adidas (XTRA:ADS) Valuation in Focus as Data Innovation Takes Center Stage at World Summit AI 2025

Reviewed by Kshitija Bhandaru

adidas (XTRA:ADS) turned heads this week as senior leaders took the stage at World Summit AI 2025 in Amsterdam, highlighting the company's commitment to data-driven innovation and its ongoing digital transformation efforts.

See our latest analysis for adidas.

adidas’s high-profile push into AI and digital transformation has helped it stay top-of-mind, but momentum has yet to translate into recent gains. The 1-year total shareholder return sits at -17.4%, and after a strong three-year run, the current year-to-date share price return remains in negative territory. Short-term price action has perked up in October; however, longer-term performance underscores the challenge of sustaining growth in a fiercely competitive space.

If you’re interested in casting a wider net for possibilities beyond just adidas, now is a great moment to discover fast growing stocks with high insider ownership.

With shares currently trading at a notable discount to analyst price targets, investors may wonder whether adidas represents an undervalued opportunity or if the market is already factoring in its potential for future growth.

Most Popular Narrative: 18.6% Undervalued

With adidas’s last close at €193.20 and the most followed narrative estimating fair value at €237.35, optimism surrounds the brand’s financial trajectory as it trades below its perceived potential. Consensus sees this gap as tied to compelling growth assumptions and margin expansion in the coming years.

The ongoing shift to direct-to-consumer e-commerce and retail channels (+9% e-commerce, +9% brick & mortar, continued D2C expansion) is improving adidas' control over branding, driving higher-margin sales, and strengthening customer data utilization. This will gradually enhance net and gross margins as the channel mix evolves.

Curious what powers this bold valuation? There’s a secret sauce behind this target: aggressive revenue growth, analyst-backed margin upgrades, and ambitious profit forecasts, all bundled into one forward-looking thesis. Unpack the full narrative to reveal which future trends and numbers could justify this premium.

Result: Fair Value of €237.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising U.S. import tariffs and intensifying competition in North America could put pressure on adidas’s margins and challenge these optimistic growth assumptions.

Find out about the key risks to this adidas narrative.

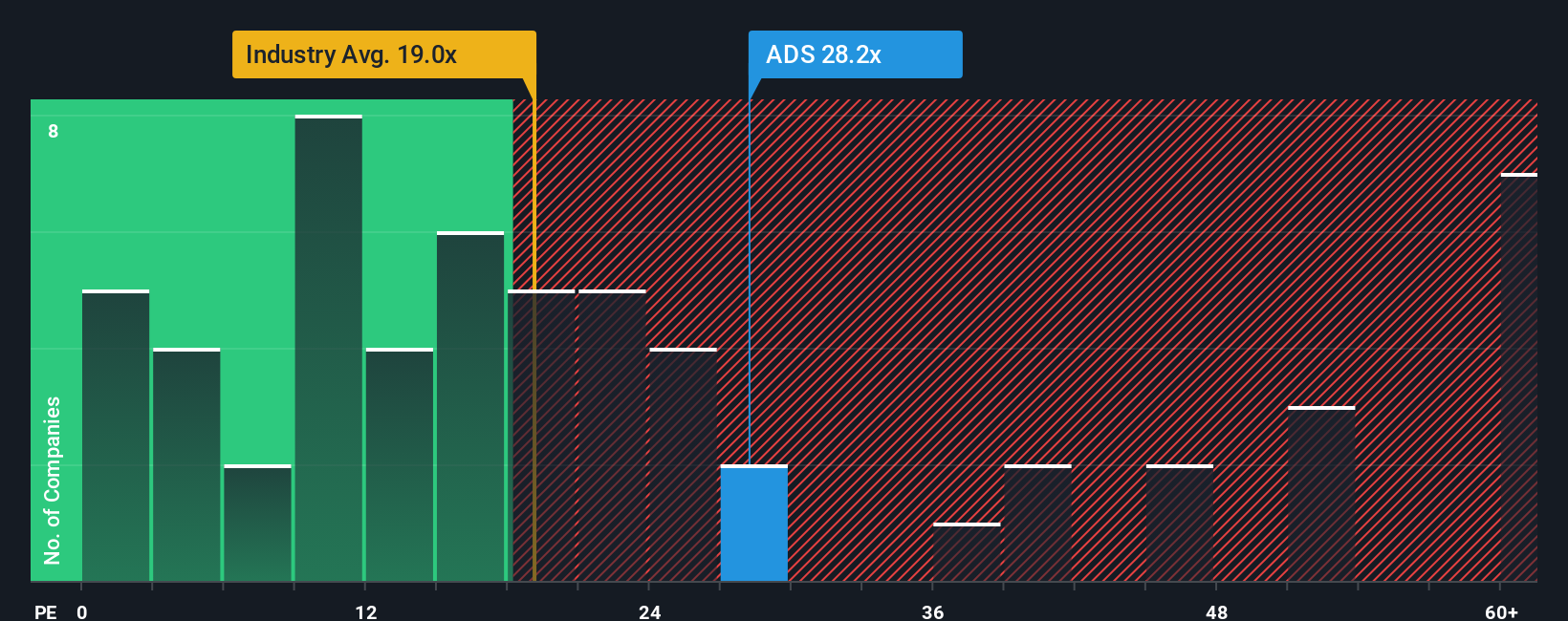

Another View: Price-to-Earnings Raises a Caution Flag

While analysts see upside, the current price-to-earnings ratio for adidas (29x) stands notably above both the European Luxury industry average (20.3x) and its peer average (23.7x). Even compared to the fair ratio (20.9x), adidas looks expensive. This premium may signal future growth or could point to downside risk ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own adidas Narrative

Prefer to dig into the numbers firsthand? You can easily uncover your own story for adidas in under three minutes using CTA_CREATE_NARRATIVE.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding adidas.

Looking for more investment ideas?

Smart investors always keep an eye out for the next opportunity. Expand your horizons now, or risk missing tomorrow’s market leaders and top returns.

- Unlock steady streams of income by reviewing these 19 dividend stocks with yields > 3% that consistently deliver attractive yields greater than 3% for income-focused portfolios.

- Ride the AI momentum and target growth by browsing these 25 AI penny stocks poised to benefit from this transformative technology trend.

- Get ahead of the market by spotting these 888 undervalued stocks based on cash flows that offer strong fundamentals at compelling valuations before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets athletic and sports lifestyle products in Europe, North America, Greater China, Latin America, Japan, and South Korea.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives