As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are increasingly focused on strategies that provide stability and income. In such a climate, high-quality dividend stocks can offer a reliable source of returns, particularly those with yields up to 5.6%, making them an attractive option for those seeking to balance growth with income in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.35% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.79% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bumitama Agri Ltd. is an investment holding company involved in the production and trade of crude palm oil, palm kernel, and related products for refineries in Indonesia, with a market capitalization of approximately SGD1.42 billion.

Operations: Bumitama Agri Ltd. generates its revenue primarily from its Plantations and Palm Oil Mills segment, which contributed IDR15,547.10 million.

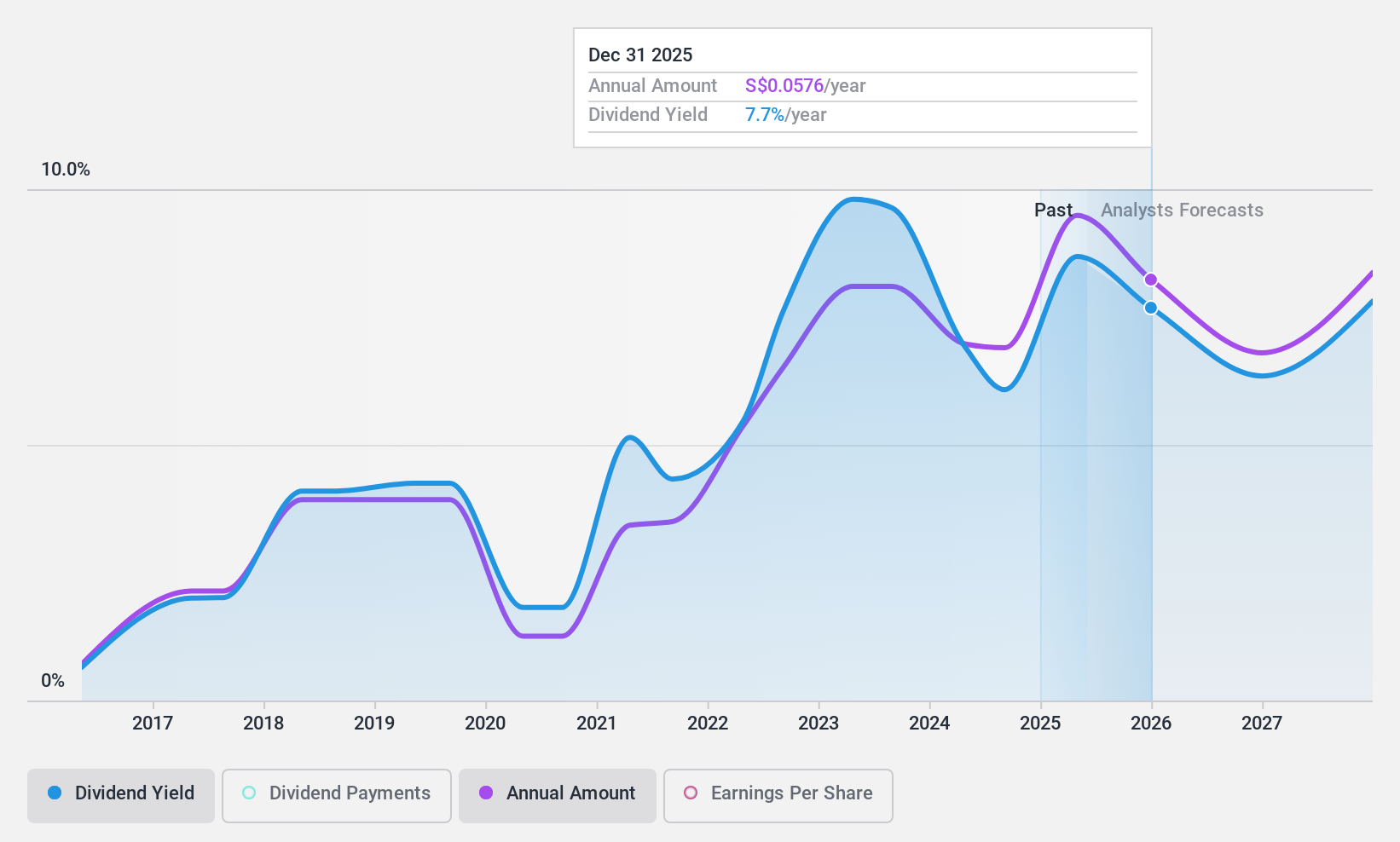

Dividend Yield: 5.7%

Bumitama Agri offers a dividend yield of 5.7%, slightly below the top quartile of Singaporean dividend payers. Despite its unstable dividend history, with volatility over the past decade, the company maintains a sustainable payout ratio of 47.2% from earnings and 54.6% from cash flows. The stock is trading at a significant discount to its estimated fair value, providing potential value relative to peers and industry standards.

- Click here to discover the nuances of Bumitama Agri with our detailed analytical dividend report.

- The analysis detailed in our Bumitama Agri valuation report hints at an deflated share price compared to its estimated value.

ENEOS Holdings (TSE:5020)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ENEOS Holdings, Inc. operates in the energy, oil and natural gas exploration and production, and metals sectors across Japan, China, Asia, and internationally with a market cap of approximately ¥2.15 trillion.

Operations: ENEOS Holdings generates revenue primarily from its Metal segment, which accounts for ¥1.07 billion, and its Oil and Natural Gas Exploration and Production segment, contributing ¥231.26 million.

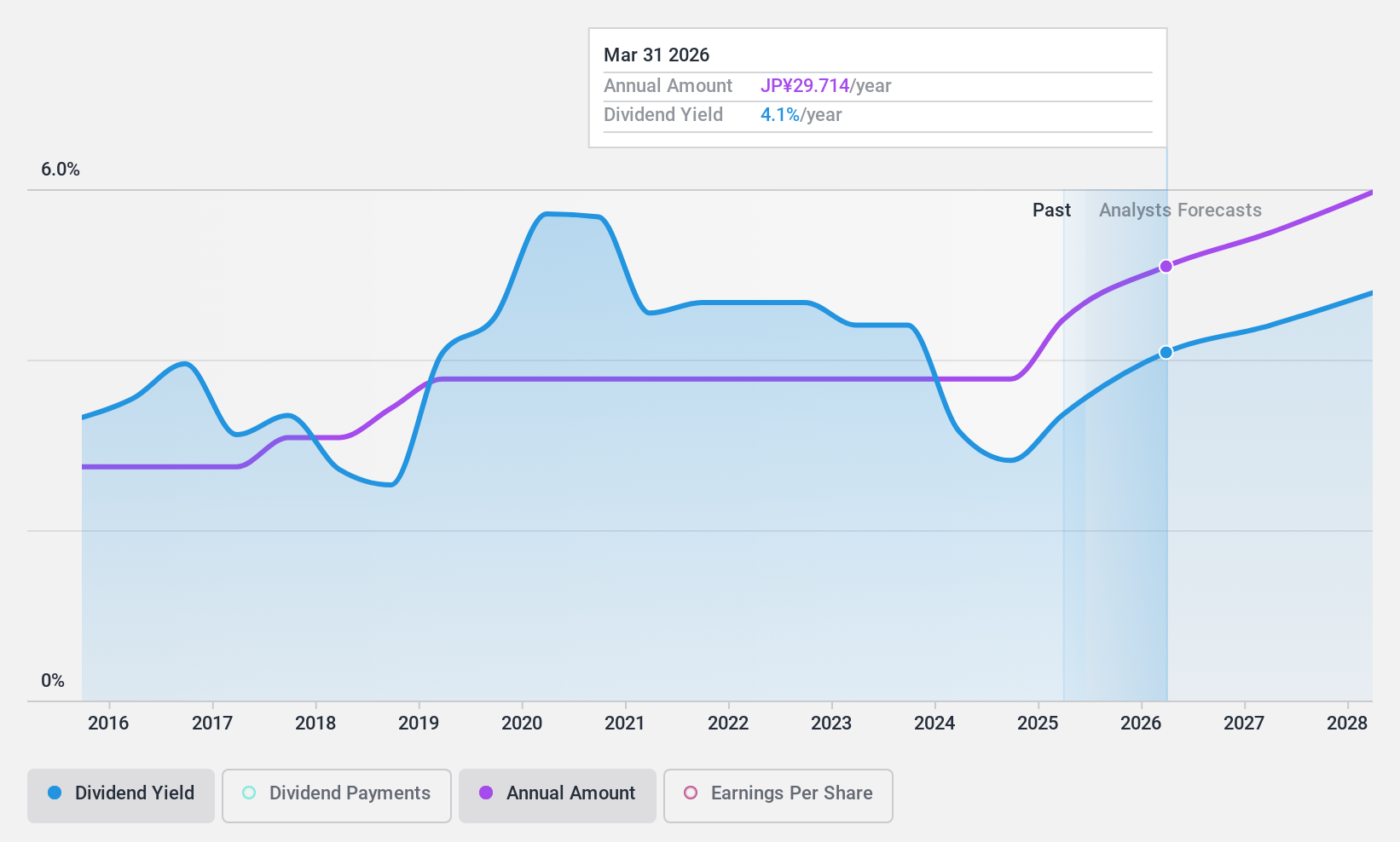

Dividend Yield: 3.3%

ENEOS Holdings maintains a stable and growing dividend, supported by a low cash payout ratio of 25.4% and earnings coverage of 38.5%. Recent buybacks totaling ¥177.22 billion enhance shareholder value, while increased earnings guidance for fiscal year 2025 reflects strong financial performance. The company raised its total annual dividend forecast to ¥26 per share, underscoring its commitment to returning profits to shareholders despite carrying high debt levels.

- Delve into the full analysis dividend report here for a deeper understanding of ENEOS Holdings.

- Our valuation report here indicates ENEOS Holdings may be overvalued.

Allianz (XTRA:ALV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Allianz SE, along with its subsidiaries, offers property-casualty insurance, life/health insurance, and asset management services globally, with a market cap of approximately €124.69 billion.

Operations: Allianz SE generates revenue through its key segments: property-casualty insurance (€76.40 billion), life/health insurance (€37.11 billion), and asset management (€3.35 billion).

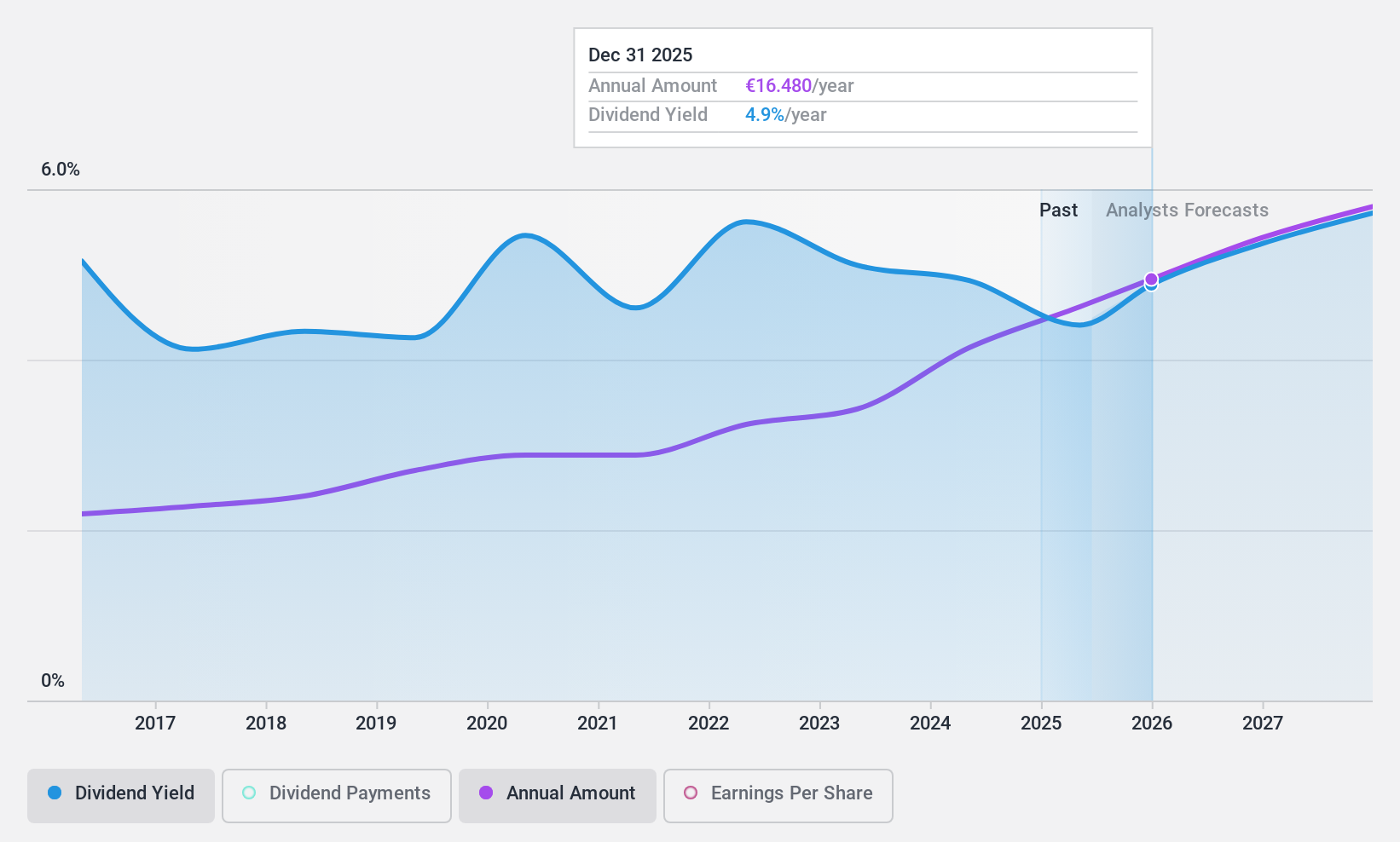

Dividend Yield: 4.3%

Allianz's dividends are well-supported, with a 60% payout ratio and a low cash payout ratio of 23%, ensuring sustainability. The dividend has been stable and growing over the past decade, albeit slightly below the top tier in the German market. Recent €1.5 billion share buybacks further bolster shareholder value. Earnings have shown consistent growth, with net income reaching €7.46 billion for nine months ending September 2024, demonstrating robust financial health amidst strategic acquisition plans.

- Click here and access our complete dividend analysis report to understand the dynamics of Allianz.

- Our comprehensive valuation report raises the possibility that Allianz is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1969 Top Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bumitama Agri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P8Z

Bumitama Agri

An investment holding company, engages in the production of crude palm oil (CPO) and palm kernel (PK) in Indonesia.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives