- Germany

- /

- Hospitality

- /

- XTRA:DHER

Delivery Hero SE's (ETR:DHER) 25% Cheaper Price Remains In Tune With Revenues

Delivery Hero SE (ETR:DHER) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Longer-term, the stock has been solid despite a difficult 30 days, gaining 17% in the last year.

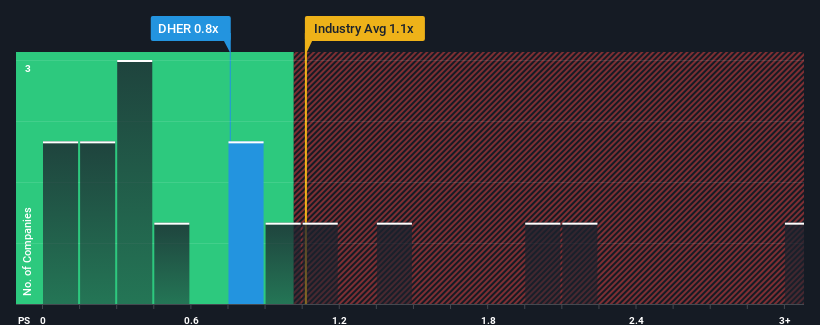

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Delivery Hero's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Hospitality industry in Germany is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Delivery Hero

What Does Delivery Hero's P/S Mean For Shareholders?

There hasn't been much to differentiate Delivery Hero's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. Those who are bullish on Delivery Hero will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Delivery Hero will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Delivery Hero?

In order to justify its P/S ratio, Delivery Hero would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 174% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the analysts watching the company. That's shaping up to be similar to the 11% per annum growth forecast for the broader industry.

With this information, we can see why Delivery Hero is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Delivery Hero's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Delivery Hero looks to be in line with the rest of the Hospitality industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Delivery Hero maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Delivery Hero that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DHER

Delivery Hero

Provides online food ordering, quick commerce, and delivery services.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives