- Germany

- /

- Oil and Gas

- /

- XTRA:VBK

Do VERBIO Vereinigte BioEnergie's (ETR:VBK) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like VERBIO Vereinigte BioEnergie (ETR:VBK). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for VERBIO Vereinigte BioEnergie

How Fast Is VERBIO Vereinigte BioEnergie Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. You can imagine, then, that it almost knocked my socks off when I realized that VERBIO Vereinigte BioEnergie grew its EPS from €1.20 to €3.66, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

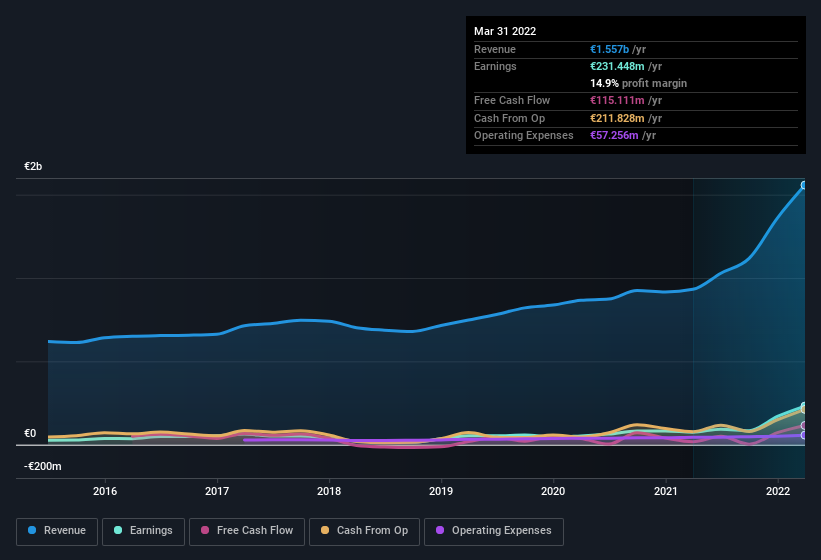

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that VERBIO Vereinigte BioEnergie is growing revenues, and EBIT margins improved by 10.8 percentage points to 22%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of VERBIO Vereinigte BioEnergie's forecast profits?

Are VERBIO Vereinigte BioEnergie Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that VERBIO Vereinigte BioEnergie insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 58%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. And their holding is extremely valuable at the current share price, totalling €1.8b. Now that's what I call some serious skin in the game!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like VERBIO Vereinigte BioEnergie with market caps between €1.9b and €6.1b is about €2.2m.

VERBIO Vereinigte BioEnergie offered total compensation worth €1.3m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does VERBIO Vereinigte BioEnergie Deserve A Spot On Your Watchlist?

VERBIO Vereinigte BioEnergie's earnings per share have taken off like a rocket aimed right at the moon. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so I do think VERBIO Vereinigte BioEnergie is worth considering carefully. You should always think about risks though. Case in point, we've spotted 3 warning signs for VERBIO Vereinigte BioEnergie you should be aware of, and 2 of them are significant.

Although VERBIO Vereinigte BioEnergie certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:VBK

Verbio

Engages in the production and distribution of fuels and finished products in Germany, Europe, North America, and internationally.

Good value with reasonable growth potential.