- Germany

- /

- Food and Staples Retail

- /

- XTRA:RDC

Redcare Pharmacy (ETR:RDC) shareholder returns have been stellar, earning 275% in 5 years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. One great example is Redcare Pharmacy NV (ETR:RDC) which saw its share price drive 275% higher over five years. Also pleasing for shareholders was the 24% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 11% in 90 days).

Since it's been a strong week for Redcare Pharmacy shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Redcare Pharmacy

Redcare Pharmacy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Redcare Pharmacy saw its revenue grow at 20% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 30% per year, compound, during the period. So it seems likely that buyers have paid attention to the strong revenue growth. Redcare Pharmacy seems like a high growth stock - so growth investors might want to add it to their watchlist.

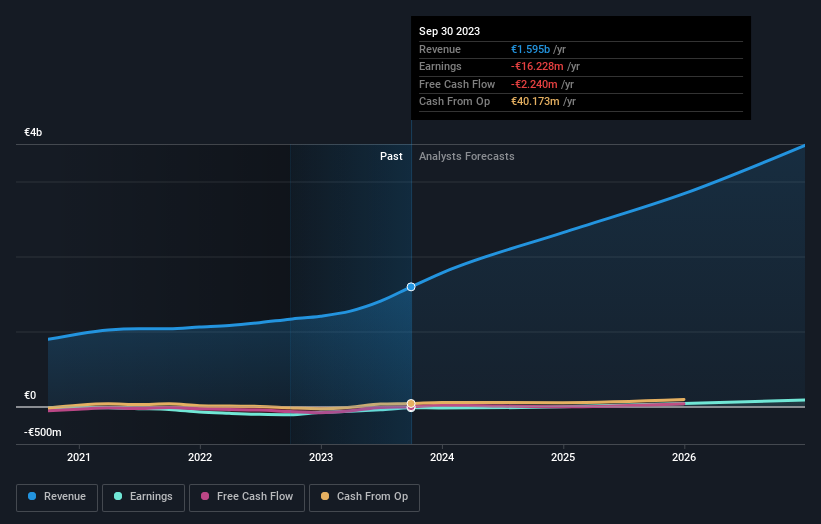

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Redcare Pharmacy is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that Redcare Pharmacy shareholders have received a total shareholder return of 112% over the last year. That gain is better than the annual TSR over five years, which is 30%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:RDC

Redcare Pharmacy

Operates in online pharmacy business in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France.

Excellent balance sheet with reasonable growth potential.