- Germany

- /

- Medical Equipment

- /

- XTRA:SHL

Siemens Healthineers (XTRA:SHL) Reports Strong Earnings Growth, Acquires Novartis Imaging Business

Reviewed by Simply Wall St

Unlock comprehensive insights into our analysis of Siemens Healthineers stock here.

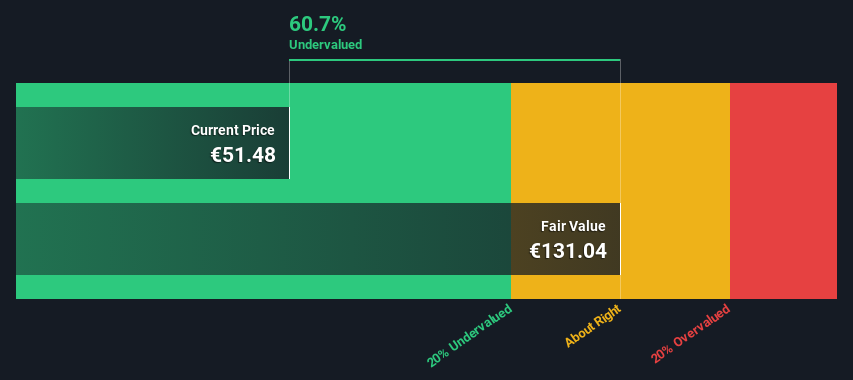

Key Assets Propelling Siemens Healthineers Forward

Siemens Healthineers has demonstrated impressive earnings growth, with a 28.7% increase over the past year, surpassing the industry average. This growth is supported by a net profit margin improvement from 7% to 8.7%, showcasing the company's strong financial health. Their stable dividend payments, covered by both earnings and cash flows, further underscore financial stability. The company's recent earnings report highlighted a year-over-year sales increase to €22.36 billion, with net income rising to €1.94 billion, reflecting effective execution of their business model. Additionally, trading at 61% below the SWS fair ratio suggests potential undervaluation, indicating a strong market position.

Challenges Constraining Siemens Healthineers's Potential

Siemens Healthineers faces challenges such as a lower-than-expected Return on Equity at 10.7%, which falls short of the typical 20% threshold. The company's net debt to equity ratio of 74.3% suggests potential financial risk, and their forecasted revenue growth of 5.8% lags behind market expectations. These factors, combined with operational inefficiencies impacting margins, as noted by CFO Bernhard Montag, highlight areas needing improvement to sustain profitability.

Future Prospects for Siemens Healthineers in the Market

The company is poised for significant growth, with earnings projected to rise by 14.3% annually. Their strategic focus on expanding into emerging markets and investing in AI and automation technologies positions them well to tap into new revenue streams and enhance operational efficiency. The acquisition of Novartis's molecular imaging business for over €200 million exemplifies their commitment to strengthening their diagnostic capabilities, potentially boosting market share.

Regulatory Challenges Facing Siemens Healthineers

Economic fluctuations pose risks to consumer spending, as highlighted by CFO Montag. Additionally, regulatory changes could present compliance challenges that may impact operations. The company is also addressing supply chain disruptions by diversifying suppliers, a proactive step in mitigating risks. These external factors necessitate careful navigation to maintain their competitive edge and market position.

Conclusion

Siemens Healthineers has shown strong financial health with a significant earnings growth of 28.7% and improved net profit margins, indicating effective business execution and financial stability. However, challenges such as a lower-than-expected Return on Equity and high net debt to equity ratio highlight areas needing attention to sustain this growth trajectory. The company's strategic investments in emerging markets and advanced technologies, alongside acquisitions like Novartis's molecular imaging business, position it for future revenue expansion and operational efficiency. Trading significantly below its estimated fair value suggests that the market may not fully recognize these growth prospects, presenting a potential opportunity for investors as the company continues to navigate regulatory and economic challenges.

Next Steps

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About XTRA:SHL

Siemens Healthineers

Through its subsidiaries, develops, manufactures, and sells a range of diagnostic and therapeutic products and services to healthcare providers worldwide.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives