- Germany

- /

- Diversified Financial

- /

- XTRA:CSQ

Breakeven On The Horizon For creditshelf Aktiengesellschaft (ETR:CSQ)

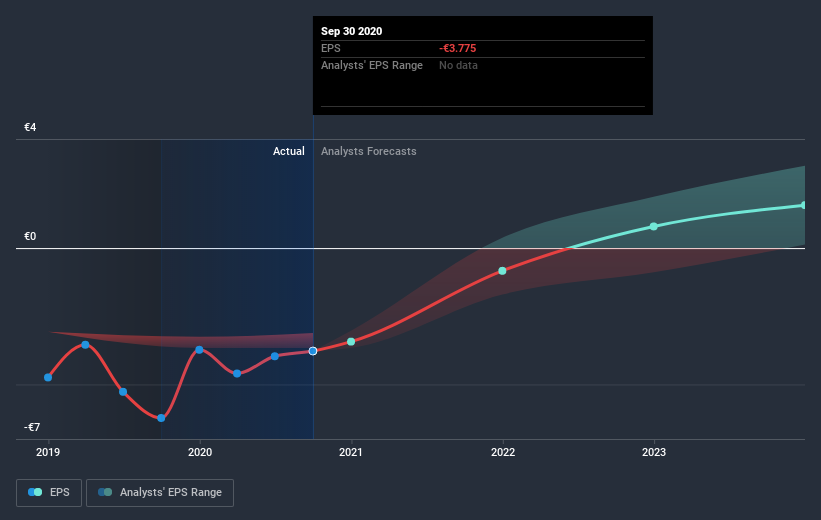

With the business potentially at an important milestone, we thought we'd take a closer look at creditshelf Aktiengesellschaft's (ETR:CSQ) future prospects. creditshelf Aktiengesellschaft operates as a digital SME financing company in Germany. The company’s loss has recently broadened since it announced a €5.0m loss in the full financial year, compared to the latest trailing-twelve-month loss of €5.1m, moving it further away from breakeven. The most pressing concern for investors is creditshelf's path to profitability – when will it breakeven? In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

See our latest analysis for creditshelf

Consensus from 3 of the German Diversified Financial analysts is that creditshelf is on the verge of breakeven. They anticipate the company to incur a final loss in 2021, before generating positive profits of €750k in 2022. Therefore, the company is expected to breakeven just over a year from now. In order to meet this breakeven date, we calculated the rate at which the company must grow year-on-year. It turns out an average annual growth rate of 86% is expected, which is extremely buoyant. Should the business grow at a slower rate, it will become profitable at a later date than expected.

We're not going to go through company-specific developments for creditshelf given that this is a high-level summary, though, bear in mind that generally a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

One thing we’d like to point out is that creditshelf has no debt on its balance sheet, which is quite unusual for a cash-burning growth company, which usually has a high level of debt relative to its equity. This means that the company has been operating purely on its equity investment and has no debt burden. This aspect reduces the risk around investing in the loss-making company.

Next Steps:

There are key fundamentals of creditshelf which are not covered in this article, but we must stress again that this is merely a basic overview. For a more comprehensive look at creditshelf, take a look at creditshelf's company page on Simply Wall St. We've also compiled a list of key factors you should further examine:

- Historical Track Record: What has creditshelf's performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on creditshelf's board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you’re looking to trade creditshelf, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if creditshelf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:CSQ

creditshelf

Operates as a digital small and medium-sized enterprises financing company in Germany.

Slightly overvalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives