- Germany

- /

- Medical Equipment

- /

- XTRA:EUZ

Do Eckert & Ziegler Strahlen- und Medizintechnik's (ETR:EUZ) Earnings Warrant Your Attention?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Eckert & Ziegler Strahlen- und Medizintechnik (ETR:EUZ), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Eckert & Ziegler Strahlen- und Medizintechnik

How Fast Is Eckert & Ziegler Strahlen- und Medizintechnik Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, Eckert & Ziegler Strahlen- und Medizintechnik has grown EPS by 31% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

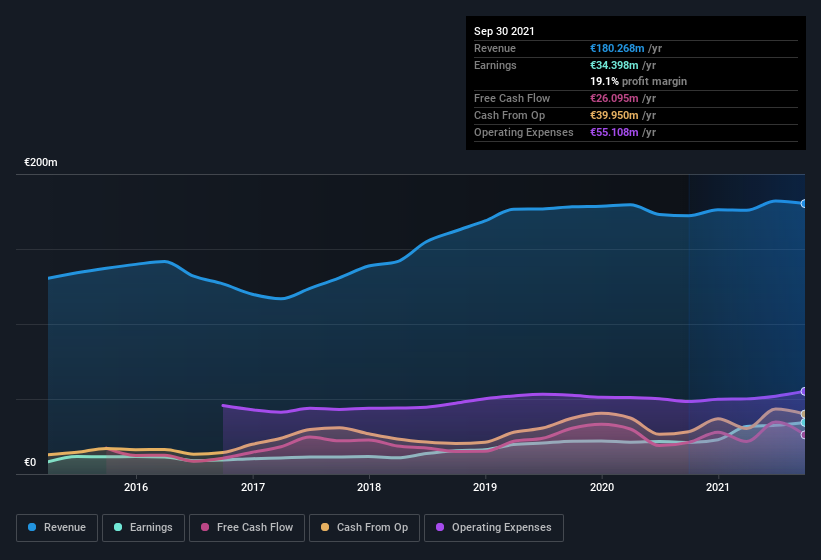

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that Eckert & Ziegler Strahlen- und Medizintechnik is growing revenues, and EBIT margins improved by 6.6 percentage points to 26%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Eckert & Ziegler Strahlen- und Medizintechnik's balance sheet strength, before getting too excited.

Are Eckert & Ziegler Strahlen- und Medizintechnik Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations between €909m and €2.9b, like Eckert & Ziegler Strahlen- und Medizintechnik, the median CEO pay is around €1.4m.

The Eckert & Ziegler Strahlen- und Medizintechnik CEO received €978k in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Eckert & Ziegler Strahlen- und Medizintechnik Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Eckert & Ziegler Strahlen- und Medizintechnik's strong EPS growth. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. So I'd argue this is the kind of stock worth watching, even if it isn't great value today. However, before you get too excited we've discovered 1 warning sign for Eckert & Ziegler Strahlen- und Medizintechnik that you should be aware of.

Although Eckert & Ziegler Strahlen- und Medizintechnik certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Eckert & Ziegler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:EUZ

Eckert & Ziegler

Manufactures and sells isotope technology components worldwide.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives