- Germany

- /

- Construction

- /

- DB:3SQ1

The Price Is Right For AHT Syngas Technology N.V. (FRA:3SQ1) Even After Diving 32%

To the annoyance of some shareholders, AHT Syngas Technology N.V. (FRA:3SQ1) shares are down a considerable 32% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 65% loss during that time.

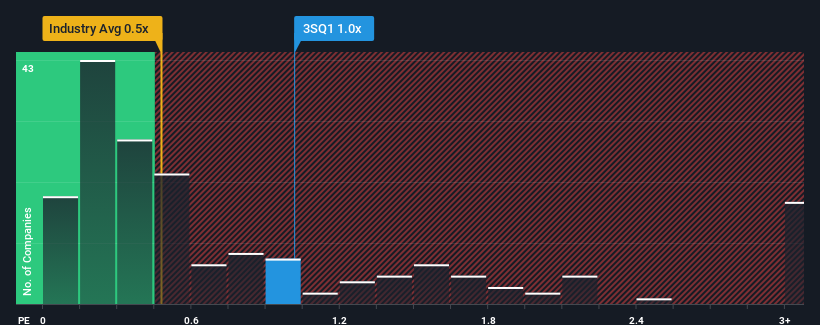

In spite of the heavy fall in price, you could still be forgiven for thinking AHT Syngas Technology is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1x, considering almost half the companies in Germany's Construction industry have P/S ratios below 0.5x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for AHT Syngas Technology

How AHT Syngas Technology Has Been Performing

Recent times have been quite advantageous for AHT Syngas Technology as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on AHT Syngas Technology's earnings, revenue and cash flow.How Is AHT Syngas Technology's Revenue Growth Trending?

In order to justify its P/S ratio, AHT Syngas Technology would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 109% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 5.3% shows it's noticeably more attractive.

In light of this, it's understandable that AHT Syngas Technology's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On AHT Syngas Technology's P/S

AHT Syngas Technology's P/S remain high even after its stock plunged. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that AHT Syngas Technology can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for AHT Syngas Technology (1 is significant!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:3SQ1

AHT Syngas Technology

Designs and installs biomass power plants worldwide.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives