As European markets grapple with renewed fears about global economic growth, Germany's DAX has seen a notable decline of 3.20%. Amid this backdrop, investors are increasingly turning to dividend stocks for stability and income. In times of market volatility, dividend stocks can provide a reliable income stream while offering potential for long-term capital appreciation. Here are three top German dividend stocks to consider for September 2024.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| All for One Group (XTRA:A1OS) | 3.03% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.40% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.71% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 5.23% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.86% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.10% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.46% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.32% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.86% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.28% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top German Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Heidelberg Materials (XTRA:HEI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Heidelberg Materials AG, with a market cap of €16.49 billion, produces and distributes cement, aggregates, ready-mixed concrete, and asphalt globally through its subsidiaries.

Operations: Heidelberg Materials AG generates revenue from several segments, including €10.90 billion from cement, €4.92 billion from aggregates, and €5.71 billion from ready-mixed concrete and asphalt.

Dividend Yield: 3.3%

Heidelberg Materials' dividend payments are well covered by earnings and cash flows, with payout ratios of 29.6% and 27.3% respectively, but have been volatile over the past decade. The company recently completed a share buyback program worth €154.5 million and reported a decline in half-year earnings to €574.3 million from €718.7 million last year, impacting its dividend reliability despite trading at good value compared to peers.

- Unlock comprehensive insights into our analysis of Heidelberg Materials stock in this dividend report.

- Our expertly prepared valuation report Heidelberg Materials implies its share price may be lower than expected.

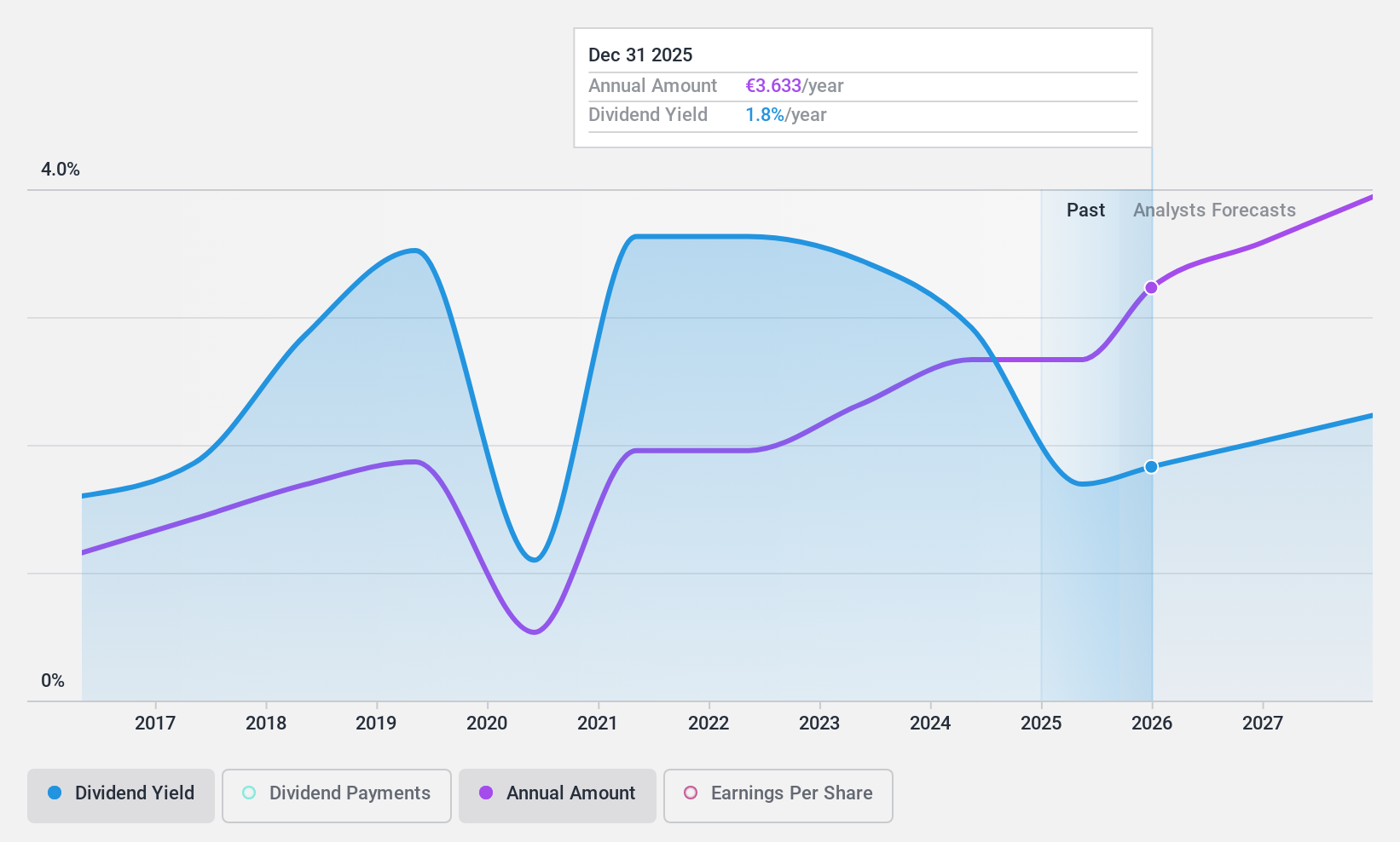

Deutsche Lufthansa (XTRA:LHA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Deutsche Lufthansa AG is a global aviation company with a market cap of €6.97 billion.

Operations: Deutsche Lufthansa AG generates revenue from several segments, including Passenger Airlines (€29.04 billion), Maintenance, Repair and Overhaul Services (MRO) (€7.06 billion), Logistics (€2.93 billion), and Additional Businesses and Group Functions (€1.01 billion).

Dividend Yield: 5.2%

Deutsche Lufthansa's dividend payments are covered by both earnings (payout ratio: 29.8%) and cash flows (cash payout ratio: 60.9%), but have been volatile over the past decade. The company recently completed a fixed-income offering of €498 million, which may impact its financial stability. Despite trading at a good value with a price-to-earnings ratio of 5.8x, the dividend yield is in the top 25% of German market payers, yet remains unreliable due to historical instability in payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Deutsche Lufthansa.

- The analysis detailed in our Deutsche Lufthansa valuation report hints at an deflated share price compared to its estimated value.

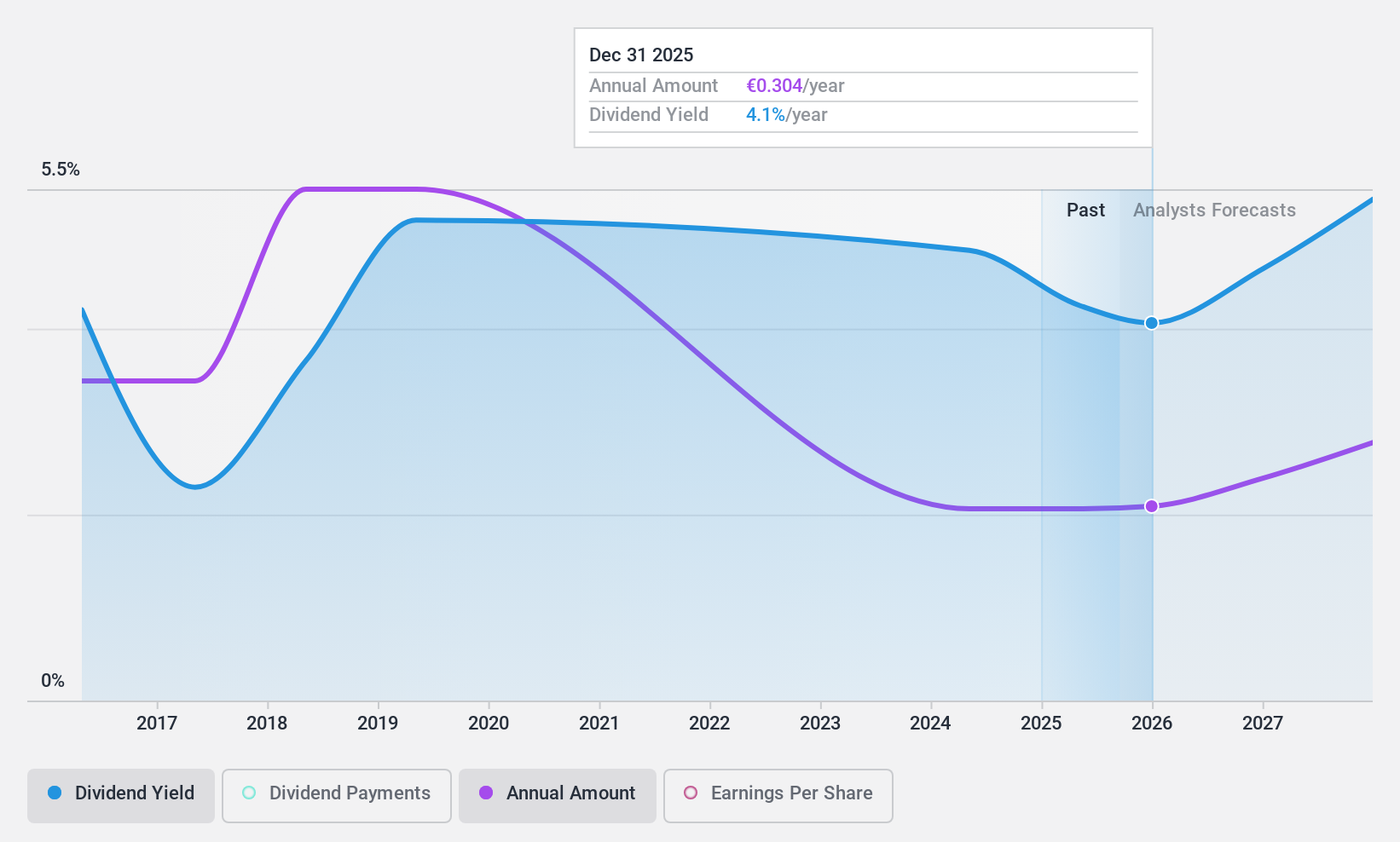

Wacker Neuson (XTRA:WAC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wacker Neuson SE manufactures and distributes light and compact equipment in Germany, Austria, the United States, and internationally, with a market cap of €918.21 million.

Operations: Wacker Neuson SE generates revenue from three primary segments: Services (€502.60 million), Light Equipment (€480.20 million), and Compact Equipment (€1.53 billion).

Dividend Yield: 8.5%

Wacker Neuson's dividend yield is in the top 25% of German market payers at 8.52%, but its high cash payout ratio (418.3%) indicates dividends are not well covered by free cash flows. Despite a reasonable earnings payout ratio (68.3%), dividends have been volatile over the past decade and are considered unreliable. Recent earnings guidance forecasts revenue between €2.3 billion and €2.4 billion for 2024, with an EBIT margin of 6-7%.

- Take a closer look at Wacker Neuson's potential here in our dividend report.

- Our valuation report here indicates Wacker Neuson may be undervalued.

Where To Now?

- Unlock more gems! Our Top German Dividend Stocks screener has unearthed 30 more companies for you to explore.Click here to unveil our expertly curated list of 33 Top German Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:LHA

Deutsche Lufthansa

Operates as an aviation company in Germany and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives