As global markets face volatility, with the S&P 500 experiencing its worst weekly drop in 18 months and European indices like Germany's DAX declining by over 3%, investors are increasingly turning their attention to smaller, more resilient opportunities. Amid this backdrop, discovering undervalued small-cap stocks in Germany could offer a compelling avenue for growth. In such fluctuating market conditions, a good stock often exhibits strong fundamentals, innovative business models, and the ability to adapt to economic shifts. This September 2024, we explore three lesser-known German companies that embody these qualities and hold promise for discerning investors.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.44% | -1.40% | -8.94% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

FRoSTA (DB:NLM)

Simply Wall St Value Rating: ★★★★★★

Overview: FRoSTA Aktiengesellschaft, along with its subsidiaries, develops, produces, and markets frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe with a market cap of €415.57 million.

Operations: FRoSTA generates revenue primarily from the sale of frozen food products across several European countries. The company reported a market cap of €415.57 million and operates in Germany, Poland, Austria, Italy, and Eastern Europe.

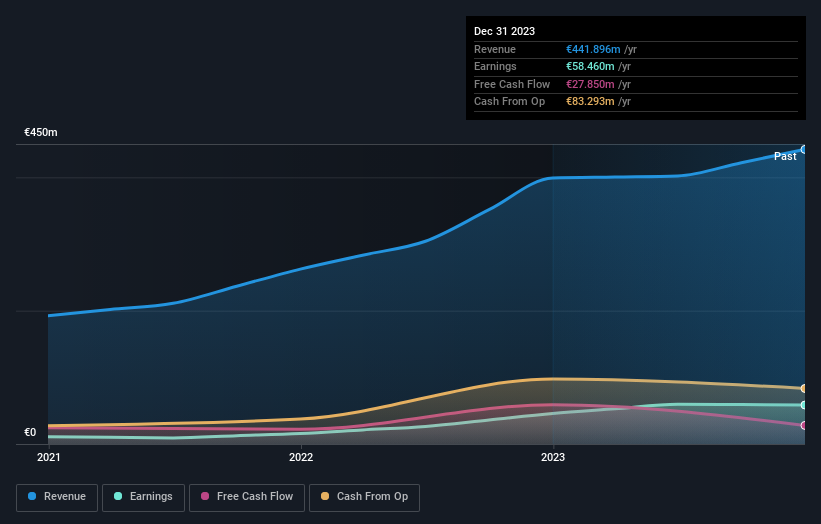

FRoSTA, a German food company, reported half-year revenue of €319.81 million and net income of €15.5 million. Over the past five years, its debt to equity ratio has decreased from 31.6% to 8.2%, highlighting improved financial health. Although earnings grew at an annual rate of 16%, they lagged behind the food industry’s growth rate of 21%. Trading just below fair value and maintaining high-quality earnings, FRoSTA continues to show strong fundamentals despite modest sales growth this year.

- Get an in-depth perspective on FRoSTA's performance by reading our health report here.

Understand FRoSTA's track record by examining our Past report.

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG, with a market cap of €609.44 million, mines, produces, and sells salt in Germany, the European Union, and internationally through its subsidiaries.

Operations: Südwestdeutsche Salzwerke AG generates revenue primarily from its salt segment (€283.67 million) and waste management services (€62.46 million). The company also has smaller contributions from other segments amounting to €17.80 million, with reconciliations at -€17.18 million impacting overall revenue figures.

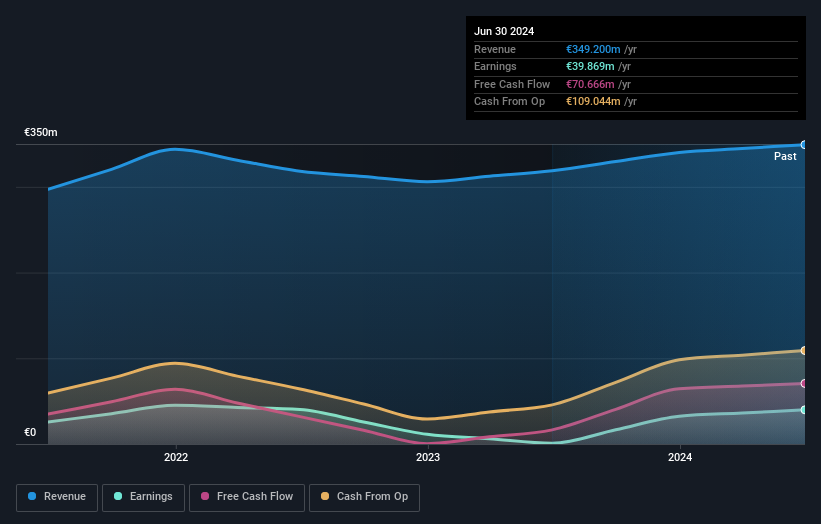

Südwestdeutsche Salzwerke's recent half-year earnings report shows sales of €163.06 million, up from €154.03 million the previous year, with net income rising to €15.4 million from €7.96 million. Basic and diluted EPS both increased to €1.47 from €0.76 a year ago, reflecting strong performance despite a highly volatile share price in the last three months and an unchanged debt-to-equity ratio of 0.3 over five years.

EnviTec Biogas (XTRA:ETG)

Simply Wall St Value Rating: ★★★★★★

Overview: EnviTec Biogas AG manufactures and operates biogas and biomethane plants across various countries, including Germany, Italy, the United States, and China, with a market cap of €472.23 million.

Operations: EnviTec Biogas AG generates revenue primarily from three segments: Service (€48.58 million), Plant Engineering (€132.13 million), and Own Operation including Energy (€236.10 million).

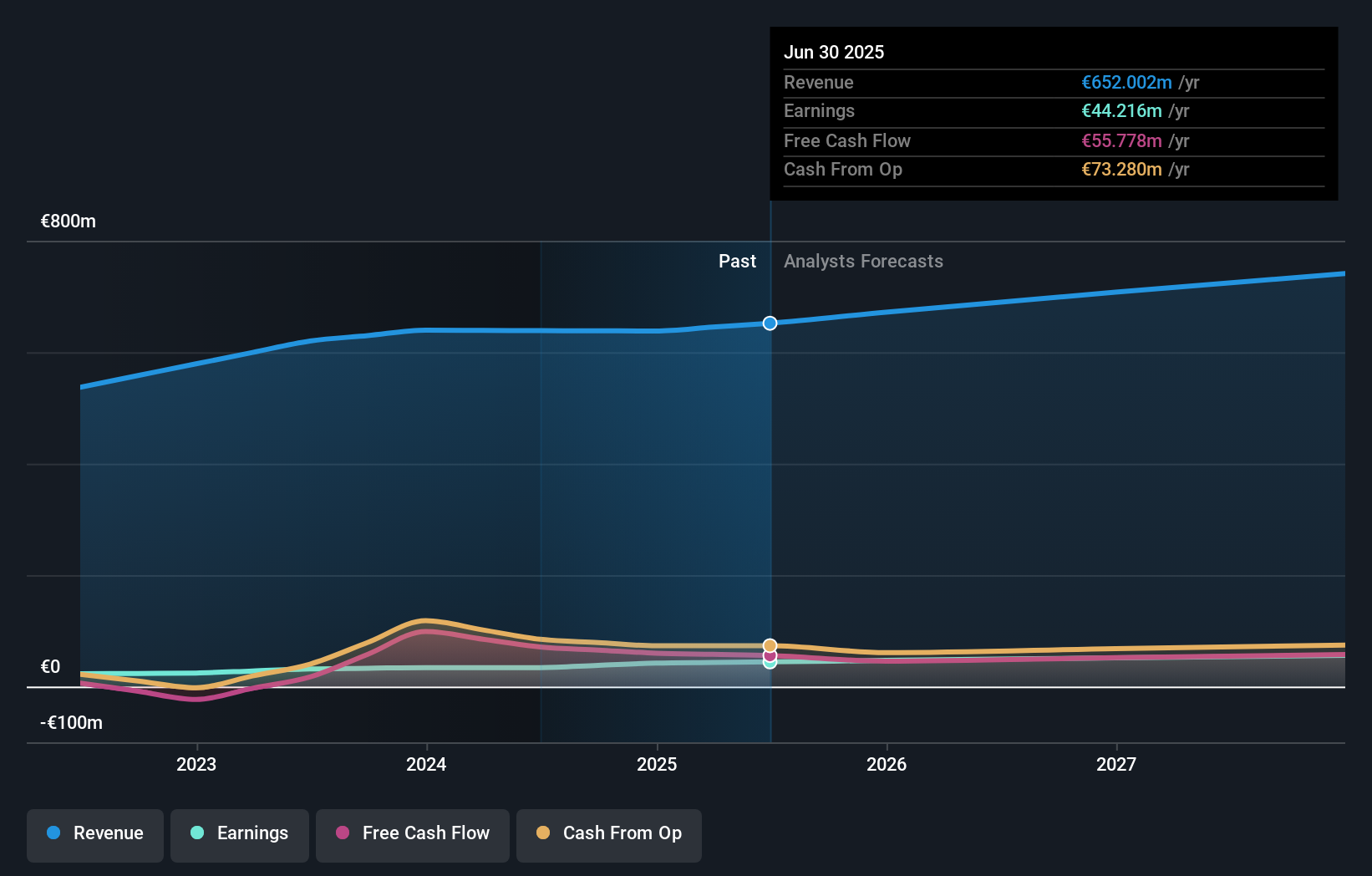

EnviTec Biogas, a small cap player in Germany's renewable energy sector, has seen its debt to equity ratio improve from 41.7% to 38% over the past five years. The company's interest payments are comfortably covered by EBIT at 419.7x coverage, indicating strong financial health. EnviTec's earnings have surged by 27.6% in the last year, outpacing the broader Oil and Gas industry growth rate of 27.6%. With a price-to-earnings ratio of 8.1x compared to the German market average of 16.4x, it appears undervalued and poised for potential future gains.

- Take a closer look at EnviTec Biogas' potential here in our health report.

Review our historical performance report to gain insights into EnviTec Biogas''s past performance.

Where To Now?

- Click this link to deep-dive into the 50 companies within our German Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:SSH

Südwestdeutsche Salzwerke

Südwestdeutsche Salzwerke AG, together with its subsidiaries, mines, produces, and sells salt in Germany, the European Union, and internationally.

Solid track record with excellent balance sheet and pays a dividend.