Schloss Wachenheim (XTRA:SWA) Trades at Deep Discount, Reinforcing Value Narrative Despite Slowdown

Reviewed by Simply Wall St

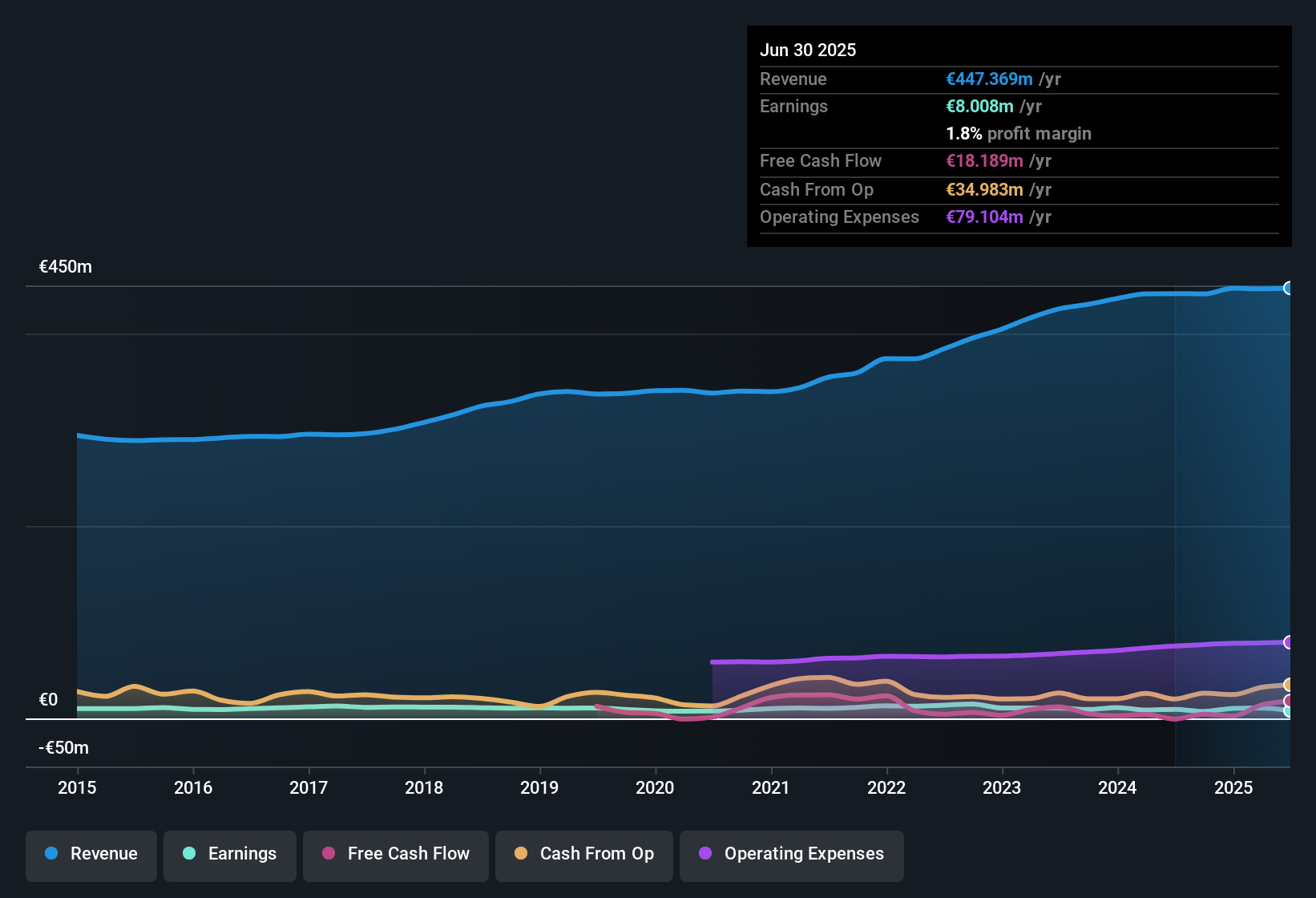

Schloss Wachenheim (XTRA:SWA) is forecast to grow earnings at 16.6% per year and revenue at 4.9% per year, just below the German market averages of 16.8% and 6% respectively. Despite negative earnings growth over the past year, SWA’s earnings are considered high quality. The company is currently trading at €14.8, well below its estimated fair value of €57.17, and offers a reward profile that includes trading below analyst targets, an attractive dividend, forecasted profit growth, and solid value metrics.

See our full analysis for Schloss Wachenheim.Next, we'll see how these results compare with the narratives that investors and analysts are watching closely. Some expectations will be confirmed, while others might be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

High-Quality Earnings Despite Recent Dip

- SWA's earnings are described as "high quality" in the filing, even though the company experienced negative earnings growth over the last year. This hints at underlying profitability drivers that are not simply tied to short-term cyclical factors.

- Market observers note that steady execution and successful geographic expansion support the view that SWA can maintain resilient performance, even as cost pressures persist.

- While the most recent year’s earnings were down, the absence of flagged risk items signals stability amid sector challenges.

- The company’s ability to generate consistent profit, even when sector peers struggle, is seen as a foundation for long-term growth potential.

Dividend Appeal and Reward Profile Stand Out

- SWA is highlighted for offering an attractive dividend and trading below analyst price targets. Both are pointed to as key strengths in its investor reward profile.

- Building on this, many investors focus on the appeal of a reliable dividend and steady profit outlook, especially during periods when broader consumer spending remains subdued.

- The combination of a below-target share price of €14.80 (vs. analyst target €20.68) and continued dividend payouts heavily supports the narrative that SWA stands out as a defensive, income-generating play.

- Forecasted profit growth of 16.6% per year adds to the confidence that SWA can sustain rewards for shareholders even as overall market sentiment is more tepid.

Valuation Discount Versus Fair Value

- At €14.80 per share, SWA trades at roughly one quarter of its DCF fair value (€57.17), presenting a wide gap between current valuation and intrinsic worth.

- This sizable discount is often cited as a buffer against downside risk, with analysts flagging the company’s sector positioning and stable business model as reasons the stock could catch up to its underlying value.

- Even with a P/E ratio of 14.6x, which is above its immediate peers but below the broader European beverage sector’s 16.6x, investors see room for multiple expansion if growth initiatives continue to gain traction.

- Absent any specific risk warnings, market watchers generally believe the valuation discount provides an opportunity for patient shareholders, especially if performance rebounds toward market averages.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Schloss Wachenheim's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.See What Else Is Out There

Although Schloss Wachenheim offers attractive dividends and trades at a discount, its recent negative earnings growth raises questions about the consistency of profit delivery over time.

If sustained performance matters most, check out stable growth stocks screener to discover companies that consistently grow earnings and revenue, even when economic conditions are less certain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SWA

Schloss Wachenheim

Produces and distributes sparkling and semi-sparkling wine products in Europe and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives