- Germany

- /

- Capital Markets

- /

- XTRA:MPCK

Upgrade: Analysts Just Made A Meaningful Increase To Their MPC Münchmeyer Petersen Capital AG (ETR:MPCK) Forecasts

MPC Münchmeyer Petersen Capital AG (ETR:MPCK) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with analysts modelling a real improvement in business performance.

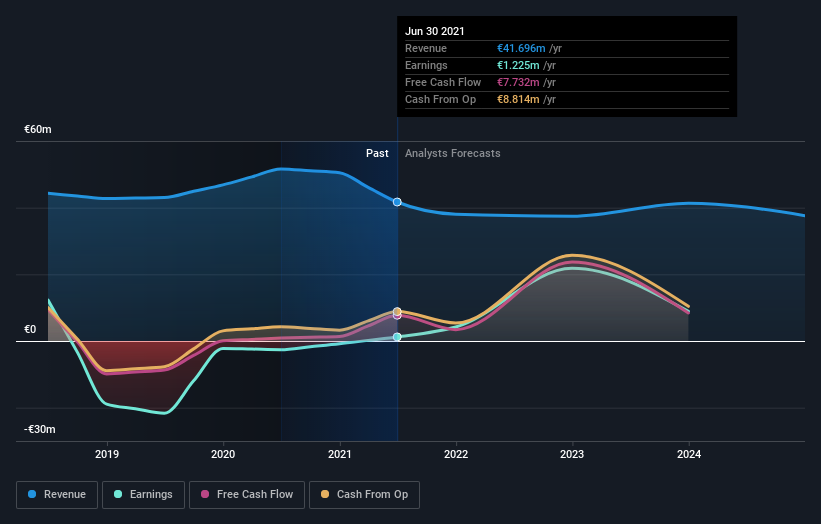

Following this upgrade, MPC Münchmeyer Petersen Capital's two analysts are forecasting 2021 revenues to be €42m, approximately in line with the last 12 months. Per-share earnings are expected to bounce 317% to €0.14. Previously, the analysts had been modelling revenues of €38m and earnings per share (EPS) of €0.12 in 2021. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

Check out our latest analysis for MPC Münchmeyer Petersen Capital

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's also worth noting that the years of declining sales look to have come to an end, with the forecast for flat revenues to the end of 2021. Historically, MPC Münchmeyer Petersen Capital's sales have shrunk approximately 1.5% annually over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 2.5% annually. Although MPC Münchmeyer Petersen Capital's revenues are expected to improve, it seems that it is still expected to grow slower than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. More bullish expectations could be a signal for investors to take a closer look at MPC Münchmeyer Petersen Capital.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for MPC Münchmeyer Petersen Capital going out as far as 2024, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:MPCK

Undervalued with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026