PUMA (XTRA:PUM): Revisiting Valuation After a Steep Slide and Recent Share Price Rebound

Reviewed by Simply Wall St

PUMA (XTRA:PUM) has been grinding through a tough stretch, and the share price reflects it, with the stock down sharply this year even after a recent bounce. That disconnect is where things get interesting.

See our latest analysis for PUMA.

Despite a punchy 7 day share price return of 27.22 percent and a modest 30 day gain, the stock is still nursing a steep year to date share price loss, and the multi year total shareholder return remains deeply negative, signaling that momentum is only tentatively turning after a long slide.

If PUMA has you rethinking where growth and resilience might come from next, it could be worth scanning fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

With PUMA trading below analyst targets yet still loss making after a bruising multi year slide, the key question now is simple: is this a contrarian entry point or is the market already discounting any future recovery?

Price-to-Sales of 0.4x: Is it justified?

Compared with its last close of €20.24, PUMA's 0.4x price-to-sales ratio screens as notably low versus peers, hinting at a potentially undervalued setup.

The price-to-sales multiple compares the company’s market value with the revenue it generates, a useful lens for businesses like PUMA that are currently loss making. For a global sports and lifestyle brand with meaningful scale, a depressed sales multiple can imply the market is heavily discounting the durability of demand or the timing of a profit recovery.

Against that backdrop, PUMA looks inexpensive on several fronts. It trades at 0.4x sales versus a 1.2x peer average and a 0.8x European luxury industry average. This suggests investors value each euro of its revenue at a substantial discount. Relative to an estimated fair price-to-sales ratio of 0.7x, the current level also sits well below where the market could move if sentiment normalises or earnings visibility improves.

Explore the SWS fair ratio for PUMA

Result: Price-to-Sales of 0.4x (UNDERVALUED)

However, lingering losses and weak long term shareholder returns raise doubts that modest revenue growth alone is sufficient to reignite sustained confidence in PUMA’s recovery story.

Find out about the key risks to this PUMA narrative.

Another View: Our DCF Take

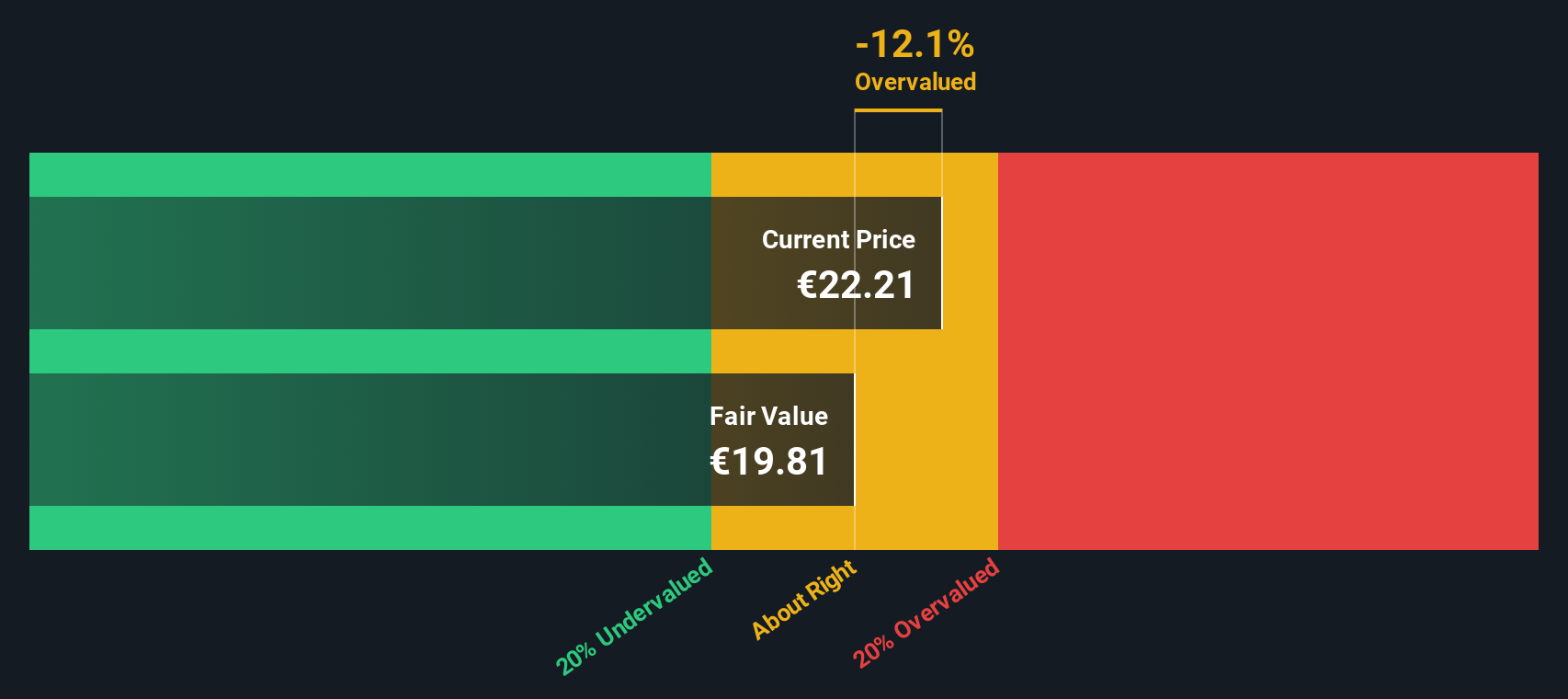

Our DCF model tells a similar story but from a different angle. It puts PUMA’s fair value at €22.91, around 11.6 percent above the current €20.24 share price. It still flags undervaluation, but the upside looks more modest and raises the question: how much risk is worth that gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PUMA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 929 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PUMA Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your PUMA research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next investment move?

If you stop with PUMA, you will miss out on other powerful setups, so put the Simply Wall St Screener to work and upgrade your opportunity set.

- Capture early-stage excitement by scanning these 3575 penny stocks with strong financials that pair speculative upside with balance sheets you can actually get comfortable owning.

- Position ahead of the next tech revolution by targeting these 25 AI penny stocks where real revenue traction meets ambitious artificial intelligence roadmaps.

- Lock in potential mispricings through these 929 undervalued stocks based on cash flows, focusing on businesses whose cash flows suggest the market is still asleep at the wheel.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PUM

PUMA

Engages in the development and sale of sports and sports lifestyle products in Germany, rest of Europe, the United States, North America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026