- Germany

- /

- Diversified Financial

- /

- XTRA:HYQ

If You Had Bought Hypoport (ETR:HYQ) Stock Five Years Ago, You Could Pocket A 532% Gain Today

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. Just think about the savvy investors who held Hypoport SE (ETR:HYQ) shares for the last five years, while they gained 532%. If that doesn't get you thinking about long term investing, we don't know what will. In more good news, the share price has risen 1.8% in thirty days.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Hypoport

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

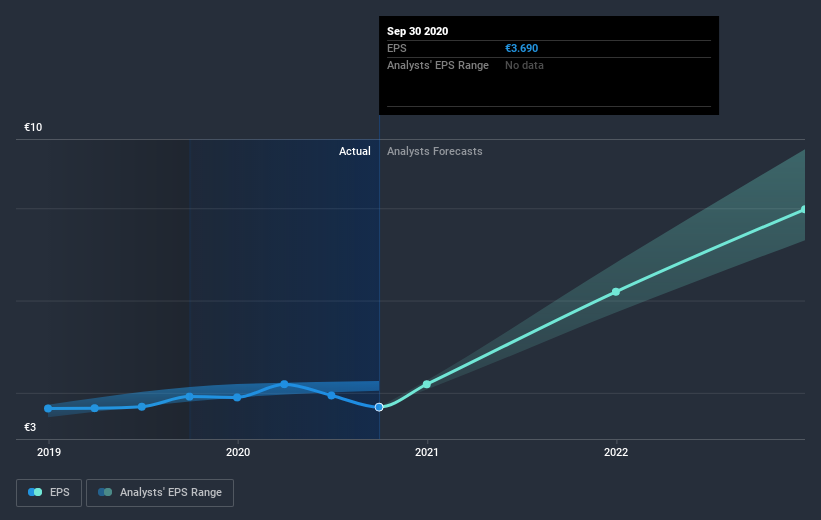

During five years of share price growth, Hypoport achieved compound earnings per share (EPS) growth of 12% per year. This EPS growth is slower than the share price growth of 45% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth. This optimism is visible in its fairly high P/E ratio of 137.93.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Hypoport's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Hypoport shareholders have received a total shareholder return of 61% over one year. That gain is better than the annual TSR over five years, which is 45%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Hypoport better, we need to consider many other factors. Even so, be aware that Hypoport is showing 1 warning sign in our investment analysis , you should know about...

But note: Hypoport may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you decide to trade Hypoport, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hypoport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:HYQ

Hypoport

Develops and markets technology platforms for the financial services, property, and insurance industries in Germany.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives