- Germany

- /

- Electric Utilities

- /

- XTRA:EBK

Explore Alternatives To EnBW Energie Baden-Württemberg With One Superior Dividend Stock

Reviewed by Sasha Jovanovic

Dividend stocks often attract investors looking for regular income streams. However, a high payout ratio, like that seen with EnBW Energie Baden-Württemberg, can raise concerns about the sustainability of these dividends. In this article, we will explore one attractive dividend stock and discuss why another should be approached with caution due to its challenging dividend cover situation.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.33% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.80% | ★★★★★★ |

| Südzucker (XTRA:SZU) | 6.46% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.79% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.76% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.17% | ★★★★★☆ |

| INDUS Holding (XTRA:INH) | 5.01% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.28% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.19% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.17% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top Dividend Stocks screener.

Let's uncover one of the gems from our specialized screener and one you can probably ignore.

Top Pick

Südzucker (XTRA:SZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Südzucker AG, with a market capitalization of €2.81 billion, is engaged in the production and sale of sugar products across Germany, the rest of the European Union, the United Kingdom, the United States, and other international markets.

Operations: Südzucker's revenue is generated from several segments: Sugar (€4.44 billion), Special Products excluding Starch (€2.43 billion), Fruit (€1.57 billion), CropEnergies (€1.21 billion), and Starch (€1.16 billion).

Dividend Yield: 6.5%

Südzucker maintains a solid dividend profile with a yield of 6.46%, ranking in the top 25% in Germany. Despite an unstable dividend track record, recent financials show dividends are well-supported, with both earnings and cash flows covering payouts at rates of 33% and 34.9%, respectively. This contrasts sharply with some peers struggling with high payout ratios. Recent actions include a share buyback program and increased dividends, signaling confidence in financial stability and shareholder value enhancement.

- Navigate through the intricacies of Südzucker with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Südzucker's share price might be too pessimistic.

One To Reconsider

EnBW Energie Baden-Württemberg (XTRA:EBK)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: EnBW Energie Baden-Württemberg AG is an integrated energy company based in Germany, with operations extending across Europe and internationally, boasting a market capitalization of €19.23 billion.

Operations: The company generates revenue through its integrated energy operations across Germany and other European countries, as well as internationally.

Dividend Yield: 2.2%

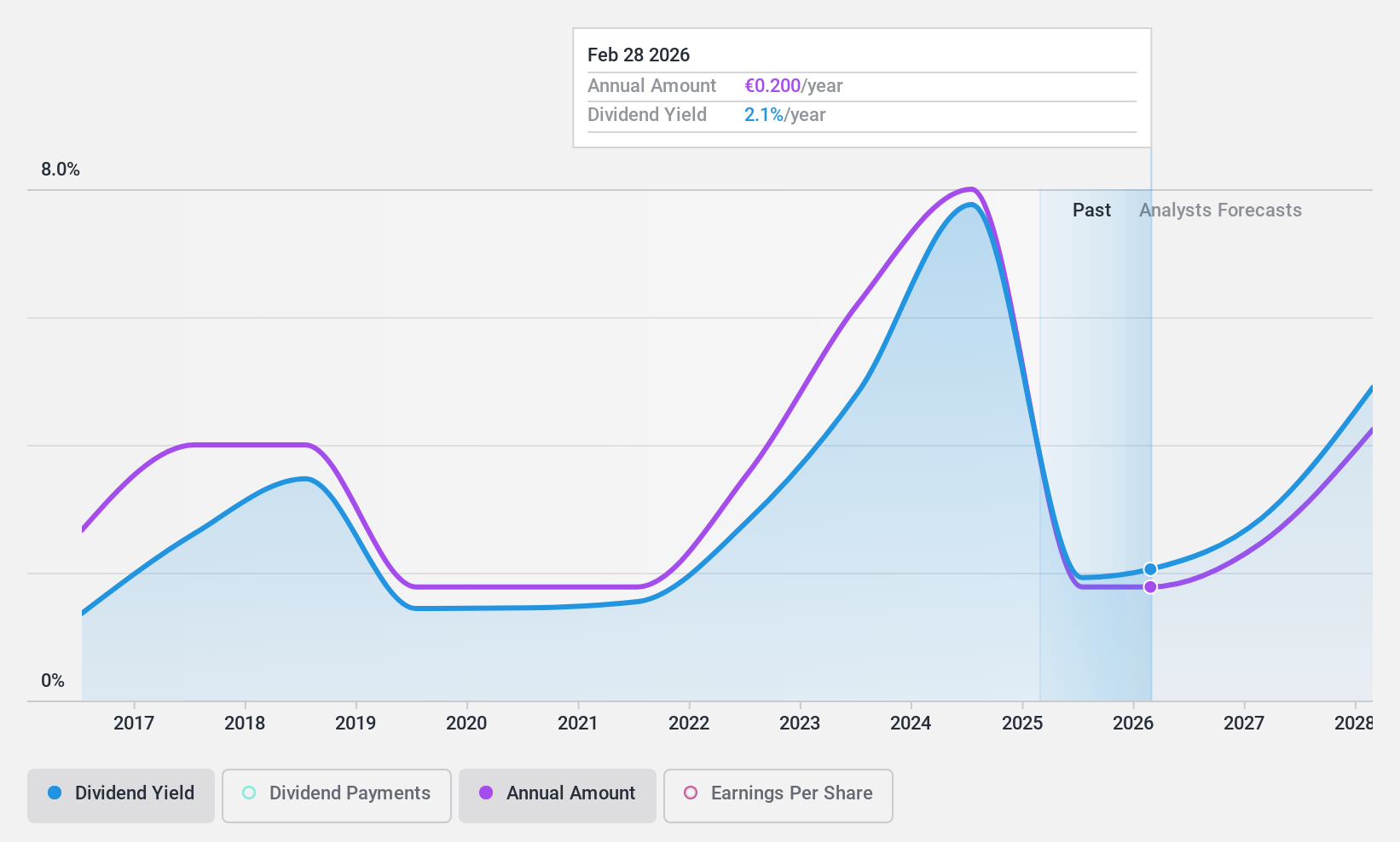

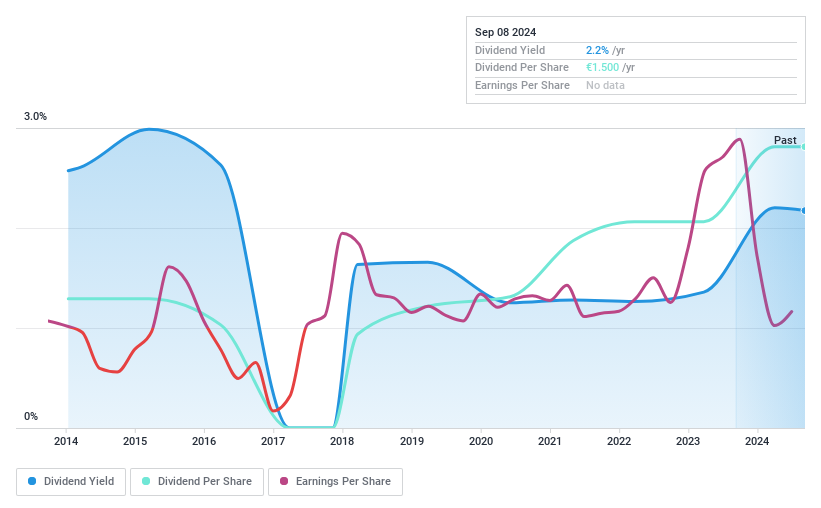

EnBW Energie Baden-Württemberg AG faces significant challenges as a dividend stock. The company's payout ratio stands at 787.4%, indicating dividends are not well covered by earnings, compounded by the absence of free cash flows. Despite a history of increasing dividends over the past decade, these payments have been volatile and unreliable. Additionally, its current dividend yield of 2.21% is below the top quartile in the German market, which averages 4.66%. Recent financial results show a sharp decline in net income and sales from previous years, further straining its financial position and impacting its ability to sustain dividends effectively.

Key Takeaways

- Reveal the 31 hidden gems among our Top Dividend Stocks screener with a single click here.

- Have you diversified into one of these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnBW Energie Baden-Württemberg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EBK

EnBW Energie Baden-Württemberg

Operates as an integrated energy company in Germany, rest of Europe, and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives