David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Gesundheitswelt Chiemgau AG (MUN:JTH) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Gesundheitswelt Chiemgau

What Is Gesundheitswelt Chiemgau's Debt?

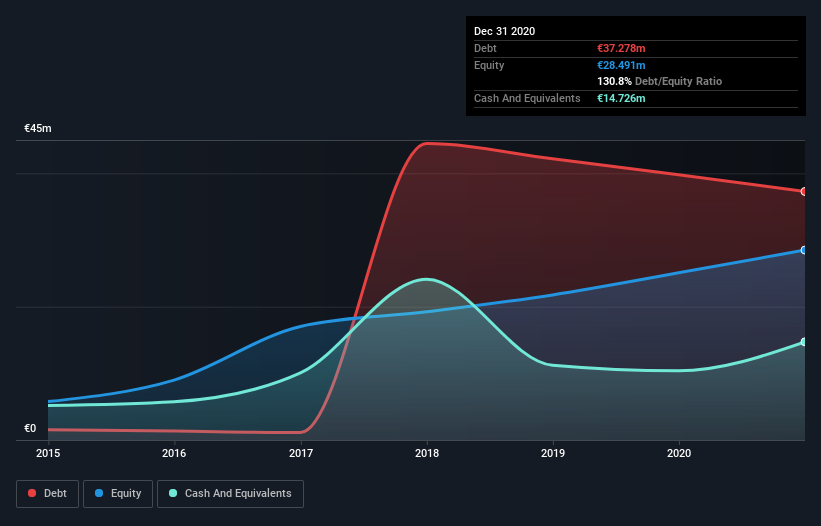

As you can see below, Gesundheitswelt Chiemgau had €37.3m of debt at December 2020, down from €39.8m a year prior. However, because it has a cash reserve of €14.7m, its net debt is less, at about €22.6m.

How Strong Is Gesundheitswelt Chiemgau's Balance Sheet?

According to the last reported balance sheet, Gesundheitswelt Chiemgau had liabilities of €1.56m due within 12 months, and liabilities of €46.6m due beyond 12 months. On the other hand, it had cash of €14.7m and €6.29m worth of receivables due within a year. So it has liabilities totalling €27.2m more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of €21.8m, we think shareholders really should watch Gesundheitswelt Chiemgau's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Gesundheitswelt Chiemgau has a debt to EBITDA ratio of 4.4, which signals significant debt, but is still pretty reasonable for most types of business. However, its interest coverage of 12.1 is very high, suggesting that the interest expense on the debt is currently quite low. If Gesundheitswelt Chiemgau can keep growing EBIT at last year's rate of 19% over the last year, then it will find its debt load easier to manage. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Gesundheitswelt Chiemgau will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Gesundheitswelt Chiemgau burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We'd go so far as to say Gesundheitswelt Chiemgau's conversion of EBIT to free cash flow was disappointing. But on the bright side, its interest cover is a good sign, and makes us more optimistic. It's also worth noting that Gesundheitswelt Chiemgau is in the Healthcare industry, which is often considered to be quite defensive. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Gesundheitswelt Chiemgau stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Gesundheitswelt Chiemgau you should be aware of, and 2 of them shouldn't be ignored.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Gesundheitswelt Chiemgau, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MUN:JTH

Gesundheitswelt Chiemgau

Engages in medicine and tourism businesses in Germany.

Good value with adequate balance sheet.

Market Insights

Community Narratives