Dividend paying stocks like TUI AG (ETR:TUI1) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

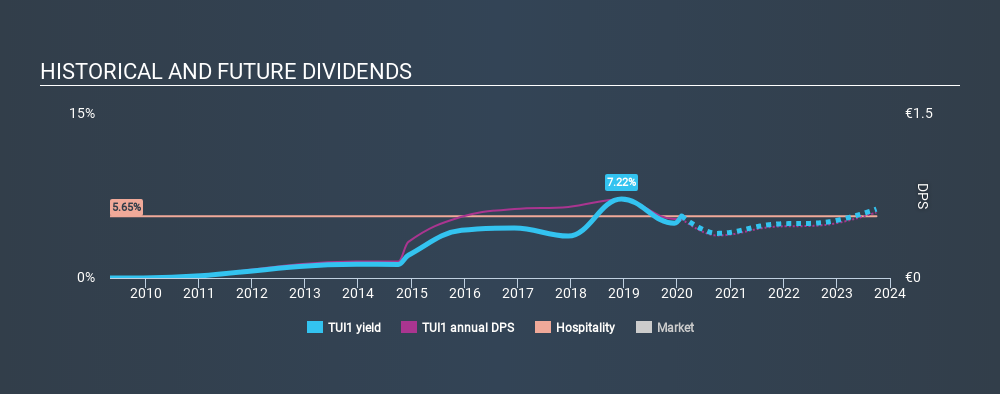

In this case, TUI likely looks attractive to dividend investors, given its 5.7% dividend yield and six-year payment history. It sure looks interesting on these metrics - but there's always more to the story . When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on TUI!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. TUI paid out 76% of its profit as dividends, over the trailing twelve month period. Paying out a majority of its earnings limits the amount that can be reinvested in the business. This may indicate a commitment to paying a dividend, or a dearth of investment opportunities.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. TUI paid out 331% of its free cash flow last year, suggesting the dividend is poorly covered by cash flow. Paying out more than 100% of your free cash flow in dividends is generally not a long-term, sustainable state of affairs, so we think shareholders should watch this metric closely. TUI paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough free cash flow to cover the dividend. Were it to repeatedly pay dividends that were not well covered by cash flow, this could be a risk to TUI's ability to maintain its dividend.

With a strong net cash balance, TUI investors may not have much to worry about in the near term from a dividend perspective.

Remember, you can always get a snapshot of TUI's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. TUI has been paying a dividend for the past six years. It's good to see that TUI has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past six-year period, the first annual payment was €0.15 in 2014, compared to €0.54 last year. Dividends per share have grown at approximately 24% per year over this time. The dividends haven't grown at precisely 24% every year, but this is a useful way to average out the historical rate of growth.

TUI has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, but it might be worth considering if the business has turned a corner.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? It's good to see TUI has been growing its earnings per share at 18% a year over the past five years. EPS are growing rapidly, although the company is also paying out more than three-quarters of its profits as dividends. If earnings keep growing, the dividend may be sustainable, but generally we'd prefer to see a fast growing company reinvest in further growth.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, the company has a payout ratio that was within an average range for most dividend stocks, but it paid out virtually all of its generated cash flow. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than TUI out there.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 18 TUI analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:TUI1

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives