- Germany

- /

- Food and Staples Retail

- /

- XTRA:HFG

Will HelloFresh’s (XTRA:HFG) PetSmart Deal Reshape Its Diversification Ambitions?

Reviewed by Sasha Jovanovic

- The Pets Table, HelloFresh’s premium direct-to-consumer pet food brand, has announced its launch in PetSmart stores and on PetSmart.com, expanding its retail distribution network in North America.

- This move signals HelloFresh’s drive to diversify beyond meal kits, leveraging growth in its pet food segment and broadening access through leading retail partners.

- To assess how this expanded retail partnership strengthens HelloFresh’s diversification efforts, we’ll explore the implications for its overall investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

HelloFresh Investment Narrative Recap

To be a shareholder in HelloFresh, you need to believe in the company’s ability to rebound from recent declines in revenue and order volumes by successfully diversifying into new categories, such as pet food. The Pets Table’s partnership with PetSmart expands HelloFresh’s reach beyond meal kits, but this news alone is not likely to materially change the main short term catalyst, which remains restoring growth in its core ready-to-eat (RTE) offerings; the most significant risk still centers on customer acquisition challenges and top-line pressure.

Recently, HelloFresh lowered its 2025 revenue guidance, citing weaker-than-expected RTE sales, which reinforces the importance of expanding into adjacent categories like pet food to soften the impact of slowdowns in core segments. This PetSmart launch offers incremental diversification, yet execution in its core business and restoring its top-line trajectory remain fundamental to its overall outlook.

However, before considering HelloFresh’s path forward, it is important for investors to be aware that, despite product diversification, ongoing declines in new customer acquisition and order volumes could still...

Read the full narrative on HelloFresh (it's free!)

HelloFresh's narrative projects €7.3 billion revenue and €221.0 million earnings by 2028. This requires a 0.1% yearly revenue decline and a €393.1 million increase in earnings from €-172.1 million today.

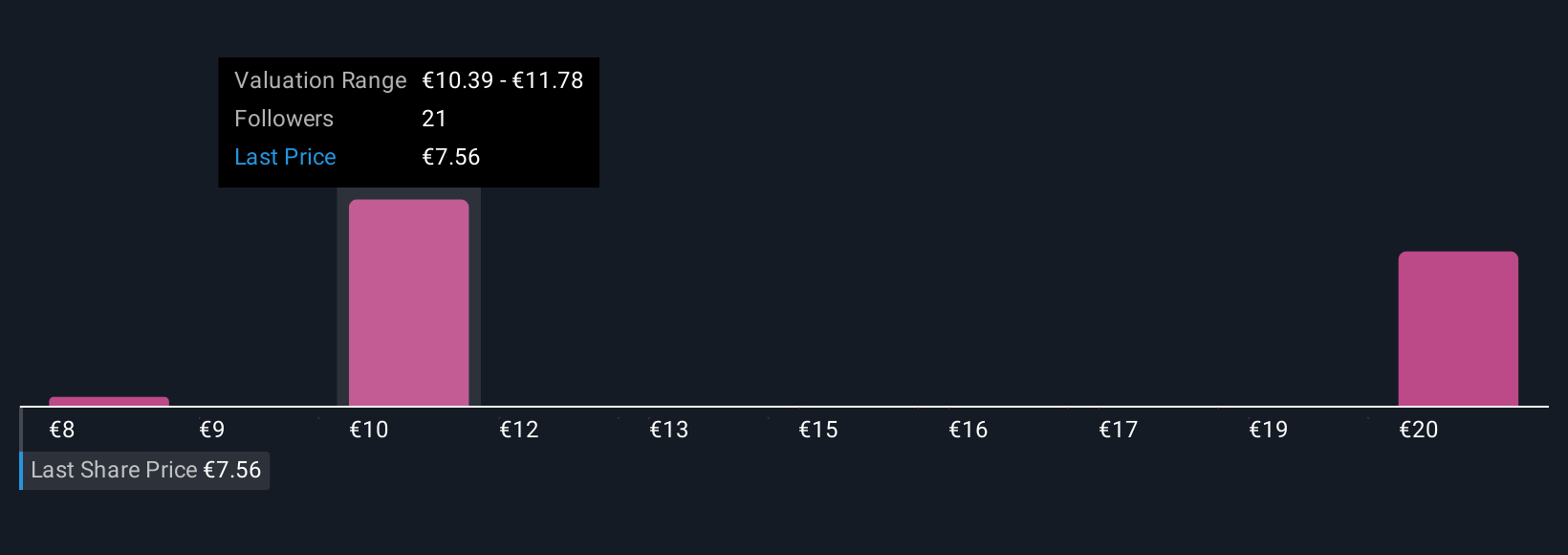

Uncover how HelloFresh's forecasts yield a €10.82 fair value, a 49% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate HelloFresh’s fair value between €5.90 and €21.54 across nine perspectives, hinting at strong disagreement about its prospects. With ongoing revenue pressure and RTE headwinds, you can explore these differing views to see how they inform expectations for HelloFresh’s future performance.

Explore 9 other fair value estimates on HelloFresh - why the stock might be worth 19% less than the current price!

Build Your Own HelloFresh Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HelloFresh research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free HelloFresh research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HelloFresh's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HelloFresh might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HFG

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026