- Germany

- /

- Healthcare Services

- /

- XTRA:FME

Investors in Fresenius Medical Care (ETR:FME) have unfortunately lost 26% over the last five years

While it may not be enough for some shareholders, we think it is good to see the Fresenius Medical Care AG (ETR:FME) share price up 20% in a single quarter. But if you look at the last five years the returns have not been good. In fact, the share price is down 34%, which falls well short of the return you could get by buying an index fund.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for Fresenius Medical Care

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Looking back five years, both Fresenius Medical Care's share price and EPS declined; the latter at a rate of 12% per year. The share price decline of 8% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve.

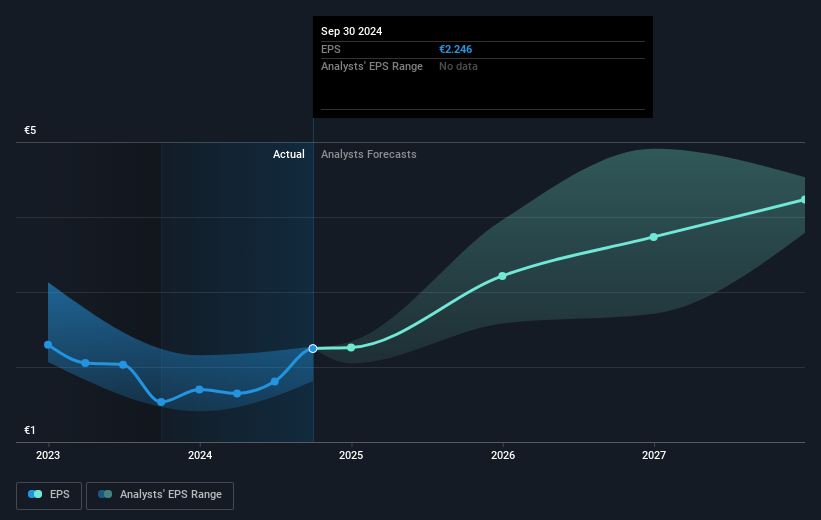

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Fresenius Medical Care has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Fresenius Medical Care will grow revenue in the future.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Fresenius Medical Care the TSR over the last 5 years was -26%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Fresenius Medical Care shareholders have received a total shareholder return of 20% over one year. Of course, that includes the dividend. Notably the five-year annualised TSR loss of 5% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Fresenius Medical Care is showing 1 warning sign in our investment analysis , you should know about...

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:FME

Fresenius Medical Care

Provides dialysis and related services for individuals with renal diseases in Germany, North America, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives