- Italy

- /

- Infrastructure

- /

- BIT:ADB

Top European Dividend Stocks For March 2025

Reviewed by Simply Wall St

As European markets navigate the challenges posed by U.S. trade tariffs and uncertainty over monetary policy, investors are keenly observing how these factors might impact economic growth across the region. Despite these headwinds, dividend stocks remain a focal point for those seeking income stability in a fluctuating market environment, as they offer potential returns through regular payouts even when broader indices face volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.21% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.16% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.68% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.75% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.07% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.57% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.66% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★☆ |

Click here to see the full list of 233 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Aeroporto Guglielmo Marconi di Bologna (BIT:ADB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aeroporto Guglielmo Marconi di Bologna S.p.A., along with its subsidiaries, is involved in developing, managing, and maintaining the airport in Bologna and has a market cap of €299.84 million.

Operations: Aeroporto Guglielmo Marconi di Bologna S.p.A. generates its revenue from two main segments: Aeronautical Services (€73.41 million) and Non-Aeronautical activities (€55.83 million).

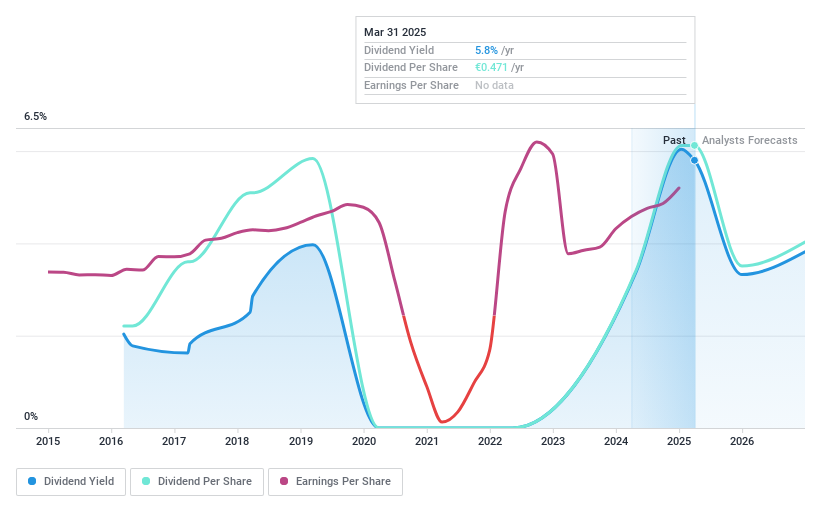

Dividend Yield: 5.7%

Aeroporto Guglielmo Marconi di Bologna offers a compelling dividend yield of 5.67%, placing it in the top 25% of Italian dividend payers. Despite recent earnings growth, its dividends have been volatile over the past nine years. The payout ratio stands at a manageable 69.3%, with strong cash flow coverage at 34.4%. However, investors should note the unstable dividend history and forecasted decline in earnings over the next three years.

- Click here to discover the nuances of Aeroporto Guglielmo Marconi di Bologna with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Aeroporto Guglielmo Marconi di Bologna's share price might be too optimistic.

Corbion (ENXTAM:CRBN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Corbion N.V. operates globally, offering lactic acid and derivatives, enzyme blends, minerals, vitamins, and algae ingredients, with a market cap of €1.21 billion.

Operations: Corbion N.V.'s revenue is primarily derived from its Health & Nutrition segment, which generates €290.20 million, and its Functional Ingredients & Solutions segment, contributing €997.90 million.

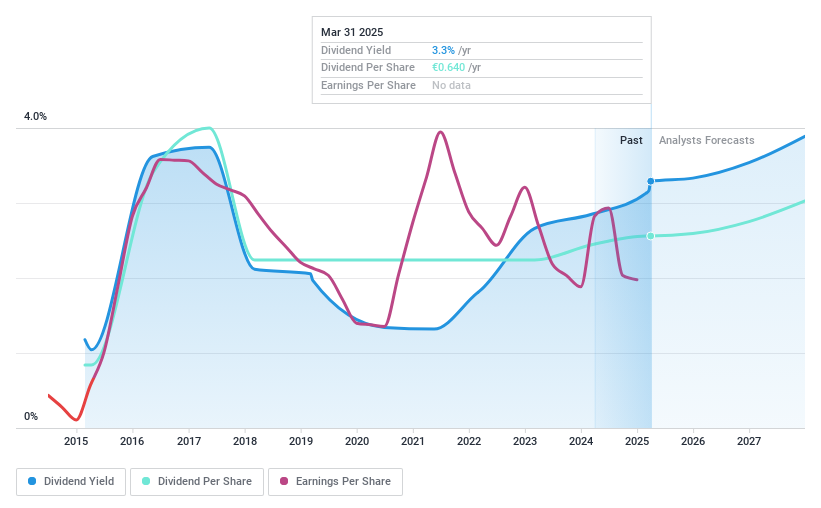

Dividend Yield: 3.1%

Corbion N.V. proposed a 5% increase in its dividend to €0.64 per share, reflecting its commitment to returning value to shareholders despite a volatile dividend history over the past decade. The company's dividends are well-covered by cash flows, with a cash payout ratio of 37.2%, though earnings coverage is tighter at 81.5%. While trading below estimated fair value and reporting significant earnings growth in 2024, Corbion carries high debt levels and offers a modest yield of 3.07%.

- Get an in-depth perspective on Corbion's performance by reading our dividend report here.

- Our valuation report here indicates Corbion may be undervalued.

OVB Holding (XTRA:O4B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: OVB Holding AG, with a market cap of €327.78 million, operates through its subsidiaries to offer advisory and brokerage services to private households across Europe.

Operations: OVB Holding AG generates revenue primarily from its insurance brokerage segment, which amounts to €392.74 million.

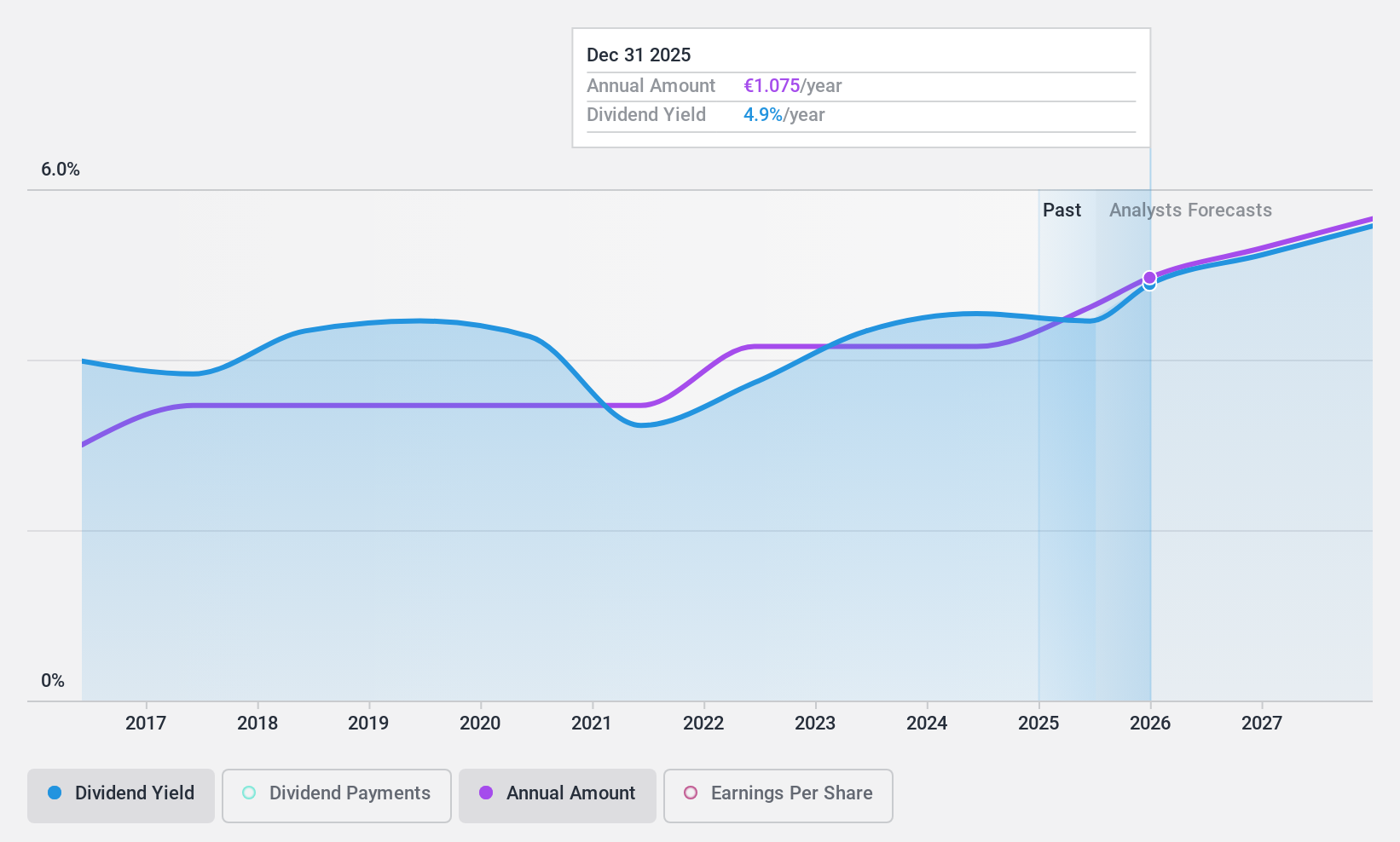

Dividend Yield: 3.9%

OVB Holding maintains a sustainable dividend with a payout ratio of 69.3%, supported by both earnings and cash flows. The company has consistently increased its dividends over the past decade, ensuring reliability and stability without significant volatility. Although its yield of 3.91% is below the top quartile in Germany, OVB's stock trades at 11.7% below estimated fair value, offering potential value for investors focused on dividend growth and income stability in Europe.

- Unlock comprehensive insights into our analysis of OVB Holding stock in this dividend report.

- Our comprehensive valuation report raises the possibility that OVB Holding is priced higher than what may be justified by its financials.

Summing It All Up

- Click through to start exploring the rest of the 230 Top European Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ADB

Aeroporto Guglielmo Marconi di Bologna

Develops, manages, and maintains an airport in Bologna.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives