- Germany

- /

- Healthcare Services

- /

- XTRA:FME

Shareholders in Fresenius Medical Care (ETR:FME) are in the red if they invested five years ago

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Fresenius Medical Care AG (ETR:FME) shareholders for doubting their decision to hold, with the stock down 41% over a half decade.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

We check all companies for important risks. See what we found for Fresenius Medical Care in our free report.While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

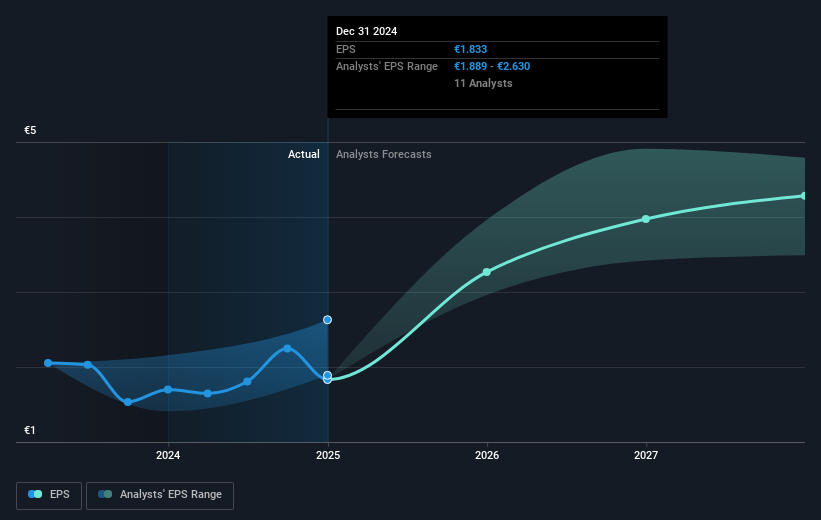

During the five years over which the share price declined, Fresenius Medical Care's earnings per share (EPS) dropped by 14% each year. The share price decline of 10% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Fresenius Medical Care's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Fresenius Medical Care the TSR over the last 5 years was -34%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Fresenius Medical Care has rewarded shareholders with a total shareholder return of 16% in the last twelve months. And that does include the dividend. There's no doubt those recent returns are much better than the TSR loss of 6% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. Importantly, we haven't analysed Fresenius Medical Care's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:FME

Fresenius Medical Care

Provides dialysis and related services for individuals with renal diseases in Germany, the United States, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives