Wacker Neuson (XTRA:WAC) to Present at German Corporate Conference Amid Earnings Challenges

Reviewed by Simply Wall St

Wacker Neuson (XTRA:WAC) is poised for a pivotal moment as it prepares to present at the Berenberg and Goldman Sachs Thirteenth German Corporate Conference 2024 in Munich. Recent financial challenges include a notable decline in earnings growth and reduced profit margins, yet the company remains committed to achieving its full-year revenue guidance of EUR 2,300 to 2,400 million with an EBIT margin of 6.0% to 7.0%. As Wacker Neuson navigates these hurdles, readers can expect a detailed analysis of its strategic initiatives, growth opportunities, and the impact of external factors on its financial performance.

Click here and access our complete analysis report to understand the dynamics of Wacker Neuson.

Core Advantages Driving Sustained Success for Wacker Neuson

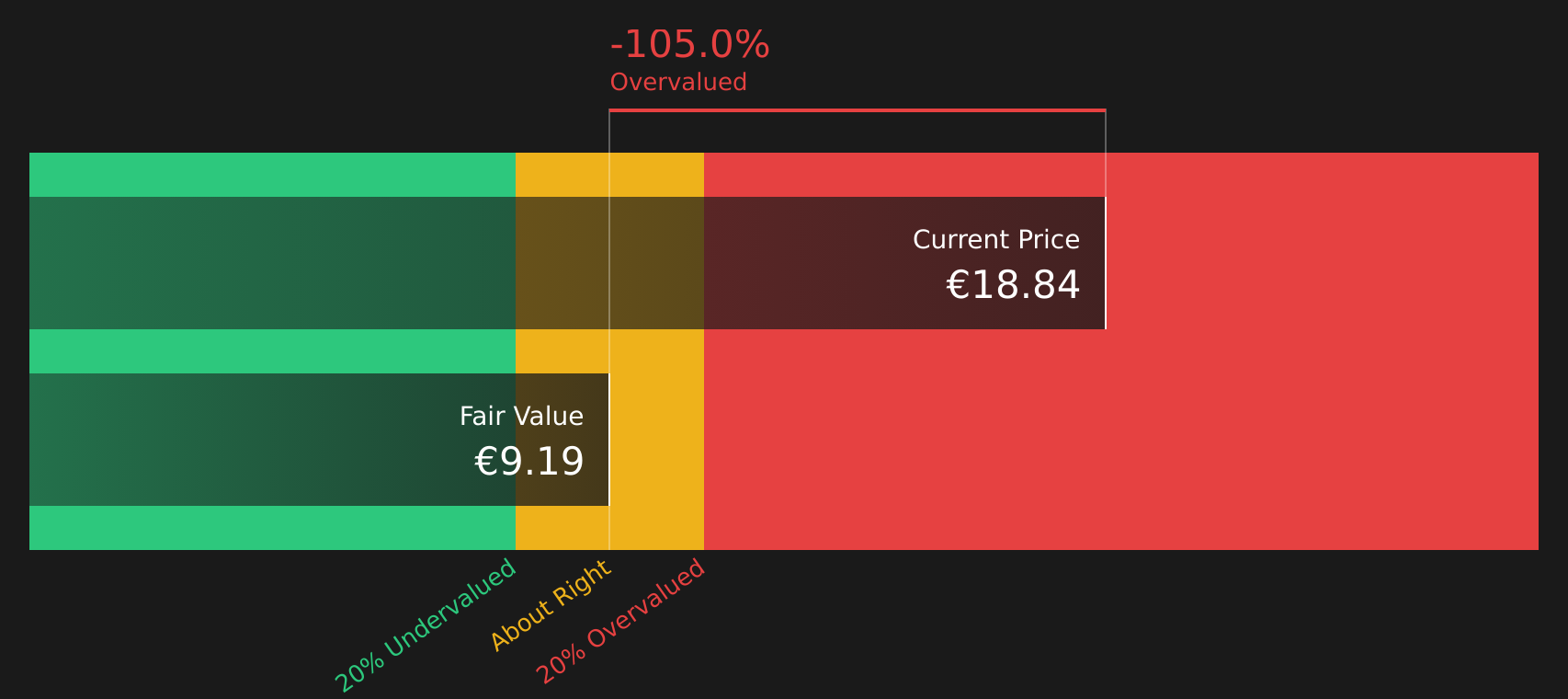

Wacker Neuson showcases financial health with a significant profit growth rate of 21.8% per year over the past five years, underscoring its strong market position. The company's experienced board, with an average tenure of 10.5 years, provides strategic stability and insight, contributing to its sustained success. Additionally, the firm maintains a satisfactory net debt to equity ratio of 31.5% and strong interest coverage by EBIT at 11.4x, reflecting solid financial management. Furthermore, Wacker Neuson's dividend yield ranks in the top 25% among German market payers at 8.2%, appealing to income-focused investors. The company is currently trading below its estimated fair value, enhancing its attractiveness compared to peers based on the SWS fair ratio.

Learn about Wacker Neuson's dividend strategy and how it impacts shareholder returns and financial stability.Challenges Constraining Wacker Neuson's Potential

Recent financial challenges include a 43.4% earnings growth decline over the past year, highlighting areas for improvement. The company's return on equity forecast of 7.7% falls short of industry expectations, indicating potential inefficiencies. Current net profit margins have decreased to 4.6% from 8% previously, suggesting pressure on profitability. Dividend reliability remains a concern, with payments not consistently covered by earnings or cash flow, reflecting potential cash management issues. Rising operational costs, as noted in the latest earnings call, further impact margins, necessitating strategic adjustments.

Growth Avenues Awaiting Wacker Neuson

Analysts forecast a promising earnings growth of 16% annually, presenting significant opportunities for expansion. The company's strategic alliances and product-related announcements, such as the well-received new product line exceeding sales forecasts by 20%, position it to capitalize on emerging market demands. Trading at a favorable valuation compared to industry peers, Wacker Neuson can leverage these opportunities to enhance its market position and achieve targeted price increases over 20% above current share prices.

To dive deeper into how Wacker Neuson's valuation metrics are shaping its market position, check out our detailed analysis of Wacker Neuson's Valuation.External Factors Threatening Wacker Neuson

Despite growth prospects, Wacker Neuson faces external threats, including economic headwinds that could dampen consumer spending, as discussed in the earnings call. Regulatory hurdles pose operational risks, requiring proactive compliance strategies to mitigate potential disruptions. Additionally, competitive pressures from new market entrants threaten market share and profitability, necessitating enhanced competitive strategies to sustain its position. The volatility in dividend payments also poses a risk, with potential for significant drops impacting investor confidence.

To gain deeper insights into Wacker Neuson's historical performance, explore our detailed analysis of past performance. See what the latest analyst reports say about Wacker Neuson's future prospects and potential market movements.Conclusion

Wacker Neuson's strong financial health, demonstrated by a 21.8% annual profit growth over the past five years and a solid net debt to equity ratio, highlights its ability to maintain market strength and appeal to income-focused investors with a high dividend yield of 8.2%. However, challenges such as declining earnings growth and pressure on profit margins necessitate strategic adjustments to sustain profitability. The company's favorable Price-To-Earnings Ratio compared to industry peers indicates it is trading at an attractive value, offering potential for future growth as it capitalizes on strategic alliances and new product successes. Despite external threats, including economic headwinds and competitive pressures, Wacker Neuson is well-positioned to leverage its current undervaluation to enhance its market position and achieve significant price increases, aligning with analysts' forecasts of a 16% annual earnings growth.

Where To Now?

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Wacker Neuson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About XTRA:WAC

Wacker Neuson

Manufactures and distributes light and compact equipment in Germany, Austria, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives