PUMA (XTRA:PUM): Reassessing Valuation After a 24% One-Month Share Price Rebound

Reviewed by Simply Wall St

PUMA (XTRA:PUM) has been quietly rebuilding momentum, with the stock up around 24% over the past month despite still being sharply lower year to date. That rebound raises a clear valuation question.

See our latest analysis for PUMA.

The recent rebound sits against a tough backdrop, with the share price still nursing a heavy year to date loss and a multi year total shareholder return deeply negative. This suggests sentiment may be stabilising rather than fully turning at this stage.

If PUMA’s turnaround has caught your eye, it could be a good moment to compare it with other branded players and explore auto manufacturers as a fresh hunting ground for related consumer cyclical ideas.

With the shares rebounding but still far below past highs, a modest discount to analyst targets and mixed fundamentals create an uneasy balance. Is this a genuine entry point, or has the market already priced in the recovery?

Price-to-Sales of 0.4x: Is it justified?

On a price-to-sales ratio of 0.4x, PUMA looks optically cheap versus peers, despite the share price still reflecting sharp multi year losses.

The price-to-sales multiple compares the market value of the company to its annual revenue. This can be particularly useful when earnings are volatile or negative, as is currently the case for PUMA. In this context, the stock trades at what appears to be good value versus peers and the wider industry, suggesting investors are heavily discounting its earnings recovery potential despite forecasts for very strong profit growth.

Against direct peers, PUMA changes hands at 0.4x sales compared with a peer average of 1.1x, and also below an estimated fair price-to-sales ratio of 0.7x. That gap implies the market is valuing each euro of PUMA’s revenue at a steep discount to both similar luxury names and the level our fair ratio suggests it could gravitate toward if sentiment improves.

Explore the SWS fair ratio for PUMA

Result: Price-to-Sales of 0.4x (UNDERVALUED)

However, weak revenue momentum and ongoing losses still mean that any macro slowdown or execution misstep could quickly derail hopes of a smooth earnings recovery.

Find out about the key risks to this PUMA narrative.

Another View: What Does Our DCF Say?

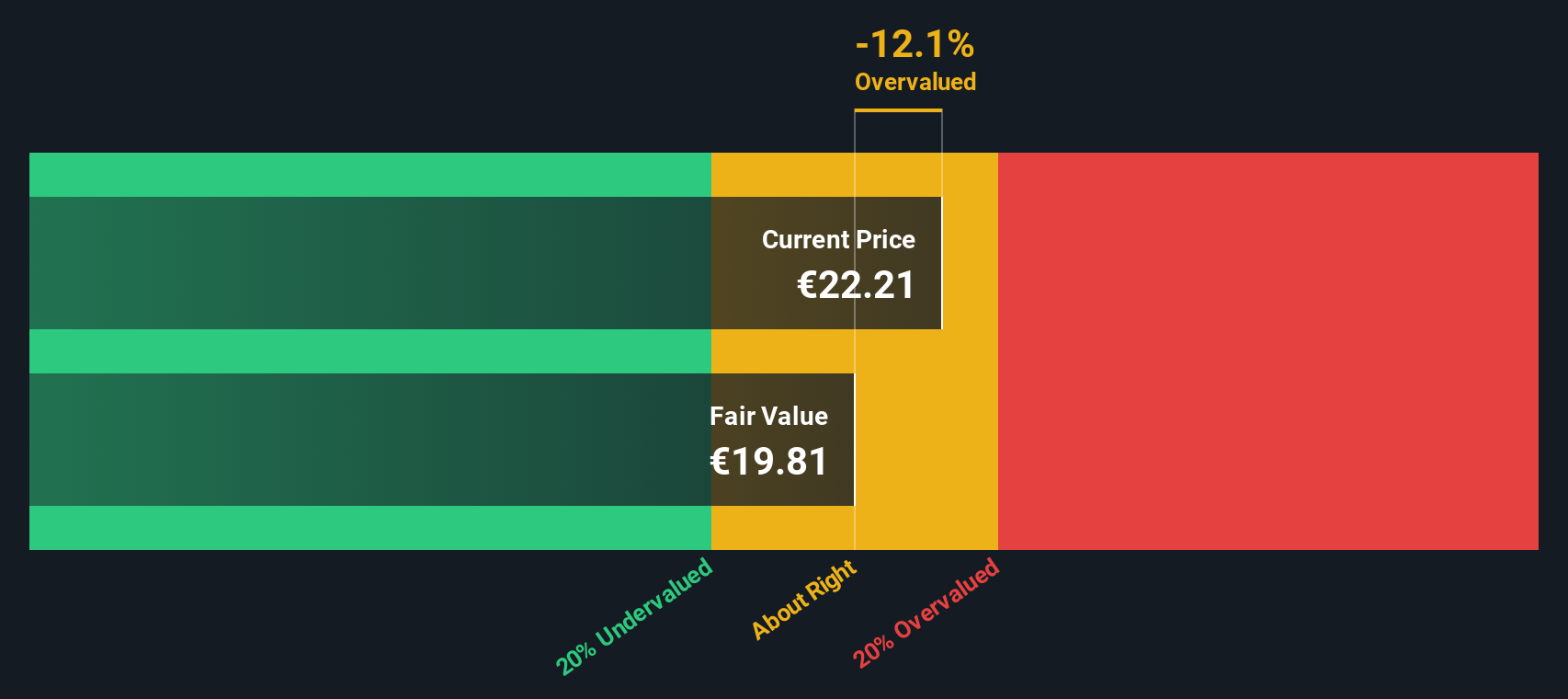

While the low price to sales makes PUMA look cheap, our DCF model is less generous. At €20.17, the shares sit slightly above our fair value estimate of €19.51, hinting at mild overvaluation. Is the market already assigning too much credit to that forecast profit rebound?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PUMA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PUMA Narrative

If you would rather examine the numbers yourself and test an alternative storyline, you can build a personalised view in minutes with Do it your way.

A great starting point for your PUMA research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few fresh opportunities by scanning other themes on Simply Wall St’s Screener so you are not relying solely on PUMA’s turnaround.

- Capture early stage potential by targeting these 3603 penny stocks with strong financials that already back up their promise with robust balance sheets and improving fundamentals.

- Position your portfolio at the heart of the AI transformation by focusing on these 26 AI penny stocks pushing real world applications and revenue growth.

- Strengthen your income stream by zeroing in on these 12 dividend stocks with yields > 3% that combine solid yields with sustainable payout ratios and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PUM

PUMA

Engages in the development and sale of sports and sports lifestyle products in Germany, rest of Europe, the United States, North America, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026