point for your BASF research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next smart move?

Before you move on, lock in a few high conviction ideas using the Simply Wall Street Screener, so you are not leaving easy opportunities on the table.

- Target resilient cash generators and tap into reliable income potential with these 15 dividend stocks with yields > 3% while yields above 3% are still being overlooked.

- Capture cutting edge innovation by using these 26 AI penny stocks to spot smaller AI names before they become mainstream headlines.

- Strengthen your portfolio with value focused opportunities through these 912 undervalued stocks based on cash flows, filtering for companies priced well below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BASF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAS

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026