- France

- /

- Commercial Services

- /

- ENXTPA:BB

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, with rate cuts from the ECB and SNB and expectations of a similar move by the Fed, investors are keeping a close eye on dividend stocks as potential stabilizers in their portfolios. In such an environment, stocks that offer consistent dividend payouts can provide a reliable income stream and may serve as a buffer against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.58% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.05% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.42% | ★★★★★★ |

Click here to see the full list of 1847 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

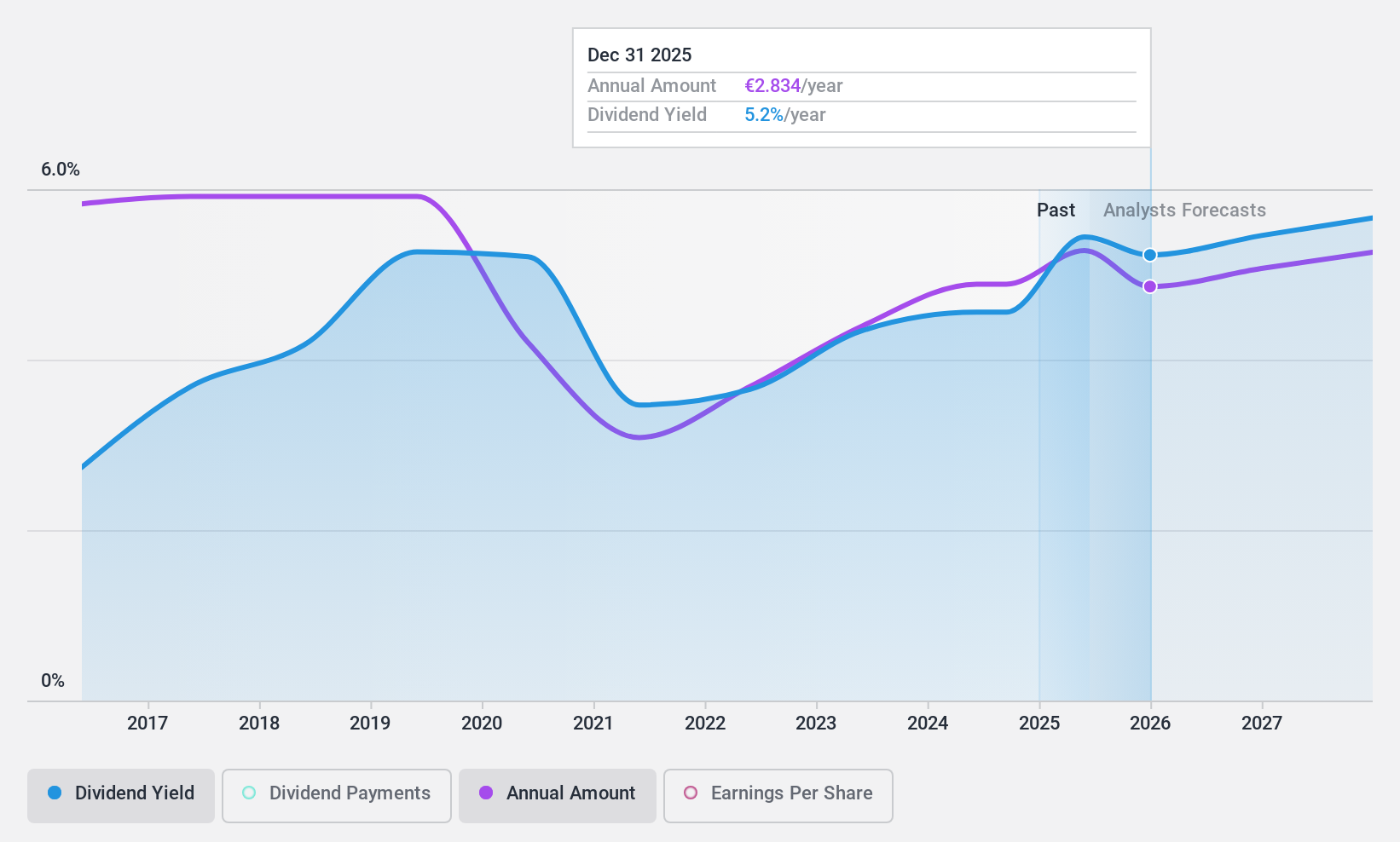

Société BIC (ENXTPA:BB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Société BIC SA is a global manufacturer and seller of stationery, lighters, shavers, and other products with a market capitalization of €2.55 billion.

Operations: Société BIC's revenue segments include €823.20 million from Stationery- Human Expression, €811.20 million from Lighters- Flame for Life, and €542.60 million from Shavers- Blade Excellence.

Dividend Yield: 4.5%

Société BIC's dividend payments are well-supported by cash flows, with a cash payout ratio of 41.5% and earnings coverage at 51.7%. Despite recent volatility in dividend history, the company has shown earnings growth of 12.8% over the past year and anticipates improved profitability in 2024 with an adjusted EBIT margin nearing 15.5%. However, its dividend yield is lower than the top quartile of French market payers, suggesting room for improvement in attractiveness to income-focused investors.

- Click here to discover the nuances of Société BIC with our detailed analytical dividend report.

- Our expertly prepared valuation report Société BIC implies its share price may be lower than expected.

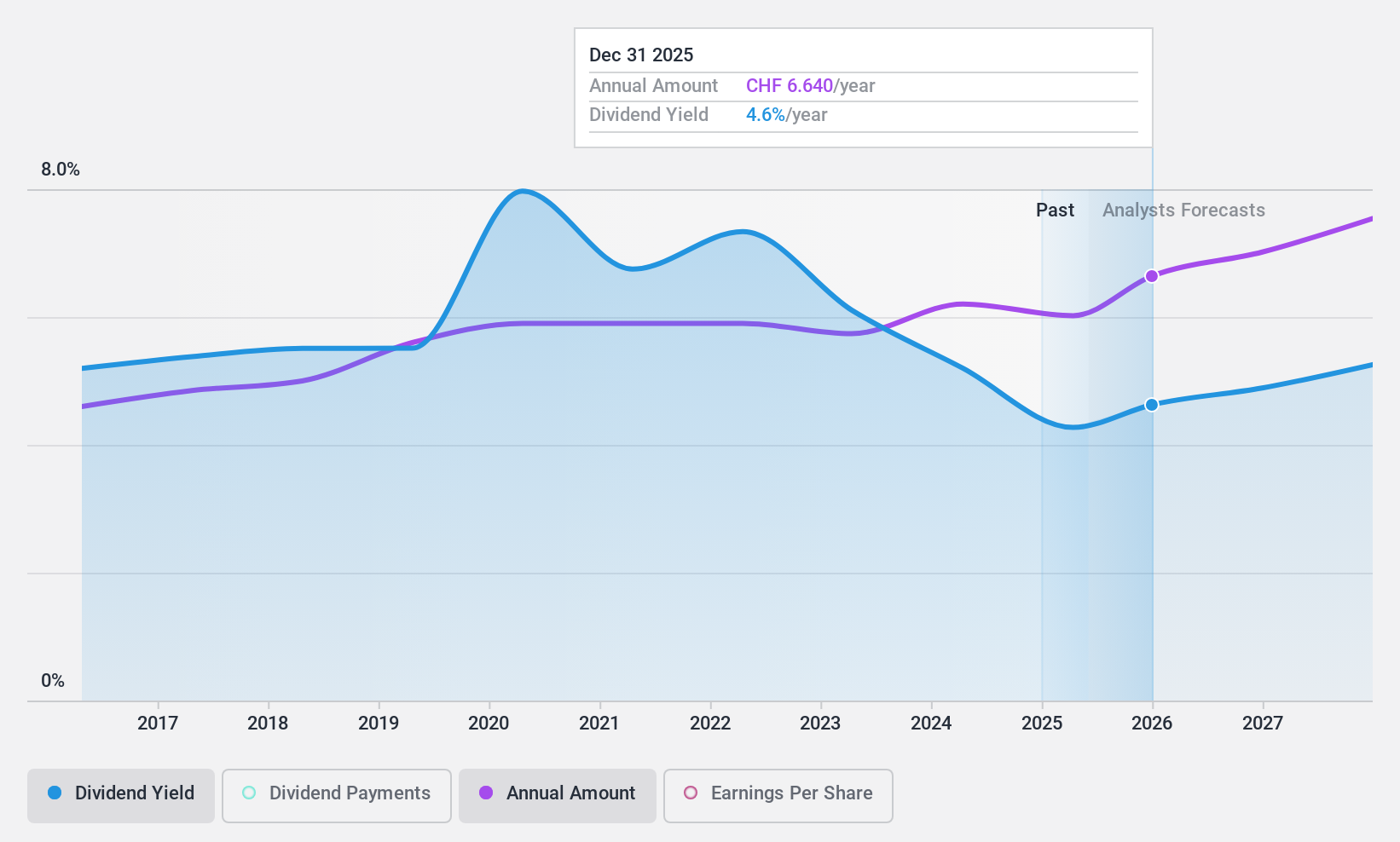

Swiss Re (SWX:SREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG, with a market cap of CHF38.58 billion, operates globally by offering wholesale reinsurance, insurance, and other risk transfer services through its subsidiaries.

Operations: Swiss Re AG's revenue is primarily derived from three segments: Property & Casualty Reinsurance ($20.99 billion), Life & Health Reinsurance ($17.47 billion), and Corporate Solutions ($6.38 billion).

Dividend Yield: 4.6%

Swiss Re's dividend yield is among the top 25% in the Swiss market, supported by a payout ratio of 67.4% and a cash payout ratio of 50%, indicating sustainability from earnings and cash flows. However, its dividend history has been volatile with declines over the past decade. Recent earnings reports show net income of US$102 million for Q3 2024, contributing to US$2.19 billion for nine months, with expectations to exceed US$3 billion by year-end.

- Delve into the full analysis dividend report here for a deeper understanding of Swiss Re.

- Our valuation report here indicates Swiss Re may be undervalued.

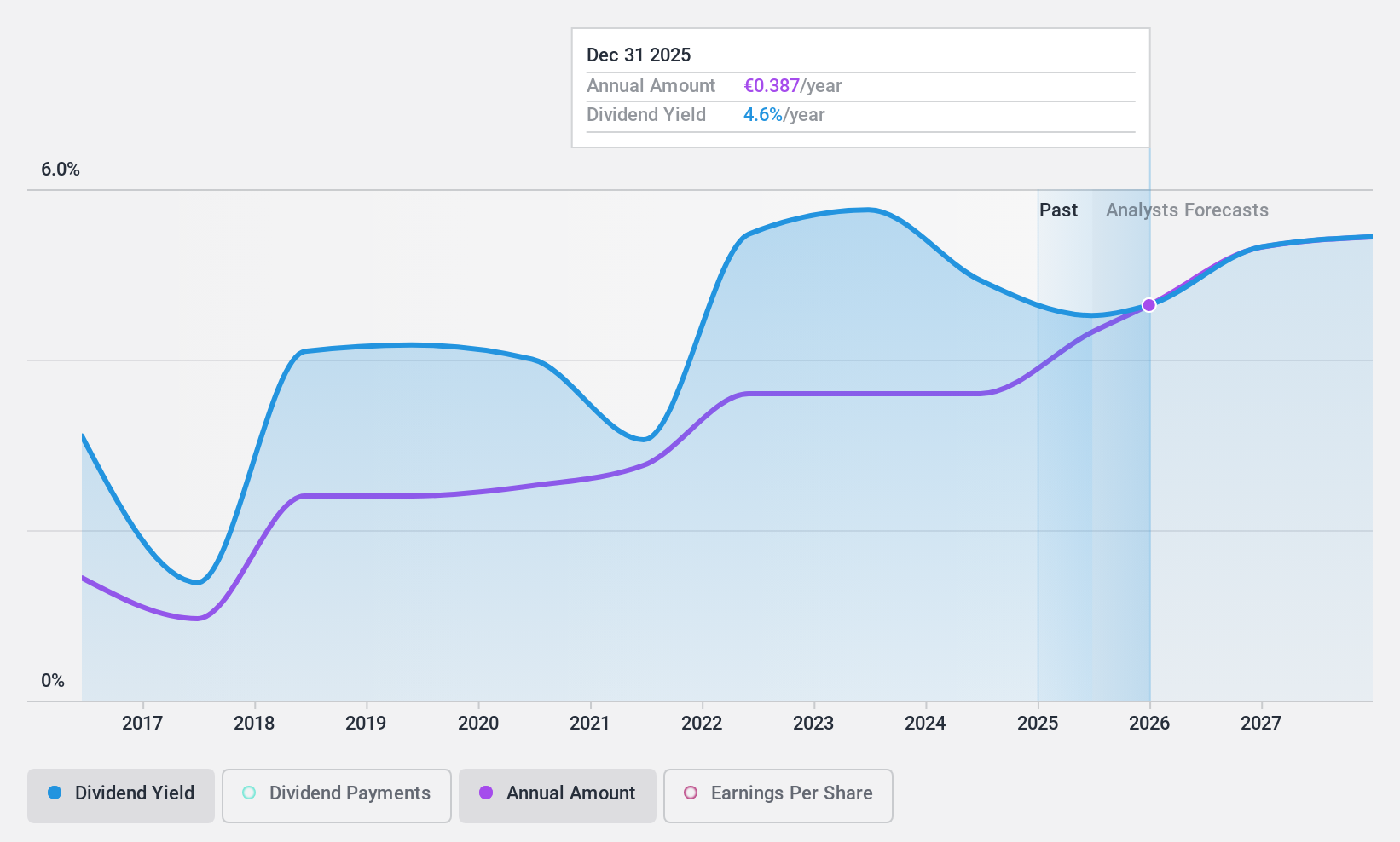

MLP (XTRA:MLP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MLP SE, with a market cap of €640.48 million, offers financial services to private, corporate, and institutional clients in Germany through its subsidiaries.

Operations: MLP SE's revenue is derived from several segments: Financial Consulting (€436.56 million), FERI (€253.38 million), Banking (€216.22 million), DOMCURA (€128.50 million), Deutschland.Immobilien (€57.54 million), and Industrial Broker (€37.20 million).

Dividend Yield: 5.1%

MLP SE's dividend yield is in the top 25% of the German market, supported by a moderate payout ratio of 51.1% and a low cash payout ratio of 15.6%, suggesting sustainability from earnings and cash flows. Despite this, its dividend history has been volatile over the past decade. Recent Q3 results show increased net income to EUR 10.29 million, with raised EBIT guidance for 2024 between EUR 85 million and EUR 95 million reflecting strong performance expectations.

- Click to explore a detailed breakdown of our findings in MLP's dividend report.

- Our valuation report unveils the possibility MLP's shares may be trading at a discount.

Key Takeaways

- Gain an insight into the universe of 1847 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BB

Société BIC

Manufactures and sells stationery, lighter, shaver, and other products worldwide.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives