- Germany

- /

- Healthcare Services

- /

- XTRA:FME

Market Participants Recognise Fresenius Medical Care AG's (ETR:FME) Earnings

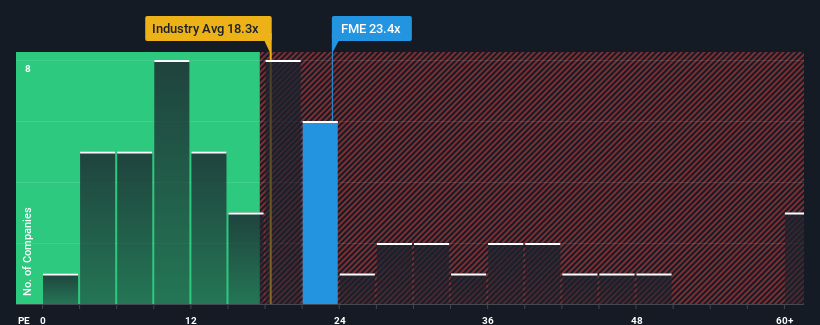

When close to half the companies in Germany have price-to-earnings ratios (or "P/E's") below 16x, you may consider Fresenius Medical Care AG (ETR:FME) as a stock to potentially avoid with its 23.4x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Fresenius Medical Care has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Fresenius Medical Care

Is There Enough Growth For Fresenius Medical Care?

Fresenius Medical Care's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 41%. As a result, earnings from three years ago have also fallen 66% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 40% per annum as estimated by the analysts watching the company. With the market only predicted to deliver 13% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Fresenius Medical Care's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Fresenius Medical Care's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Fresenius Medical Care you should be aware of.

Of course, you might also be able to find a better stock than Fresenius Medical Care. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Fresenius Medical Care, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:FME

Fresenius Medical Care

Provides dialysis and related services for individuals with renal diseases in Germany, the United States, and internationally.

Excellent balance sheet established dividend payer.