- Germany

- /

- Diversified Financial

- /

- XTRA:HYQ

3 Growth Companies With Insider Ownership Up To 33%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising inflation and cautious monetary policies, U.S. stock indexes edge toward record highs with growth stocks outpacing their value counterparts. In this context, companies with high insider ownership can offer unique insights into potential growth trajectories, as insiders often have a vested interest in the company's success and are typically well-informed about its prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 38.5% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 118.4% |

Here's a peek at a few of the choices from the screener.

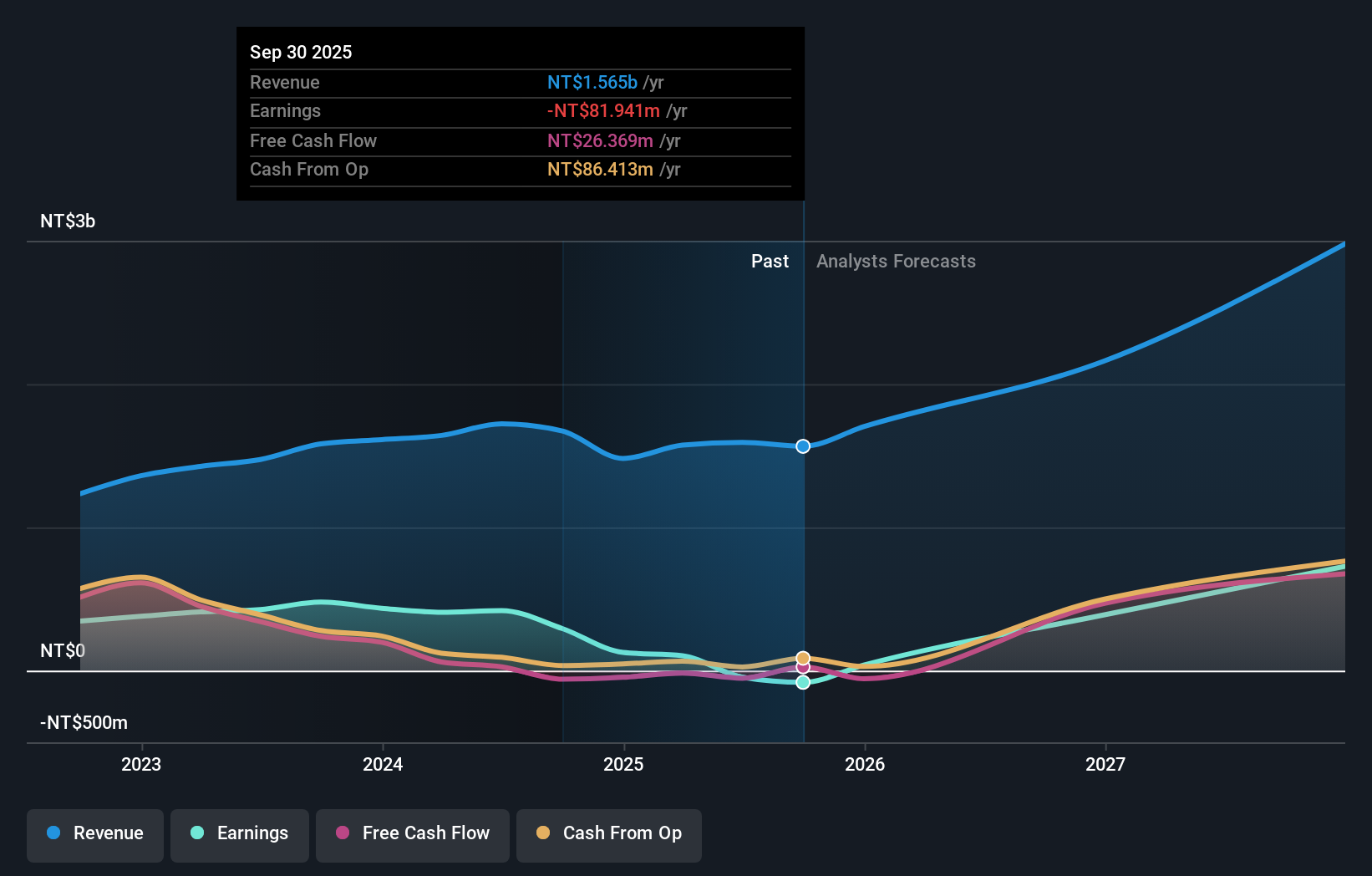

M31 Technology (TPEX:6643)

Simply Wall St Growth Rating: ★★★★★★

Overview: M31 Technology Corporation offers silicon intellectual property design services within the integrated circuit industry and has a market cap of NT$33.11 billion.

Operations: The company's revenue primarily comes from its Semiconductor Equipment and Services segment, amounting to NT$1.67 billion.

Insider Ownership: 27.2%

M31 Technology is poised for significant growth with forecasted earnings expansion of 47.89% annually, outpacing the TW market's 17.9% growth rate. Despite a volatile share price and declining profit margins from 30.2% to 17.5%, its revenue is expected to grow at an impressive 21.7% per year, surpassing the market average of 11.3%. The company recently participated in high-profile industry events, indicating active engagement with investors and stakeholders in Taiwan.

- Click here to discover the nuances of M31 Technology with our detailed analytical future growth report.

- The analysis detailed in our M31 Technology valuation report hints at an inflated share price compared to its estimated value.

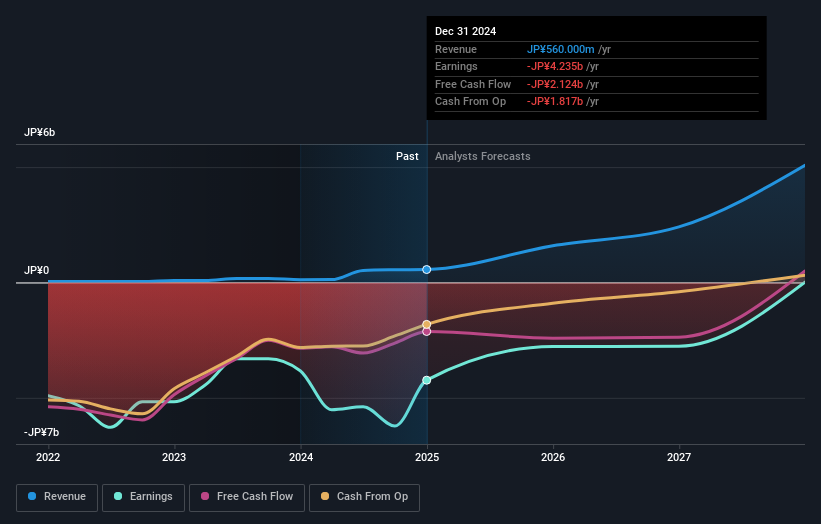

Healios K.K (TSE:4593)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Healios K.K. is involved in the research, development, manufacture, and sale of cell therapy and regenerative medicine products across Japan, Europe, and the United States with a market cap of ¥37.96 billion.

Operations: Revenue Segments (in millions of ¥): null

Insider Ownership: 31.7%

Healios K.K. is positioned for robust growth, with revenue projected to increase by 35.7% annually, significantly outpacing the JP market's 4.2%. Despite current unprofitability and a volatile share price, the company is advancing its eNK cell therapy through strategic alliances and private placements totaling ¥1.95 billion. These initiatives are expected to enhance Healios' capabilities in regenerative medicine, supported by collaborations with prominent investors like Athos Capital Limited and OrbiMed Advisors LLC.

- Navigate through the intricacies of Healios K.K with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Healios K.K is priced higher than what may be justified by its financials.

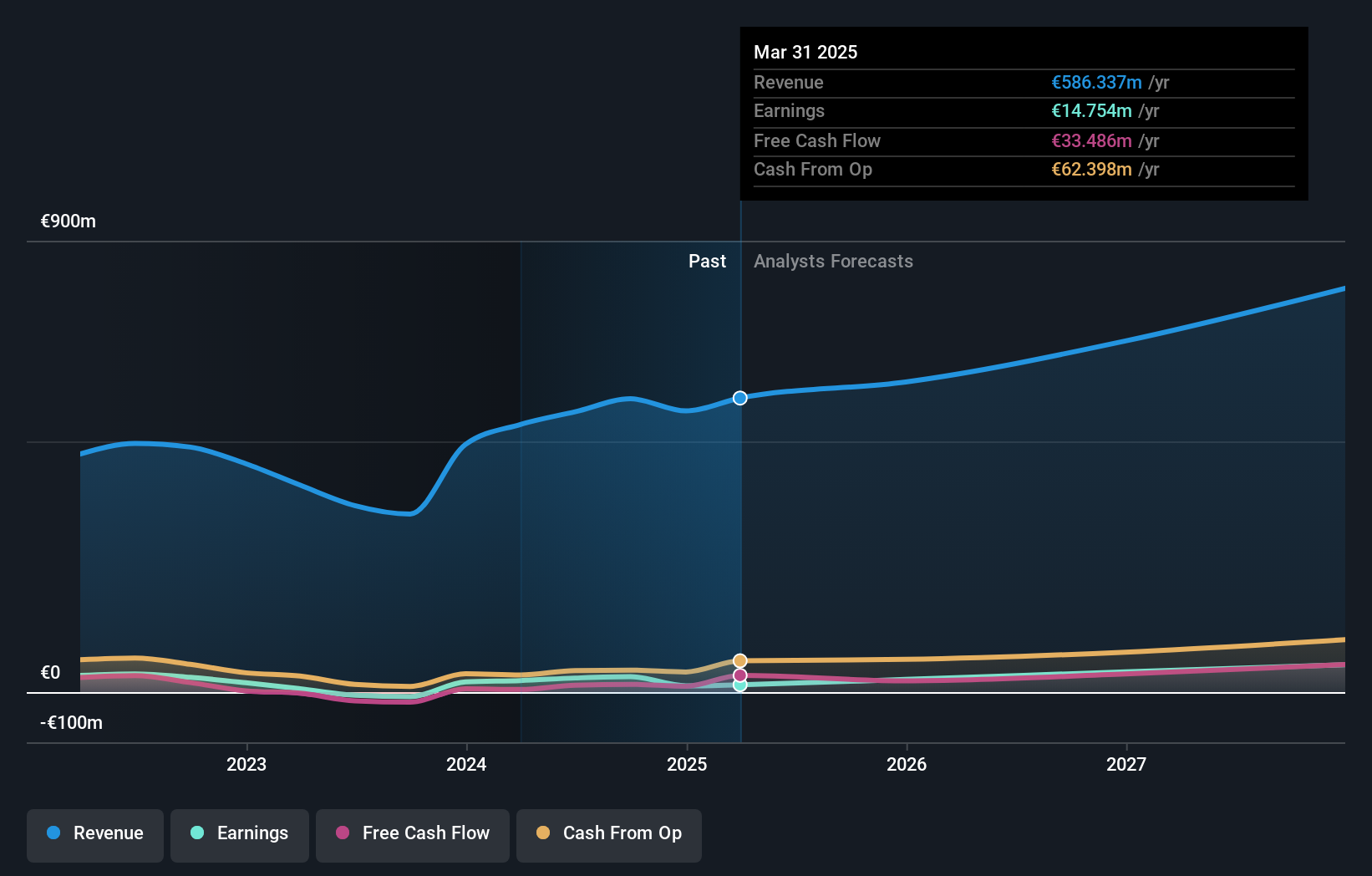

Hypoport (XTRA:HYQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hypoport SE develops and markets technology platforms for the financial services, property, and insurance industries in Germany, with a market cap of €1.42 billion.

Operations: The company's revenue segments include €27.44 million from Holding, €66.60 million from the Insurance Platform, and a Segment Adjustment of €359.92 million.

Insider Ownership: 33.5%

Hypoport SE, with significant insider ownership, is positioned for substantial growth. Earnings are forecast to grow at 27.9% annually over the next three years, outpacing the German market's 19.9%. The company became profitable this year and revenue is expected to grow by 11% per year, faster than the market's 5.9%. However, return on equity is projected to remain low at 11.1%, and recent financials were impacted by large one-off items.

- Delve into the full analysis future growth report here for a deeper understanding of Hypoport.

- Our valuation report unveils the possibility Hypoport's shares may be trading at a premium.

Where To Now?

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1463 more companies for you to explore.Click here to unveil our expertly curated list of 1466 Fast Growing Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hypoport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HYQ

Hypoport

Develops and markets technology platforms for the financial services, property, and insurance industries in Germany.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives