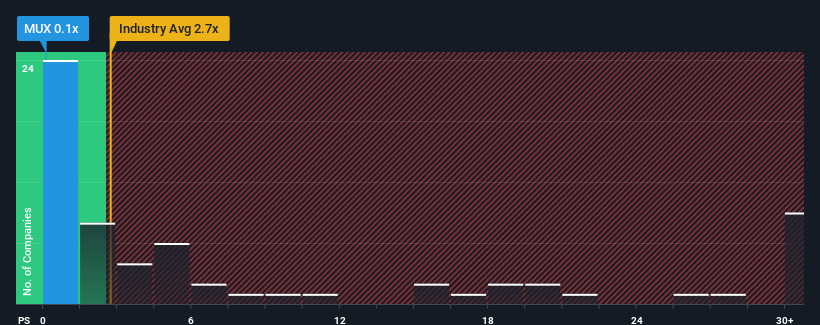

You may think that with a price-to-sales (or "P/S") ratio of 0.1x Mutares SE & Co. KGaA (ETR:MUX) is definitely a stock worth checking out, seeing as almost half of all the Capital Markets companies in Germany have P/S ratios greater than 2.7x and even P/S above 19x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Mutares SE KGaA

How Mutares SE KGaA Has Been Performing

Mutares SE KGaA's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mutares SE KGaA.Is There Any Revenue Growth Forecasted For Mutares SE KGaA?

Mutares SE KGaA's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. Pleasingly, revenue has also lifted 145% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth will be highly resilient over the next year growing by 23%. Meanwhile, the broader industry is forecast to contract by 3.3%, which would indicate the company is doing very well.

With this in mind, we find it intriguing that Mutares SE KGaA's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

What Does Mutares SE KGaA's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Mutares SE KGaA currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Mutares SE KGaA (2 shouldn't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Mutares SE KGaA, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:MUX

Mutares SE KGaA

A private equity firm specializing in investments in secondary direct, special situations, bridge financing, recapitalization, distressed/vulture, management succession, reorganization, carve-outs, turnarounds, spin-offs and re-funding.

Good value second-rate dividend payer.

Market Insights

Community Narratives