- Germany

- /

- Capital Markets

- /

- XTRA:FTK

flatexDEGIRO (XTRA:FTK): Revenue Growth Surpasses German Market, Reinforcing Bullish Narratives

Reviewed by Simply Wall St

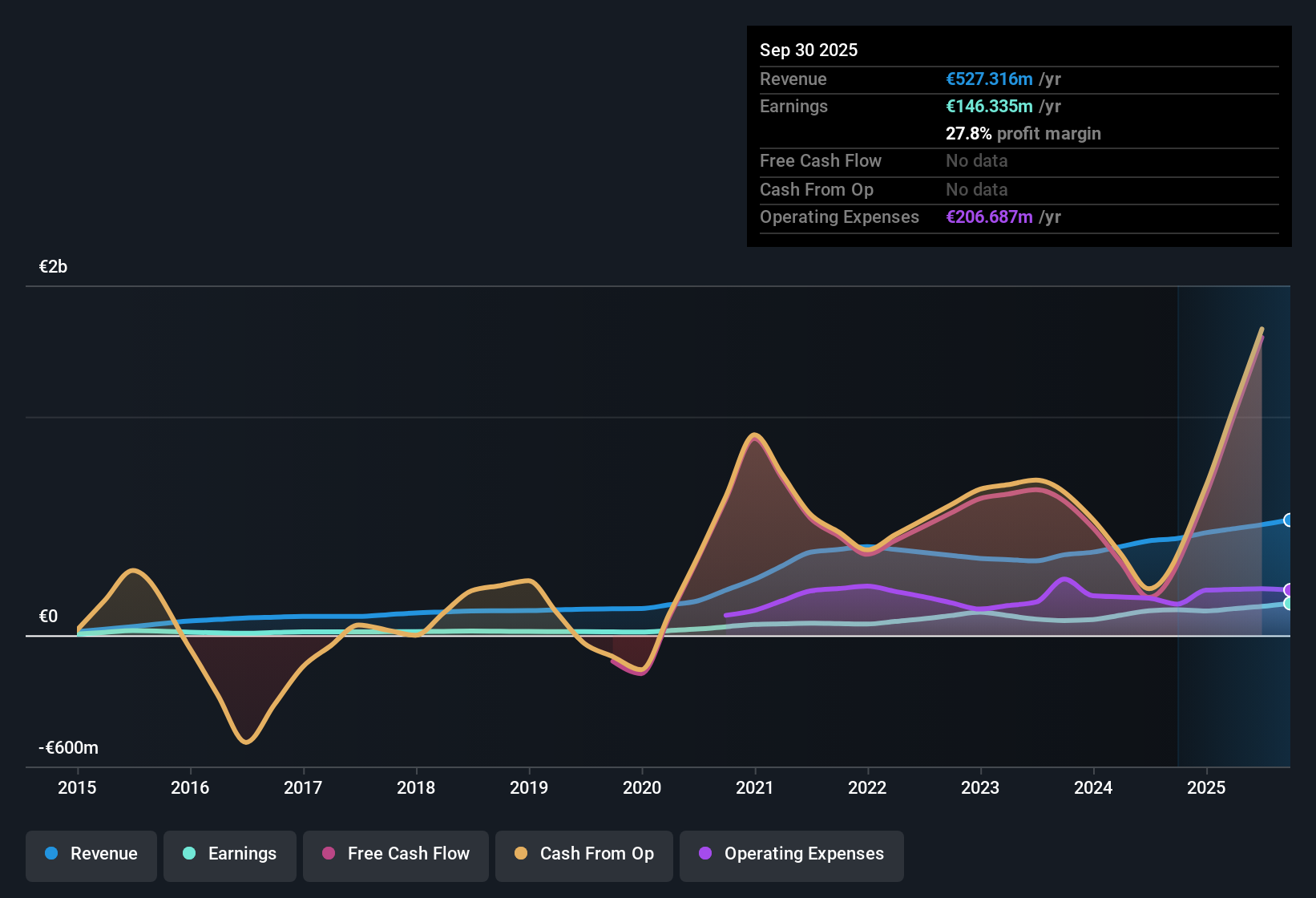

flatexDEGIRO (XTRA:FTK) booked revenue growth of 8.3% per year, beating the German market’s expected 6% pace. Earnings are projected to climb 16.2% annually, just a touch below the market average of 16.6%. The profit margin held steady at 26.1% with a one-year earnings growth of 17.4% compared to a five-year average of 20.8% per year. Investors see a strong balance of rewards here as high-quality earnings, value against peers and discounted cash flow models, and an absence of flagged risks shape a positive backdrop for the latest results.

See our full analysis for flatexDEGIRO.The next step is to see how these headline numbers compare with the key narratives investors have built around flatexDEGIRO. This is where the results could reinforce or upend the prevailing story on Simply Wall St.

See what the community is saying about flatexDEGIRO

Profit Margin Steady at 26.1%

- Profit margin remained flat at 26.1%, matching last year’s level. This indicates the company is keeping costs in line even as revenues expand.

- Analysts’ consensus view sees the stable margin, combined with growing product offerings and improved operational efficiency, as supporting a sustainable earnings platform.

- Consensus narrative notes that operational efficiencies and EU regulatory trends should support improved margins and steady long-term profit growth.

- It is notable that despite competition and sector fee pressures, flatexDEGIRO managed to avoid the margin compression that many fintech peers face.

See how analysts weigh profitability and future expansion in the full consensus narrative. 📊 Read the full flatexDEGIRO Consensus Narrative.

PE Ratio: Discount to Peers, Premium to Industry

- The stock trades on a Price-to-Earnings (PE) ratio of 26.8x, which is higher than the German capital markets industry average of 16.3x but below its peer average of 39.5x.

- Analysts’ consensus view highlights that this relative valuation signals flatexDEGIRO offers better value than close competitors, even as it still commands a premium to the sector.

- Consensus narrative points to the company's high-quality earnings and scalability as justification for the above-industry multiple.

- The current PE ratio also implies that future growth needs to be delivered to defend this pricing, especially as industry fee compression and competition intensify.

DCF Fair Value Shows Upside

- The company’s share stands at €33.16, below its DCF fair value estimate of €36.27, indicating possible upside for long-term investors.

- Analysts’ consensus view draws a line between the fair value and today’s price, noting that ongoing product launches and pan-European growth ambitions are expected to lift recurring revenue streams.

- Consensus narrative calls out upcoming crypto trading and securities lending launches as key diversification levers not yet fully priced in.

- The modest gap between current price and consensus target suggests the market is watching execution closely, with margin expansion and recurring revenues in focus over the next three years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for flatexDEGIRO on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the story looks different through your eyes? In just a few minutes, you can craft your own perspective and share it with others. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding flatexDEGIRO.

See What Else Is Out There

While flatexDEGIRO’s premium valuation means future growth must be delivered to justify its pricing, ongoing competition and sector fee pressures could challenge this outlook.

Worried about paying too much? Discover better-priced opportunities with these 878 undervalued stocks based on cash flows that could offer stronger value for your next investment idea.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if flatexDEGIRO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FTK

flatexDEGIRO

Provides online brokerage and IT solutions in the areas of finance and financial technology services in Europe.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives