- Germany

- /

- Medical Equipment

- /

- XTRA:EUZ

Uncover These 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, key indices like the S&P 600 for small-cap stocks have experienced notable fluctuations. Amid these dynamic conditions, discovering potential opportunities requires a keen eye for companies with robust fundamentals and adaptability to market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | NA | 13.11% | 9.95% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 12.19% | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Biotage (OM:BIOT)

Simply Wall St Value Rating: ★★★★★★

Overview: Biotage AB (publ) offers solutions and products for drug discovery and development, analytical testing, and water and environmental testing, with a market cap of approximately SEK12.10 billion.

Operations: Biotage generates revenue primarily from its Healthcare Software segment, which contributes SEK 2.12 billion.

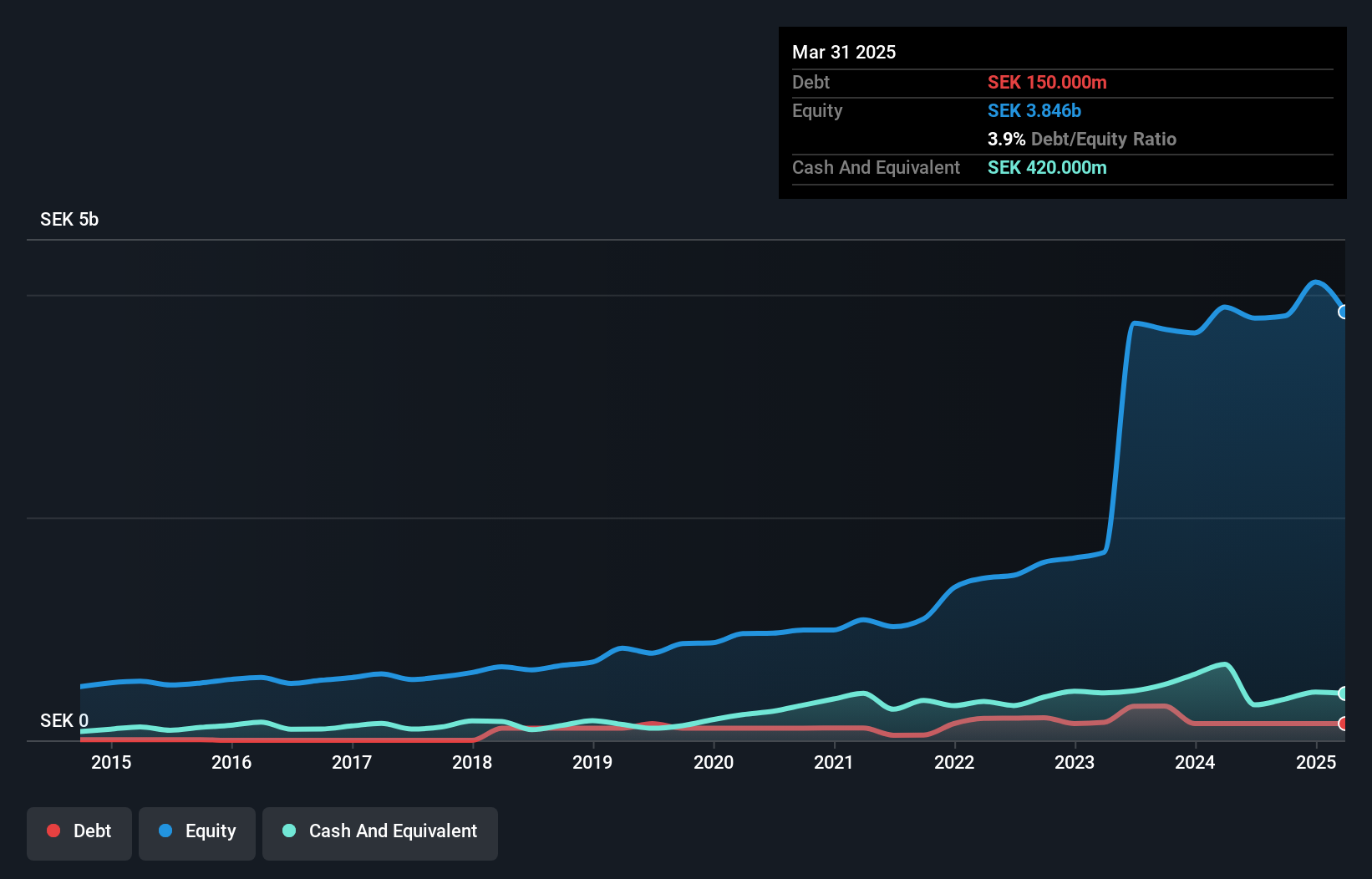

Biotage, a promising player in the life sciences sector, has demonstrated robust financial health with its debt to equity ratio dropping from 12.6% to 3.9% over five years. Trading at a significant discount of 46.3% below estimated fair value, it offers potential upside for investors seeking undervalued opportunities. The company reported earnings growth of 7.3% annually over the past five years and forecasts suggest a further increase of 19.53%. Recent results show quarterly sales rising to SEK 490 million from SEK 449 million year-on-year, with net income climbing to SEK 45 million from SEK 38 million, highlighting its steady performance trajectory.

- Get an in-depth perspective on Biotage's performance by reading our health report here.

Examine Biotage's past performance report to understand how it has performed in the past.

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vaudoise Assurances Holding SA offers insurance products and services mainly in Switzerland, with a market cap of CHF1.36 billion.

Operations: The company generates revenue primarily through its insurance products and services in Switzerland, with a market cap of CHF1.36 billion.

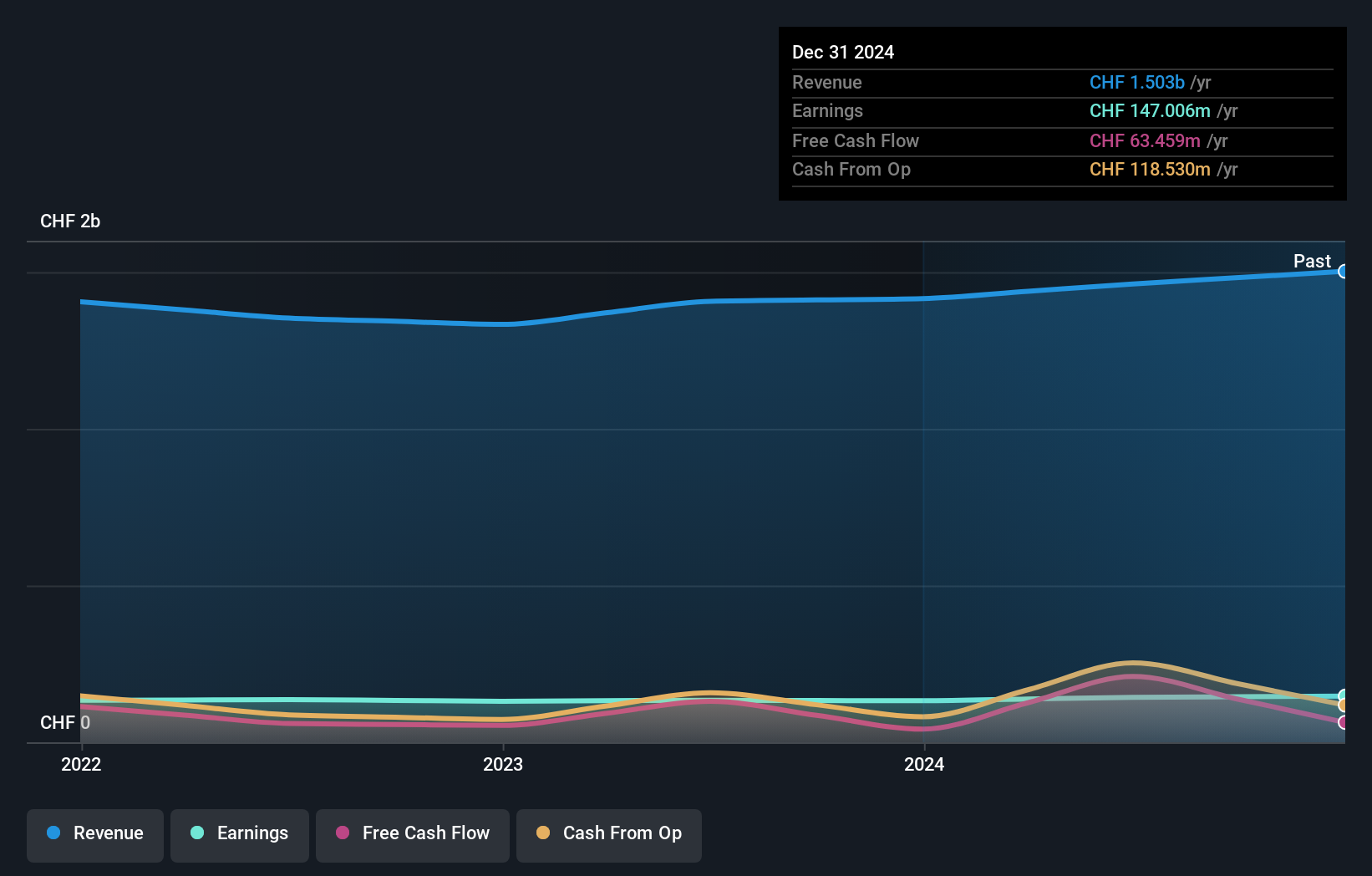

Vaudoise Assurances Holding stands out with its robust financial health, operating debt-free for the past five years and trading at a significant 64.2% below its estimated fair value. The company reported a net income of CHF 81 million for the first half of 2024, up from CHF 70 million in the previous year, indicating strong earnings growth. Notably, Vaudoise's earnings have grown by 7.1% over the last year, surpassing industry averages and underscoring its position as an attractive prospect within the insurance sector. Its high-quality earnings further enhance investor confidence in this promising entity's future potential.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE is a global manufacturer and distributor of isotope technology components, with a market capitalization of €770.87 million.

Operations: Eckert & Ziegler generates revenue primarily through its Isotope Products segment (€150.79 million) and Medical segment (€137.52 million), with adjustments and eliminations affecting the total.

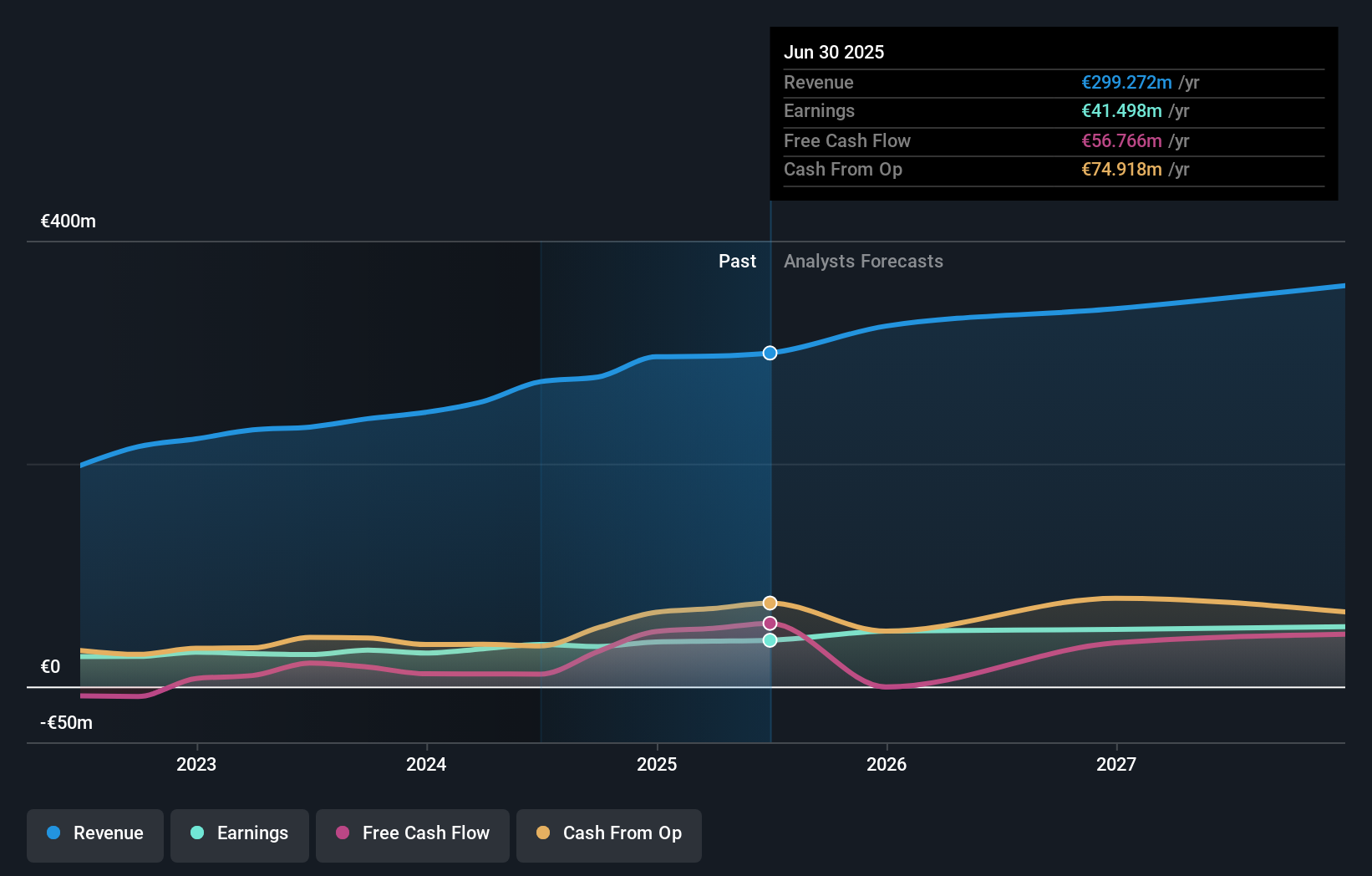

Eckert & Ziegler (EZAG) is making waves with its robust earnings performance and strategic collaborations. Over the past year, earnings surged by 10%, outpacing the Medical Equipment industry. The company trades at a significant discount, 66% below its estimated fair value, while maintaining high-quality earnings and a healthy debt-to-equity ratio that dropped from 13.5% to 8.6% over five years. Recent partnerships, like the one with Telix Pharmaceuticals for actinium-225 production, underscore EZAG's role in advancing targeted alpha therapies—a promising area in cancer treatment—highlighting their innovative edge in isotope technology.

- Click here to discover the nuances of Eckert & Ziegler with our detailed analytical health report.

Gain insights into Eckert & Ziegler's past trends and performance with our Past report.

Summing It All Up

- Investigate our full lineup of 4638 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eckert & Ziegler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EUZ

Eckert & Ziegler

Manufactures and sells isotope technology components worldwide.

Flawless balance sheet with proven track record.