- Germany

- /

- Diversified Financial

- /

- XTRA:DFTK

Should You Be Adding DF Deutsche Forfait (ETR:DFTK) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like DF Deutsche Forfait (ETR:DFTK). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for DF Deutsche Forfait

How Fast Is DF Deutsche Forfait Growing Its Earnings Per Share?

Over the last three years, DF Deutsche Forfait has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, DF Deutsche Forfait's EPS shot from €0.27 to €0.57, over the last year. Year on year growth of 108% is certainly a sight to behold.

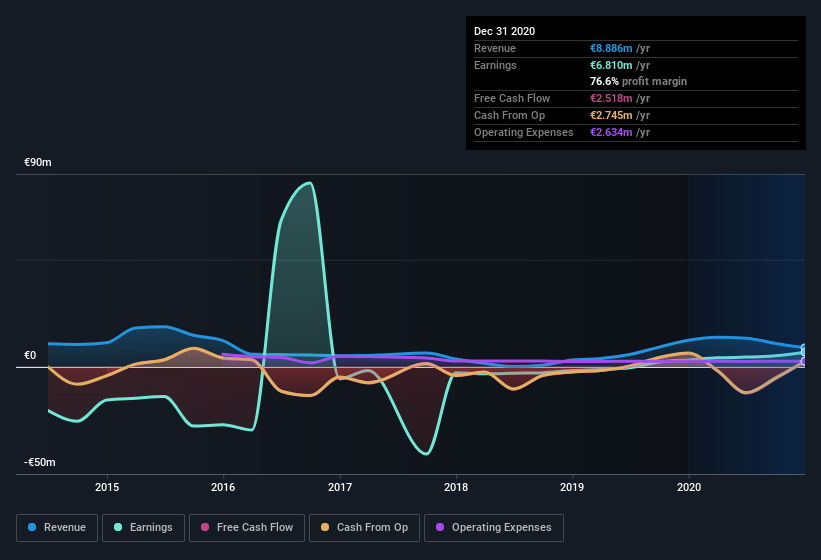

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that DF Deutsche Forfait's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. To cut to the chase DF Deutsche Forfait's EBIT margins dropped last year, and so did its revenue. That is, not a hint of euphemism here, suboptimal.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

DF Deutsche Forfait isn't a huge company, given its market capitalization of €20m. That makes it extra important to check on its balance sheet strength.

Are DF Deutsche Forfait Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that DF Deutsche Forfait insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 79%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about €16m riding on the stock, at current prices. That's nothing to sneeze at!

Does DF Deutsche Forfait Deserve A Spot On Your Watchlist?

DF Deutsche Forfait's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering DF Deutsche Forfait for a spot on your watchlist. Still, you should learn about the 3 warning signs we've spotted with DF Deutsche Forfait (including 1 which is potentially serious) .

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade DF Deutsche Forfait, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:DFTK

DF Deutsche Forfait

Provides foreign trade finance and related services for exporters, importers, and other financial companies in the Middle East and Eastern Europe.

Medium-low risk with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026