- Germany

- /

- Hospitality

- /

- XTRA:TUI1

Evaluating TUI’s Share Price After Strong 18% Yearly Gain and Ongoing Travel Recovery

Reviewed by Bailey Pemberton

Thinking about what to do with TUI stock? You are definitely not alone. After a period of volatility, TUI’s share price has recently slipped slightly, down 1.2% over the past week and 5.9% in the past month. This comes despite a solid 18.4% gain over the last year and a respectable three-year return of 15.9%. That history shows TUI has resilience, even if its five-year performance is still in the red at -16.5%, which is a sign of the company navigating both pandemic headwinds and the slow-burning recovery in travel demand.

Investors have been watching sentiment closely, particularly as global travel continues its rebound and competitors jostle for market share. While short-term dips can signal caution, they also open possibilities. The company’s value score, which tallies how many different valuation checks TUI passes, sits at an impressive 5 out of 6. That suggests the stock appears discounted by several measures, even factoring in the risk that comes with any travel sector name.

So, how do you know if TUI’s current price offers genuine value, or just looks like it on paper? Let us dig into the different ways analysts break down a stock’s worth, and at the end of this article, we will introduce a perspective on valuation that might just change how you view the numbers entirely.

Approach 1: TUI Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) valuation estimates a company’s worth by projecting its future cash flows and then discounting those figures back to today’s value. For TUI, this involves analyzing cash flows that the business is expected to generate and adjusting them for risk and time to reflect their present value.

TUI’s current Free Cash Flow stands at €1.02 billion, showing the company’s strong ability to generate cash. According to analyst estimates, TUI’s Free Cash Flow is projected to reach €1.39 billion by 2029. While analysts typically provide projections for up to five years, later estimates are carefully extrapolated to give investors a sense of the company’s long-term earning potential.

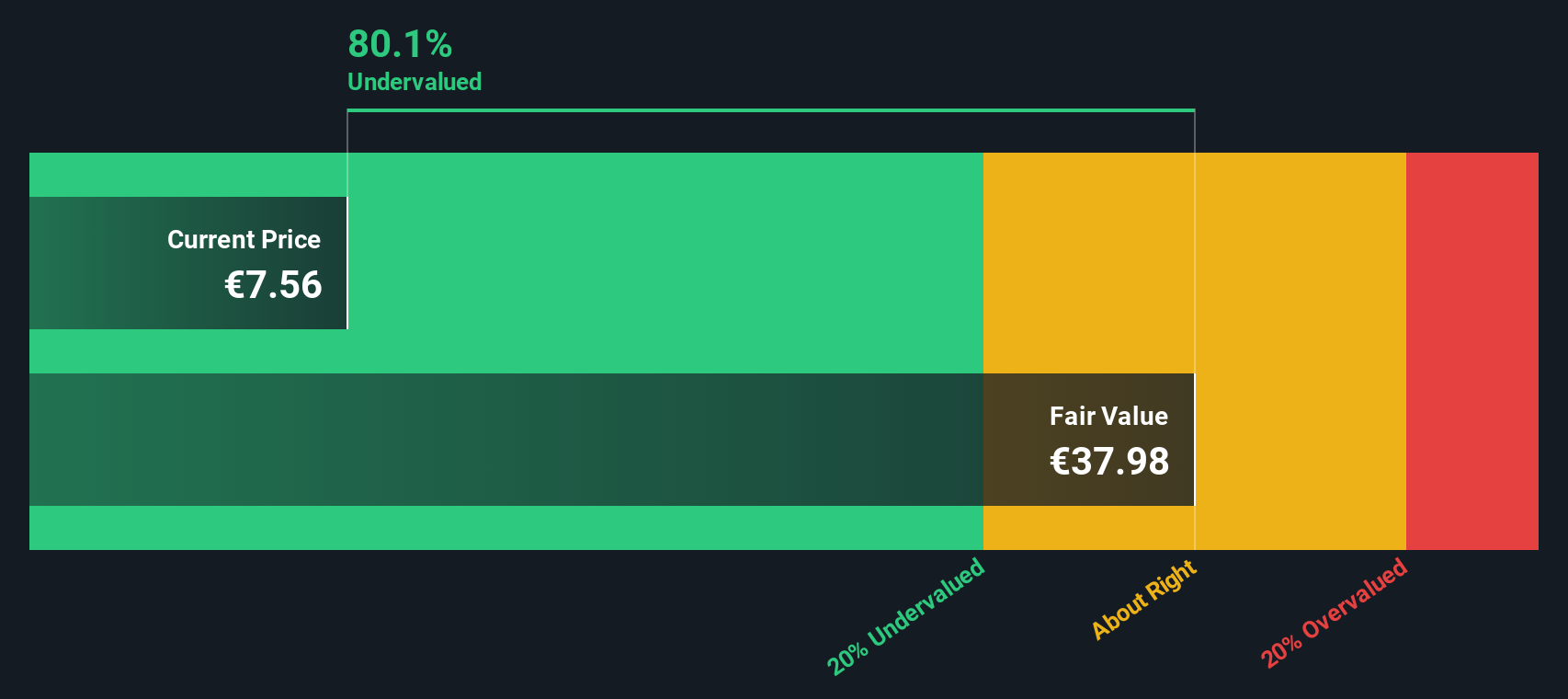

Using this model, the DCF calculation indicates an intrinsic value of €38.29 per share. Compared to the current share price, this represents a substantial discount of about 79.8%. This suggests that the stock is significantly undervalued based on projected future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TUI is undervalued by 79.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: TUI Price vs Earnings (PE Ratio)

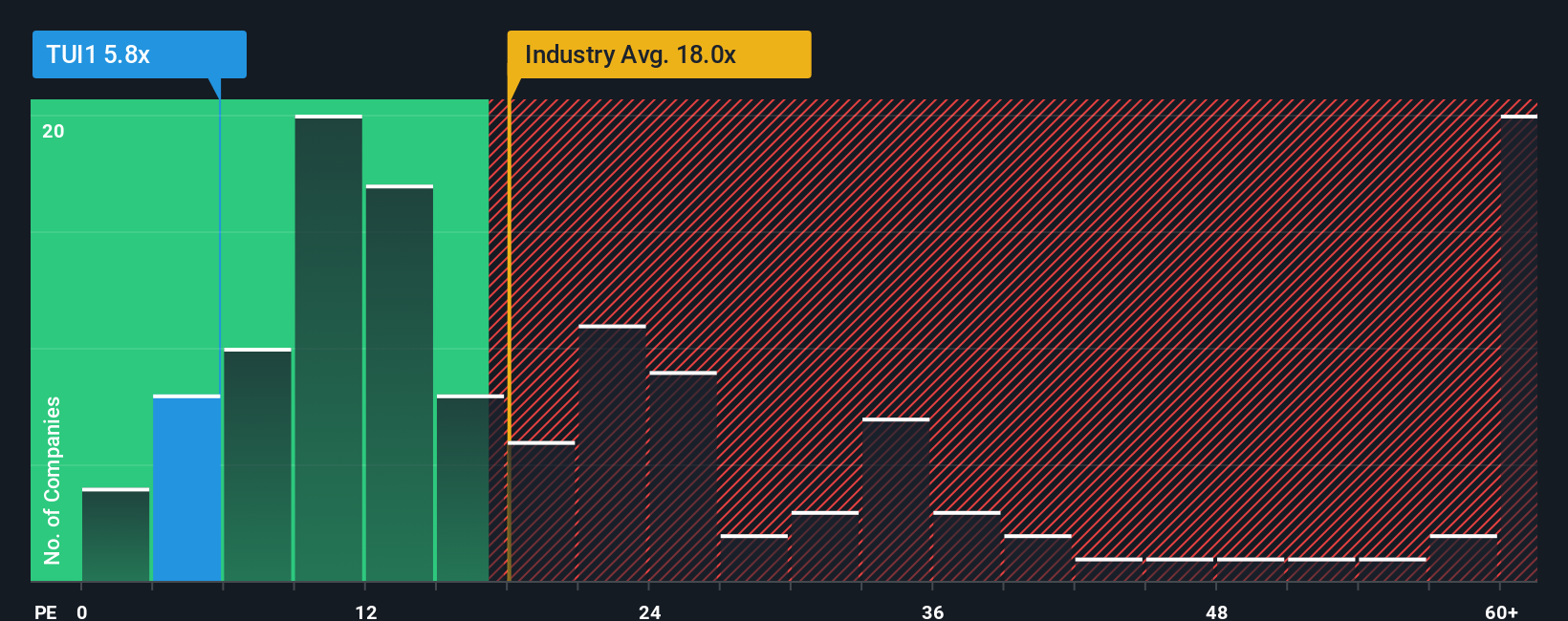

For companies that are generating consistent profits, the Price-to-Earnings (PE) ratio is one of the most reliable and widely used valuation metrics. It tells investors how much they are paying for each euro of earnings, helping to put both growth prospects and risk into perspective.

While a "normal" or "fair" PE ratio depends on many variables, it is ultimately shaped by expectations for a company’s future growth and how risky those earnings are perceived to be. Higher growth and stable, predictable profits typically support a higher PE, while more cyclical or risk-prone earnings generally warrant a lower one.

TUI’s current PE ratio stands at just 5.9x, which is substantially lower than both the Hospitality industry average of 22.0x and the average for its peers at 29.0x. At first glance, this suggests that TUI might be undervalued, perhaps a result of ongoing market concerns about its risk profile or future profitability.

This is where the “Fair Ratio,” developed by Simply Wall St, becomes essential. Unlike broad averages, the Fair Ratio gives you a customized benchmark that considers TUI’s unique factors, like its projected earnings growth, profit margins, sector influences, and company size. This makes it a far more useful tool when judging a stock’s true value.

TUI’s Fair Ratio is calculated to be 19.3x. Since the company’s actual PE ratio (5.9x) is far below this fair value, it reinforces the idea that TUI’s shares are currently trading at an appealing discount for investors seeking value in the sector.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TUI Narrative

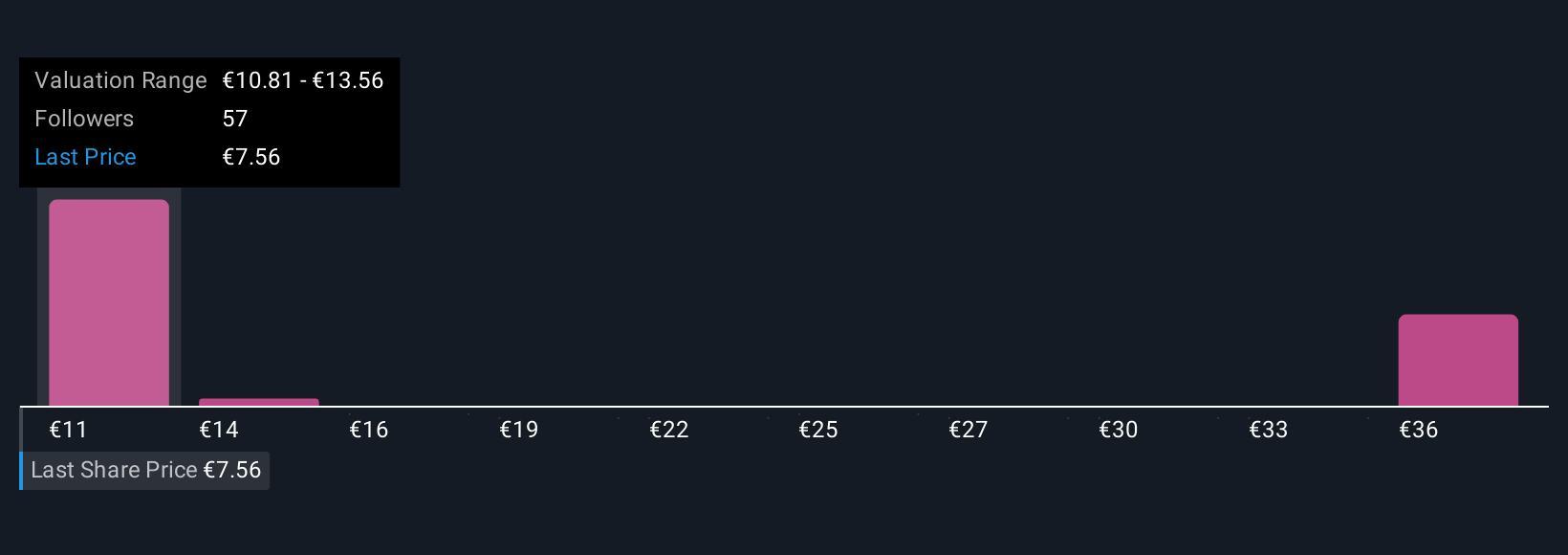

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personalized story for a company, where you connect what you believe about TUI’s business, such as its strengths in digital expansion or travel trends, to actual forecasts and a fair value calculation, all in one place.

With Narratives, you can turn your perspective into a dynamic forecast and see how your view stacks up against millions of other investors within Simply Wall St’s Community. This tool allows you to decide if TUI is a buy or sell by comparing your own Fair Value to the latest share price, and then nudges you with live updates whenever new data, such as earnings or news, could impact your thesis.

For example, looking at TUI today, one investor’s Narrative might be optimistic about the company’s vertical integration and digital growth, landing on a fair value as high as €16.00 per share. A more skeptical peer may point to competition and margin pressures and target just €7.30. Narratives empower you to blend data with your judgment and act confidently as things evolve.

Do you think there's more to the story for TUI? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TUI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TUI1

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success