As global markets navigate a choppy start to the year, influenced by inflation concerns and political uncertainties, investors are searching for stability amidst fluctuating indices. In such an environment, dividend stocks can offer a compelling option for those seeking consistent income and potential resilience against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.27% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.77% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.17% | ★★★★★★ |

Click here to see the full list of 2017 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

FRoSTA (DB:NLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FRoSTA Aktiengesellschaft, along with its subsidiaries, is engaged in the development, production, and marketing of frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe with a market cap of €446.23 million.

Operations: FRoSTA Aktiengesellschaft generates its revenue from the development, production, and marketing of frozen food products across various European countries including Germany, Poland, Austria, Italy, and Eastern Europe.

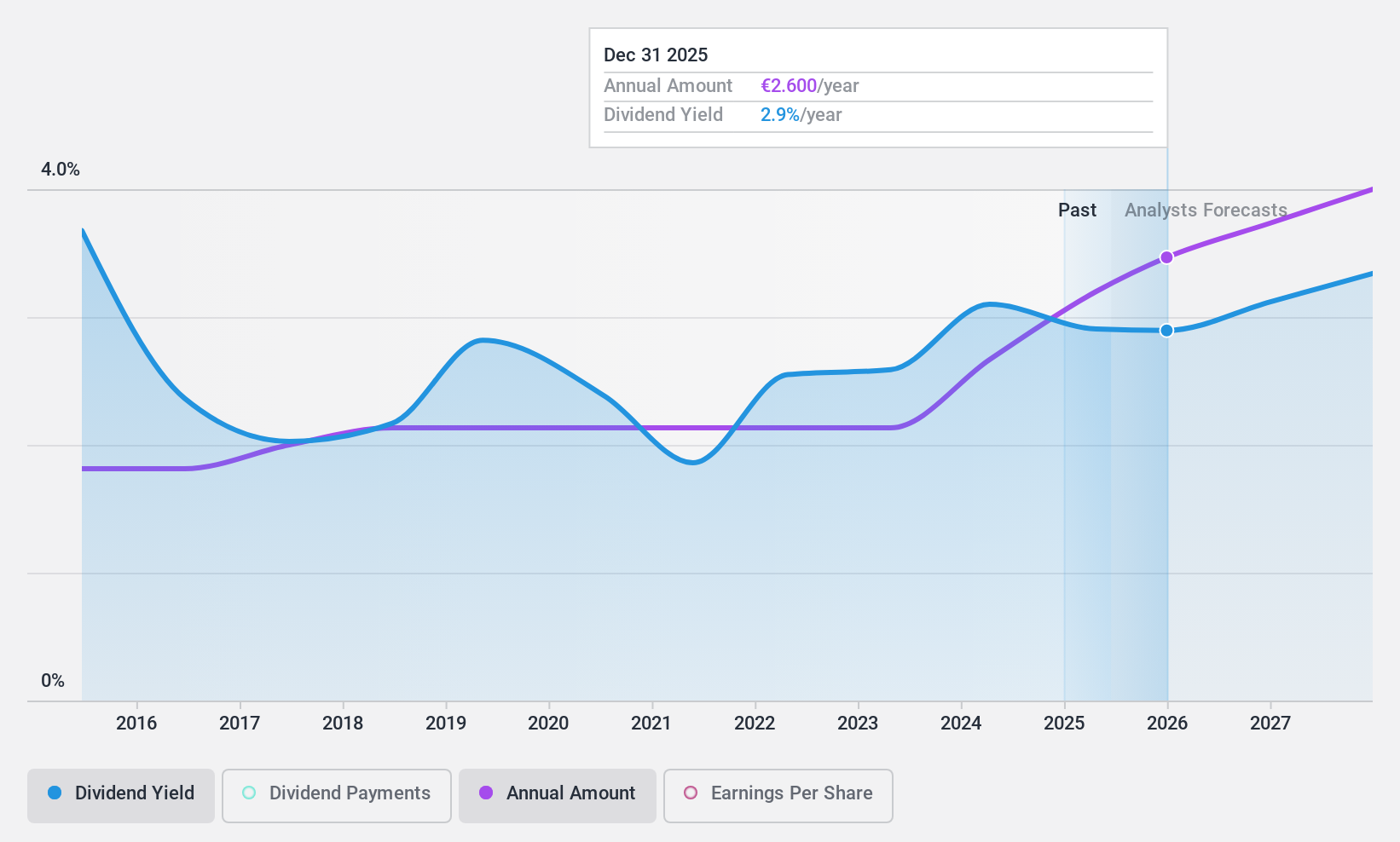

Dividend Yield: 3%

FRoSTA's dividend payments are well-supported by earnings and cash flows, with a payout ratio of 40% and a cash payout ratio of 19.3%. The company has consistently increased its dividends over the past decade with minimal volatility. However, its current dividend yield of 2.99% is lower than the top quartile of German dividend payers at 4.83%. Despite this, FRoSTA trades significantly below its estimated fair value, potentially offering an attractive entry point for investors seeking stability in dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of FRoSTA.

- According our valuation report, there's an indication that FRoSTA's share price might be on the cheaper side.

Dubai Islamic Bank P.J.S.C (DFM:DIB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Islamic Bank P.J.S.C. operates in corporate, retail, and investment banking both in the United Arab Emirates and internationally, with a market cap of AED52.47 billion.

Operations: Dubai Islamic Bank P.J.S.C.'s revenue segments include Consumer Banking (AED4.59 billion), Corporate Banking (AED3.00 billion), Treasury (AED2.37 billion), and Real Estate Development (AED530.10 million).

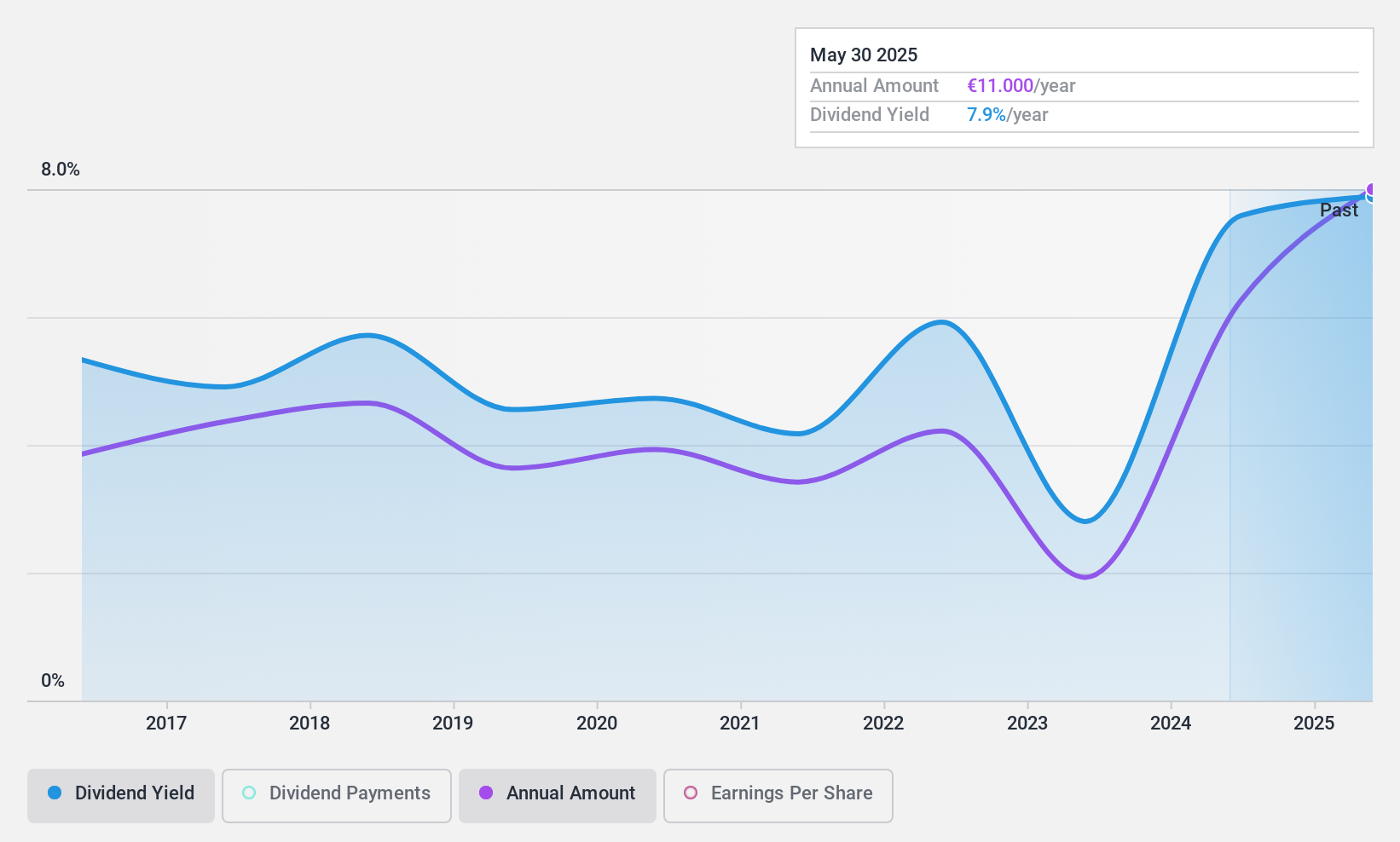

Dividend Yield: 6.2%

Dubai Islamic Bank P.J.S.C. offers a dividend yield of 6.2%, slightly below the top quartile in the AE market. Despite a volatile and unreliable dividend history, dividends have grown over the past decade and are well-covered by earnings, with a current payout ratio of 46.6%. The bank's low price-to-earnings ratio of 7.5x suggests good value compared to the market average, although high non-performing loans at 4.8% remain a concern.

- Dive into the specifics of Dubai Islamic Bank P.J.S.C here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Dubai Islamic Bank P.J.S.C shares in the market.

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme supplies electricity and natural gas to individuals, businesses, and local authorities in France with a market cap of €892.59 million.

Operations: Électricite de Strasbourg Société Anonyme generates its revenue primarily from the production and distribution of electricity and gas (€1.24 billion) and as an electricity distributor (€302.94 million).

Dividend Yield: 6.9%

Électricité de Strasbourg Société Anonyme provides a dividend yield of 6.91%, placing it in the top quartile of French dividend payers. The dividends are well-covered by earnings and cash flows, with payout ratios of 43.8% and 38.6%, respectively, suggesting sustainability despite a volatile track record over the past decade. Trading significantly below its estimated fair value, the company presents potential value for investors, although its dividend reliability remains a concern due to historical volatility.

- Navigate through the intricacies of Électricite de Strasbourg Société Anonyme with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Électricite de Strasbourg Société Anonyme's share price might be too pessimistic.

Key Takeaways

- Reveal the 2017 hidden gems among our Top Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:NLM

FRoSTA

Develops, produces, and markets frozen food products in Germany, Poland, Austria, Italy, and Eastern Europe.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives