Unveiling Three Undiscovered German Gems with Solid Potential

Reviewed by Simply Wall St

As global tensions and economic shifts impact markets, Germany's DAX index recently experienced a decline amid broader European market caution. Despite this backdrop, opportunities may exist within small-cap stocks that often remain under the radar but exhibit strong fundamentals and potential resilience in volatile environments. Identifying such stocks involves looking for companies with robust financial health, innovative business models, or niche market positions that can navigate current challenges effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| EnviTec Biogas | 48.48% | 20.85% | 46.34% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| DFV Deutsche Familienversicherung | NA | 19.63% | 62.92% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Gelsenwasser (DB:WWG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gelsenwasser AG operates in the water, wastewater, gas supply, and electricity sectors across Germany, the Czech Republic, and Poland with a market capitalization of approximately €1.80 billion.

Operations: Gelsenwasser AG generates revenue primarily from energy sales (€3.93 billion) and energy grids (€271.20 million), with additional contributions from water services (€286.30 million) and wastewater management (€39.20 million). The company's net profit margin reflects its financial performance across these segments, indicating the efficiency of its operations in managing costs relative to revenue generation.

Gelsenwasser, a notable player in the utility sector, has shown impressive financial health with no debt and high-quality earnings. It trades at 87% below its estimated fair value, suggesting potential undervaluation. Despite a recent dip in sales to €1.30 billion from €2.40 billion last year, net income remains robust at €68 million. Earnings per share slightly decreased to €19.85, but the company still outpaces industry growth with a 32.9% increase in earnings over the past year.

- Click here and access our complete health analysis report to understand the dynamics of Gelsenwasser.

Examine Gelsenwasser's past performance report to understand how it has performed in the past.

MLP (XTRA:MLP)

Simply Wall St Value Rating: ★★★★★★

Overview: MLP SE, along with its subsidiaries, offers financial services to private, corporate, and institutional clients in Germany and has a market capitalization of approximately €661.25 million.

Operations: MLP SE generates revenue primarily from Financial Consulting (€429.61 million), FERI (€231.23 million), and Banking (€206.97 million) segments, with additional contributions from DOMCURA and Deutschland.Immobilien. The company faces a consolidation adjustment of -€86.32 million, impacting its overall financial performance.

MLP, a financial services firm in Germany, has shown robust growth with earnings rising 28.4% over the past year, outpacing the Capital Markets industry average of 19%. The company is debt-free and trades at a value 42% below its estimated fair value. Recent reports highlight significant revenue growth to €230 million in Q2 2024 from €212 million last year, with net income jumping from €2.39 million to €10.31 million. MLP's raised EBIT forecast for 2024 now stands between €85-95 million, reflecting strong performance-based compensation gains and positive overall results.

- Take a closer look at MLP's potential here in our health report.

Gain insights into MLP's historical performance by reviewing our past performance report.

Mühlbauer Holding (XTRA:MUB)

Simply Wall St Value Rating: ★★★★★★

Overview: Mühlbauer Holding AG specializes in the production and personalization of smart cards, passports, solar cells, and RFID solutions across Germany, Europe, Asia, the United States, Africa, and globally with a market capitalization of approximately €664.18 million.

Operations: Mühlbauer Holding AG generates revenue primarily from its Automation segment (€230.92 million) and Tecurity® segment (€171.70 million), with additional income from Precision Parts & Systems (€53.76 million).

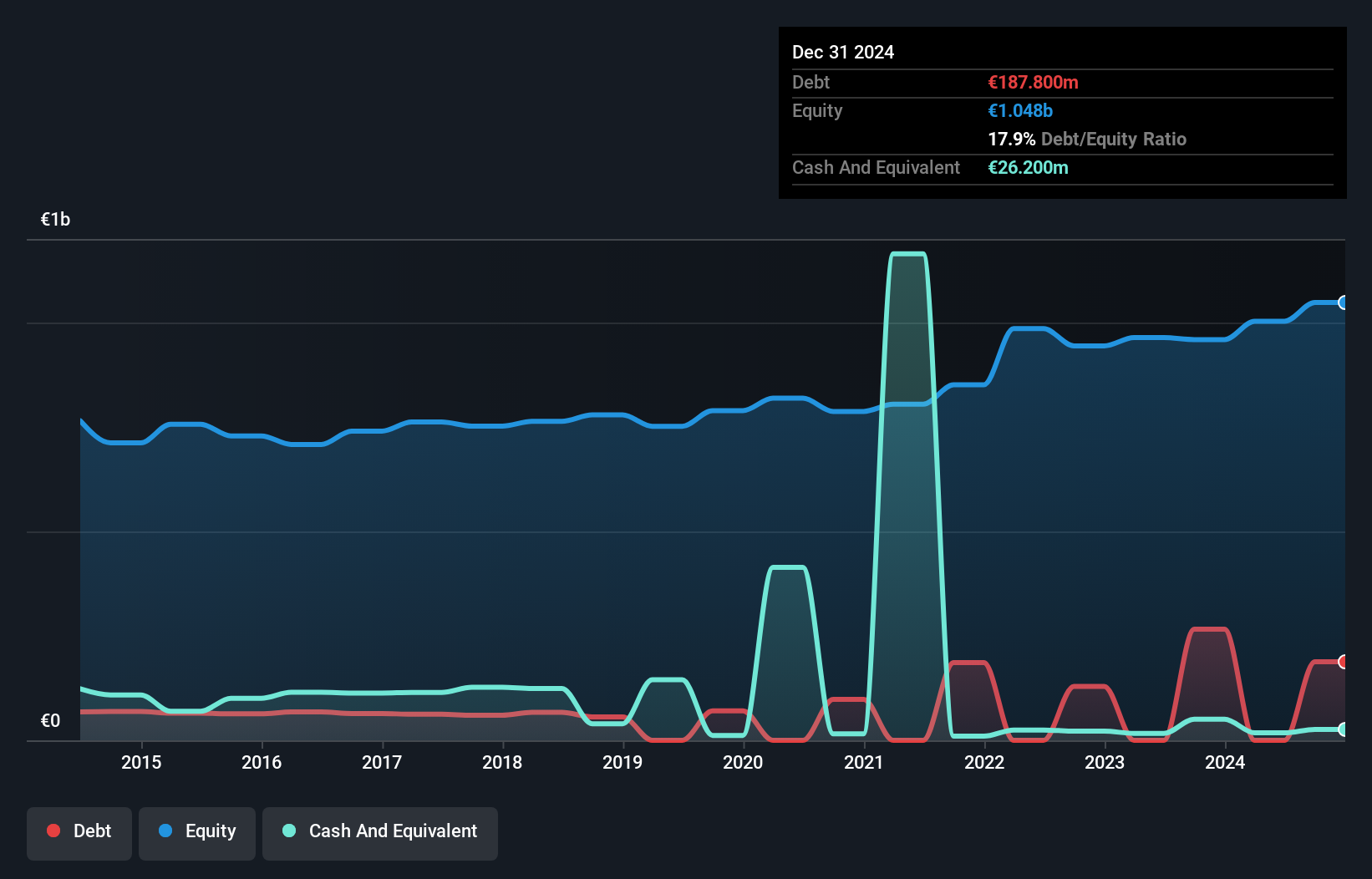

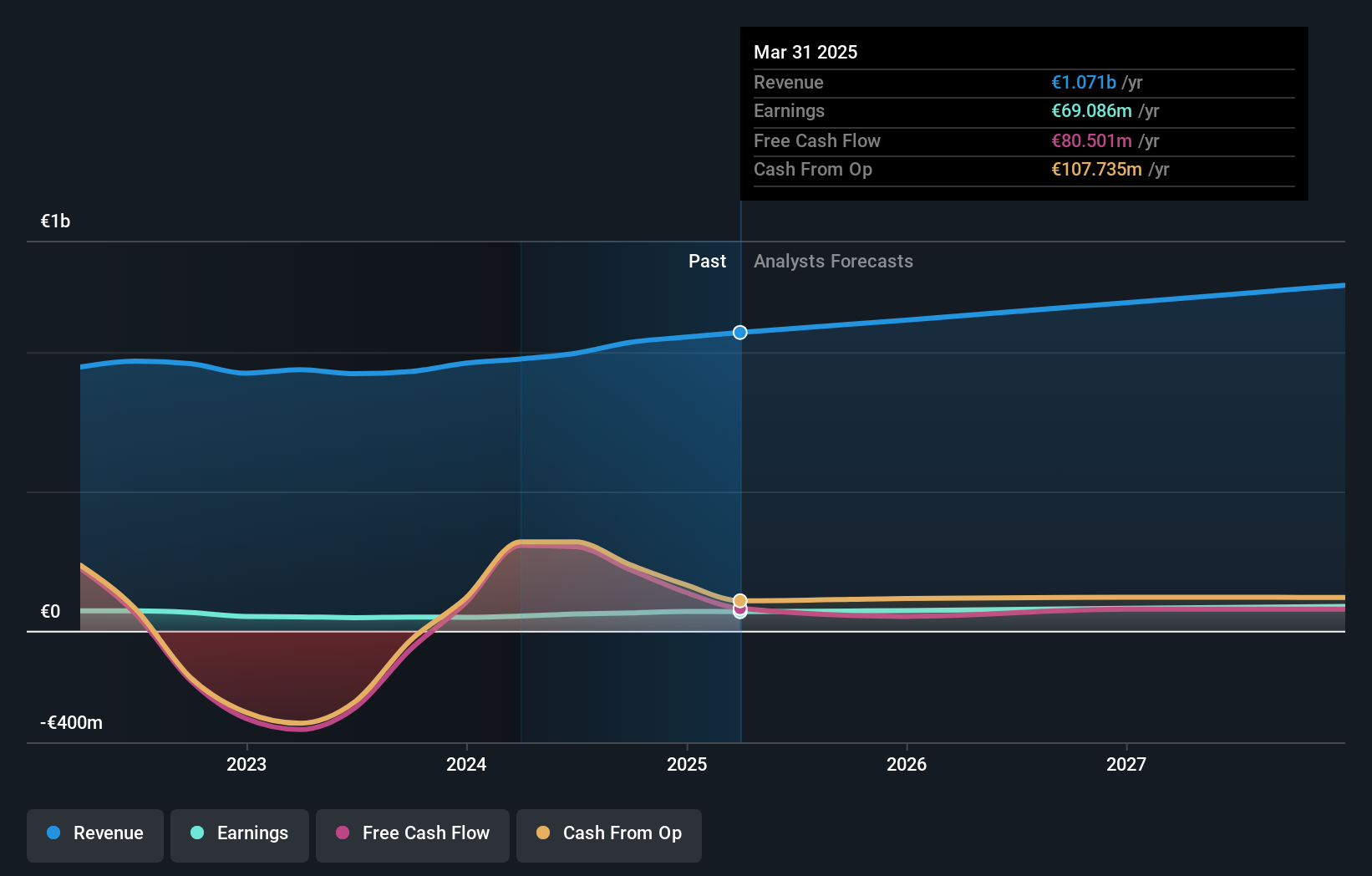

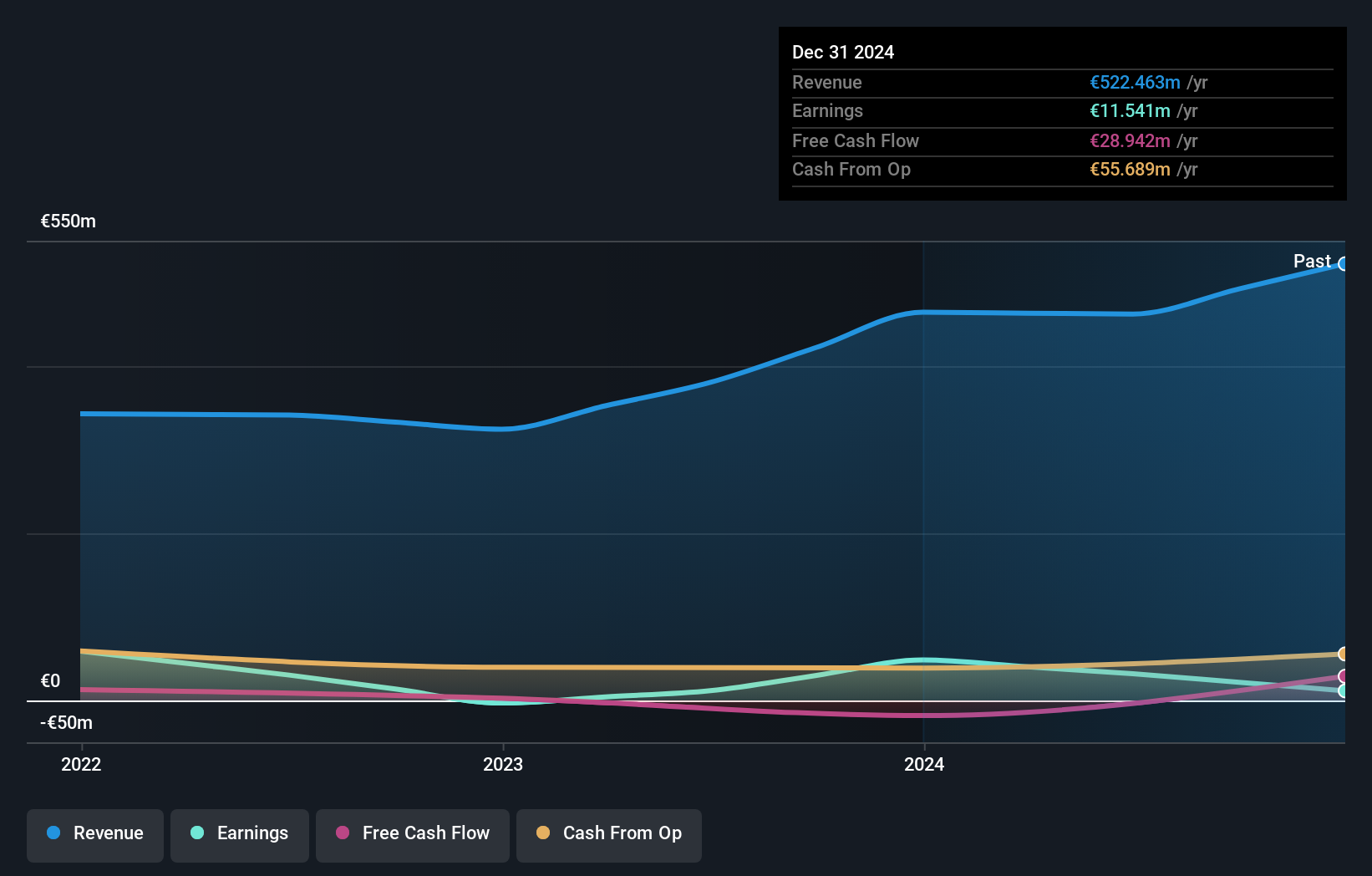

Mühlbauer Holding, a nimble player in the machinery sector, has experienced impressive earnings growth of 175% over the past year, outpacing the industry average. Despite no debt for five years, its recent half-year sales stood at €210.37 million with net income dipping to €4.66 million from €21 million previously. Basic earnings per share fell to €0.33 from €1.52 last year, indicating potential areas for improvement amidst high-quality past earnings and strong industry positioning.

- Click to explore a detailed breakdown of our findings in Mühlbauer Holding's health report.

Assess Mühlbauer Holding's past performance with our detailed historical performance reports.

Key Takeaways

- Get an in-depth perspective on all 56 German Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MUB

Mühlbauer Holding

Engages in the production and personalization of smart cards, ePassports, solar cells, and RFID solutions in Germany, rest of Europe, Asia, the United States, Africa, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives