- Germany

- /

- Oil and Gas

- /

- XTRA:VH2

Undiscovered Gems With Promising Potential This December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are navigating a complex landscape marked by cautious Federal Reserve commentary and looming political uncertainties. Smaller-cap stocks have been particularly impacted, with indices like the S&P 600 experiencing notable declines amid broader market volatility. In this environment, identifying promising stocks involves looking for companies that demonstrate resilience and potential for growth despite economic headwinds—qualities that can transform them into undiscovered gems in the investment arena.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Conoil | 27.59% | 16.64% | 46.05% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.18% | 50.86% | 65.05% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Hwang Chang General Contractor (TWSE:2543)

Simply Wall St Value Rating: ★★★★★★

Overview: Hwang Chang General Contractor Co., Ltd operates as a contractor for civil engineering projects in Taiwan with a market capitalization of approximately NT$30.49 billion.

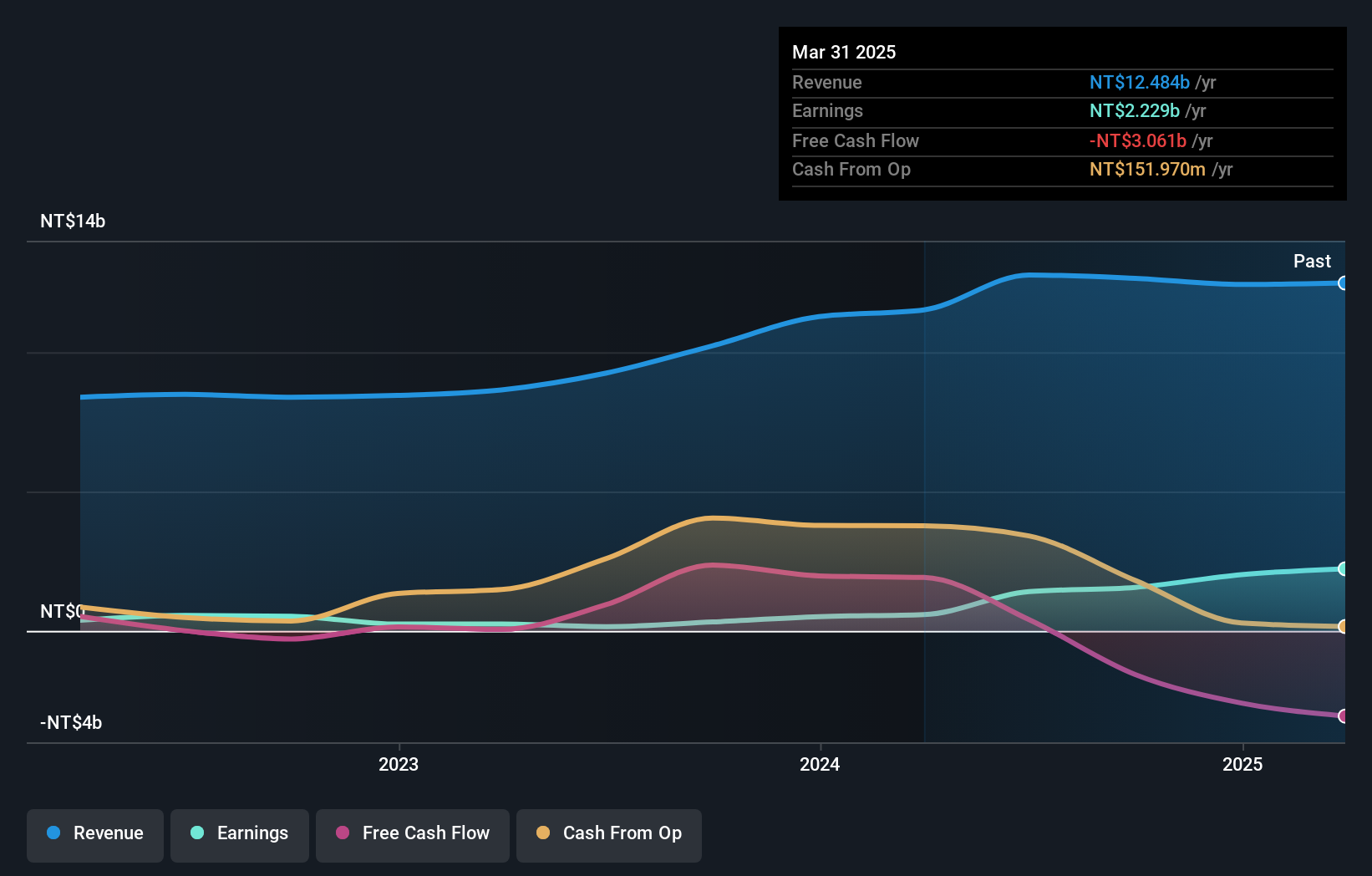

Operations: Hwang Chang General Contractor generates revenue primarily from its Construction Engineering Division, contributing NT$11.47 billion, and the Concrete Department, adding NT$1.95 billion. The company experienced an adjustment and write-off of -NT$0.77 billion in its financials.

Hwang Chang General Contractor, a nimble player in the construction sector, posted impressive earnings growth of 388% over the past year, outpacing the industry average of 9%. The company's net income for Q3 reached TWD 318 million, a notable jump from TWD 165 million last year. Despite some shareholder dilution and share price volatility recently, its debt to equity ratio improved from 73.8% to 31.5% over five years. With interest payments well covered by EBIT at a multiple of 46 and satisfactory net debt levels at 19%, Hwang Chang shows resilience amidst market fluctuations.

Khgears International (TWSE:4571)

Simply Wall St Value Rating: ★★★★★★

Overview: Khgears International Limited, along with its subsidiaries, specializes in the manufacturing and sale of gears and gearboxes across Asia, the United States, and Europe, with a market capitalization of NT$13.03 billion.

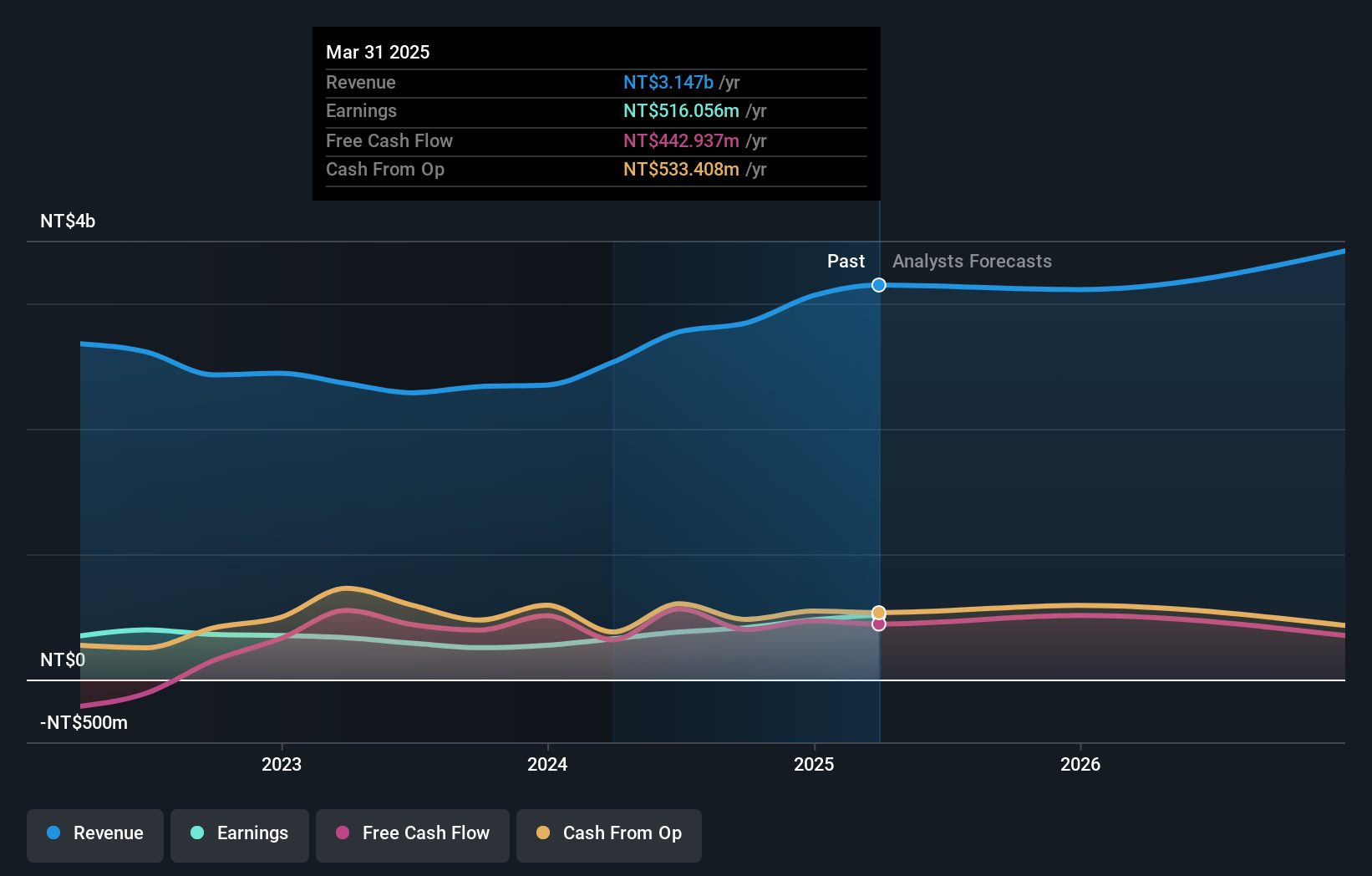

Operations: The company generates revenue primarily from gear manufacturing and sales, amounting to NT$2.84 billion.

Khgears International, a smaller player in the machinery sector, has demonstrated notable financial growth and resilience. Recent earnings for Q3 2024 showed sales reaching TWD 719.61 million, up from TWD 649.59 million last year, with net income climbing to TWD 97.57 million from TWD 62.91 million previously. The company's earnings per share also saw an increase, reflecting strong operational performance and profitability with basic EPS at TWD 1.89 compared to last year's TWD 1.19. Despite a volatile share price over the past three months, Khgears boasts high-quality earnings and has reduced its debt-to-equity ratio significantly over five years from 4.4% to 2.7%. With free cash flow remaining positive and profit growth outpacing industry averages by a substantial margin of over four times (62% vs industry’s nearly15%), Khgears seems well-positioned within its niche market segment despite broader economic challenges.

- Delve into the full analysis health report here for a deeper understanding of Khgears International.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Value Rating: ★★★★★☆

Overview: Friedrich Vorwerk Group SE focuses on providing solutions for the transformation and transportation of energy across Germany and Europe, with a market cap of €556 million.

Operations: The company generates revenue primarily from electricity (€139.09 million), natural gas (€159.02 million), clean hydrogen (€25.66 million), and adjacent opportunities (€113.55 million).

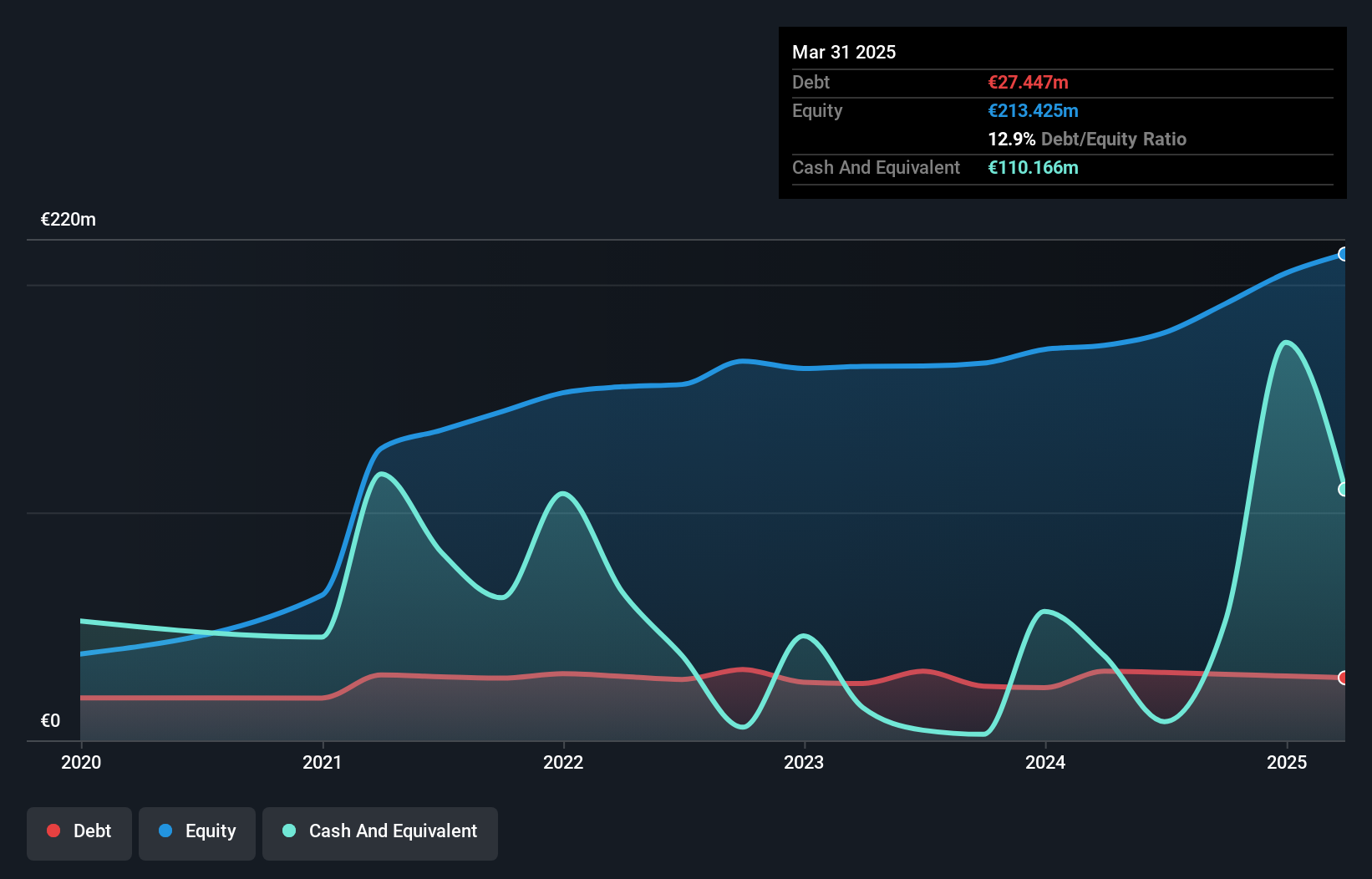

Friedrich Vorwerk Group has shown impressive growth, with earnings soaring by 1330% over the past year, far outpacing the Oil and Gas industry's -28.6%. The company reported a significant increase in net income for Q3 2024 at €12.74 million compared to €1.17 million the previous year, reflecting strong operational performance. With sales reaching €144.98 million in Q3 from last year's €109.51 million, it demonstrates robust revenue generation capabilities. The company's debt is well-managed as it holds more cash than total debt, and interest payments are comfortably covered by EBIT at 48 times coverage, indicating financial stability and potential for future growth.

- Get an in-depth perspective on Friedrich Vorwerk Group's performance by reading our health report here.

Gain insights into Friedrich Vorwerk Group's past trends and performance with our Past report.

Make It Happen

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4609 more companies for you to explore.Click here to unveil our expertly curated list of 4612 Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VH2

Friedrich Vorwerk Group

Provides various solutions for transformation and transportation of energy in Germany and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.