Amidst a backdrop of political uncertainty and fluctuating markets in Europe, investors are increasingly seeking stable returns, making dividend stocks a focal point of interest. In this context, companies like SAF-Holland that consistently pay dividends can offer a semblance of predictability and potential income in an otherwise volatile environment.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.40% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.91% | ★★★★★★ |

| Südzucker (XTRA:SZU) | 6.53% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.41% | ★★★★★☆ |

| INDUS Holding (XTRA:INH) | 4.85% | ★★★★★☆ |

| MLP (XTRA:MLP) | 4.82% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.25% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 4.92% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.33% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.14% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

SAF-Holland (XTRA:SFQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SAF-Holland SE specializes in manufacturing and supplying chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses, with a market capitalization of approximately €0.78 billion.

Operations: SAF-Holland SE generates revenue through three primary geographical segments: Americas (€898.79 million), Asia/Pacific including China and India (€280.64 million), and Europe, the Middle East, and Africa (EMEA) with €951.75 million in sales.

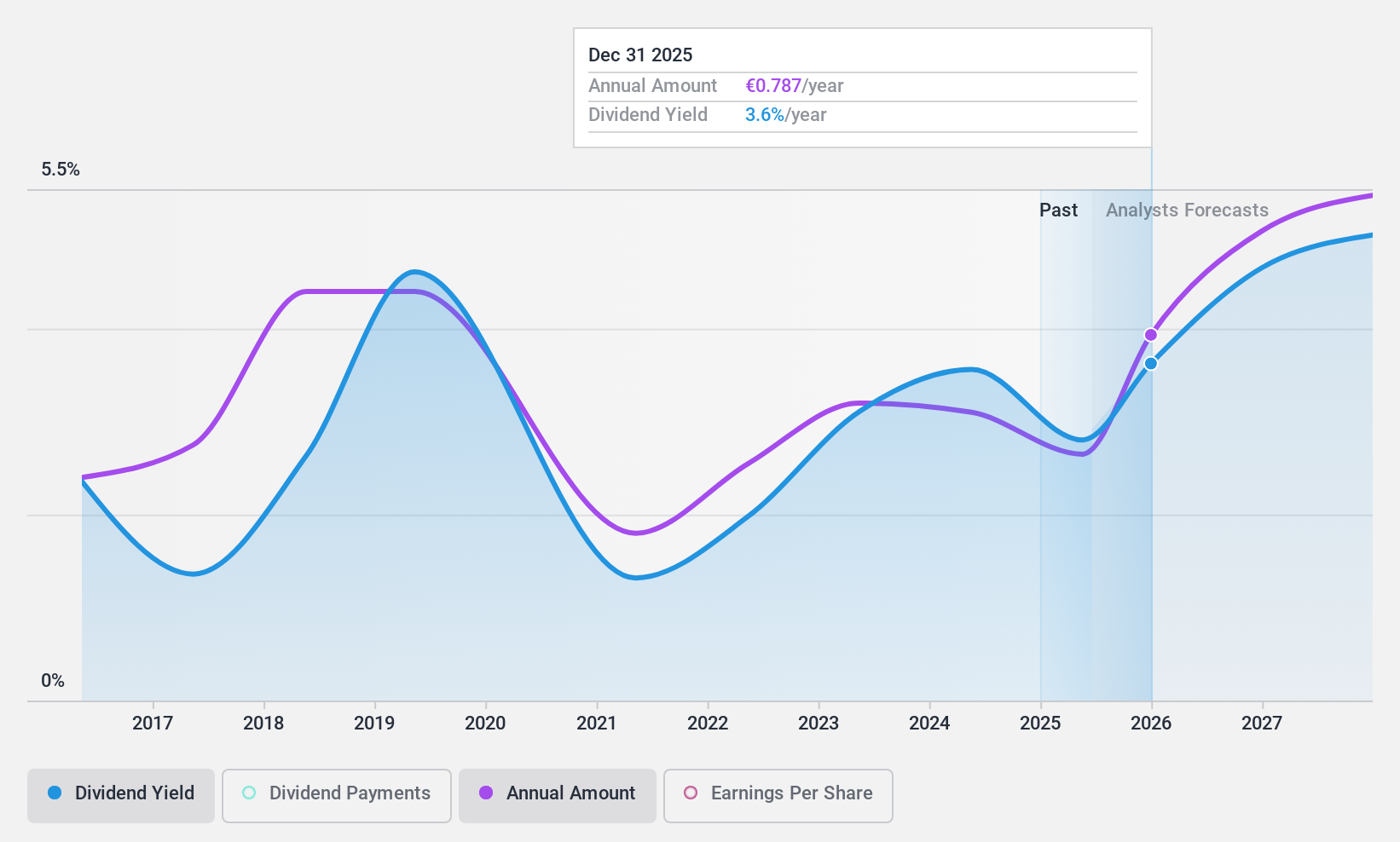

Dividend Yield: 4.9%

SAF-Holland SE, with a dividend yield of 4.92%, ranks in the top 25% of German dividend payers. The company's dividends are well-supported by both earnings and cash flows, with payout ratios of 44.6% and 31.6% respectively, indicating sustainability despite its volatile history over the past decade. Recent financials show growth, with Q1 sales rising to €505.43 million from €480.42 million year-over-year and net income increasing to €26.23 million from €19.56 million, reflecting a positive earnings trajectory.

- Get an in-depth perspective on SAF-Holland's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, SAF-Holland's share price might be too pessimistic.

Südzucker (XTRA:SZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Südzucker AG is a global producer and seller of sugar products, operating in Germany, other parts of the European Union, the United Kingdom, the United States, and internationally, with a market capitalization of approximately €2.81 billion.

Operations: Südzucker AG's revenue is generated from several segments: Sugar (€4.44 billion), Special Products excluding Starch (€2.43 billion), Fruit (€1.57 billion), Starch (€1.16 billion), and CropEnergies (€1.21 billion).

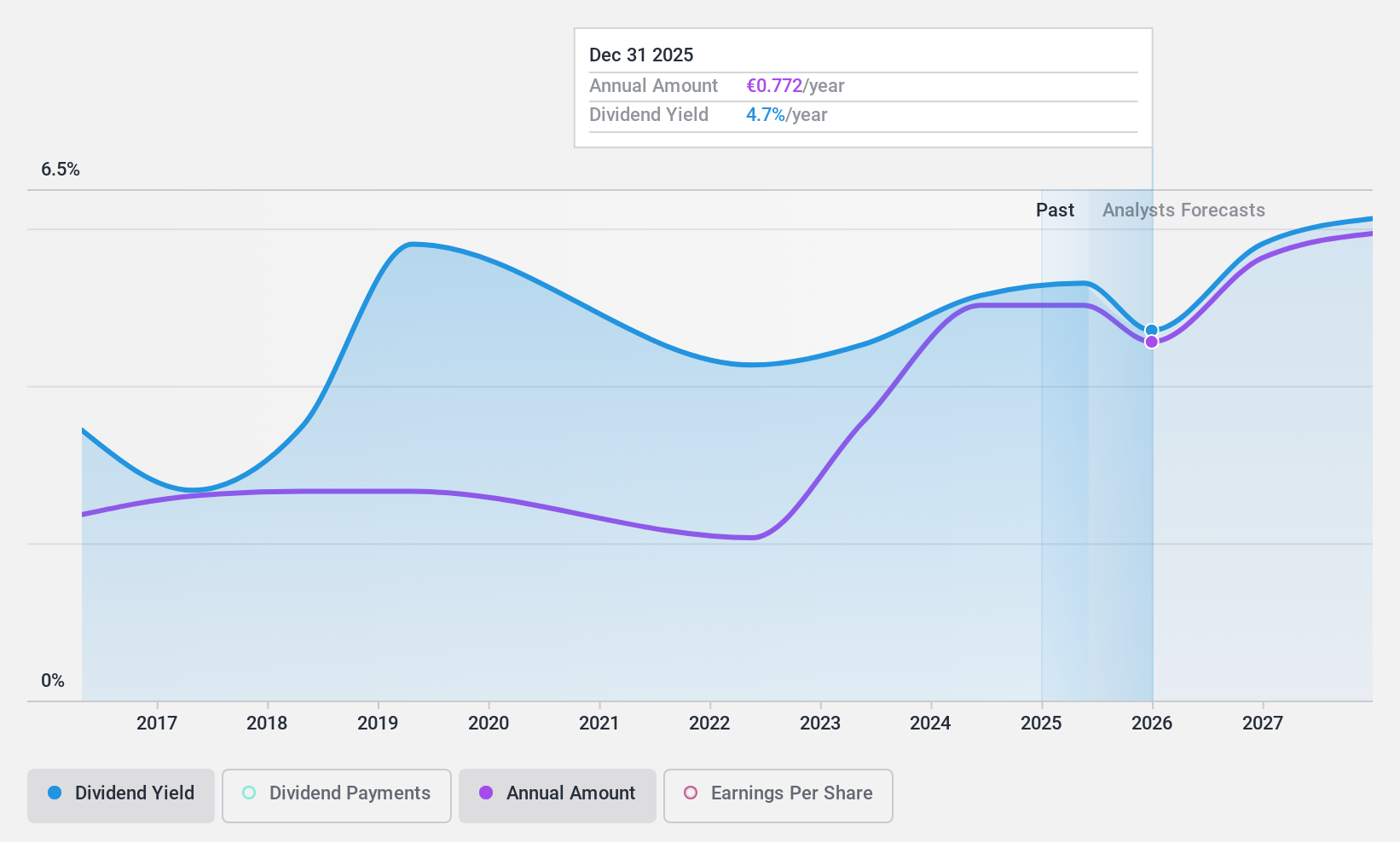

Dividend Yield: 6.5%

Südzucker AG, trading 48.8% below its estimated fair value, offers a dividend yield of 6.53%, ranking in the top quartile of German dividend payers. Despite a volatile dividend history over the past decade, recent increases include a rise to €0.90 per share for fiscal 2023/24 from €0.70 previously. The dividends are well-covered by earnings and cash flows with payout ratios at 33% and 34.9%, respectively, though earnings are projected to decline by an average of 32.3% annually over the next three years.

- Delve into the full analysis dividend report here for a deeper understanding of Südzucker.

- Our valuation report here indicates Südzucker may be undervalued.

technotrans (XTRA:TTR1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Technotrans SE is a global technology and services company with a market capitalization of approximately €134.01 million.

Operations: Technotrans SE generates revenue primarily through its Technology and Services segments, with earnings of €188.31 million and €63.04 million respectively.

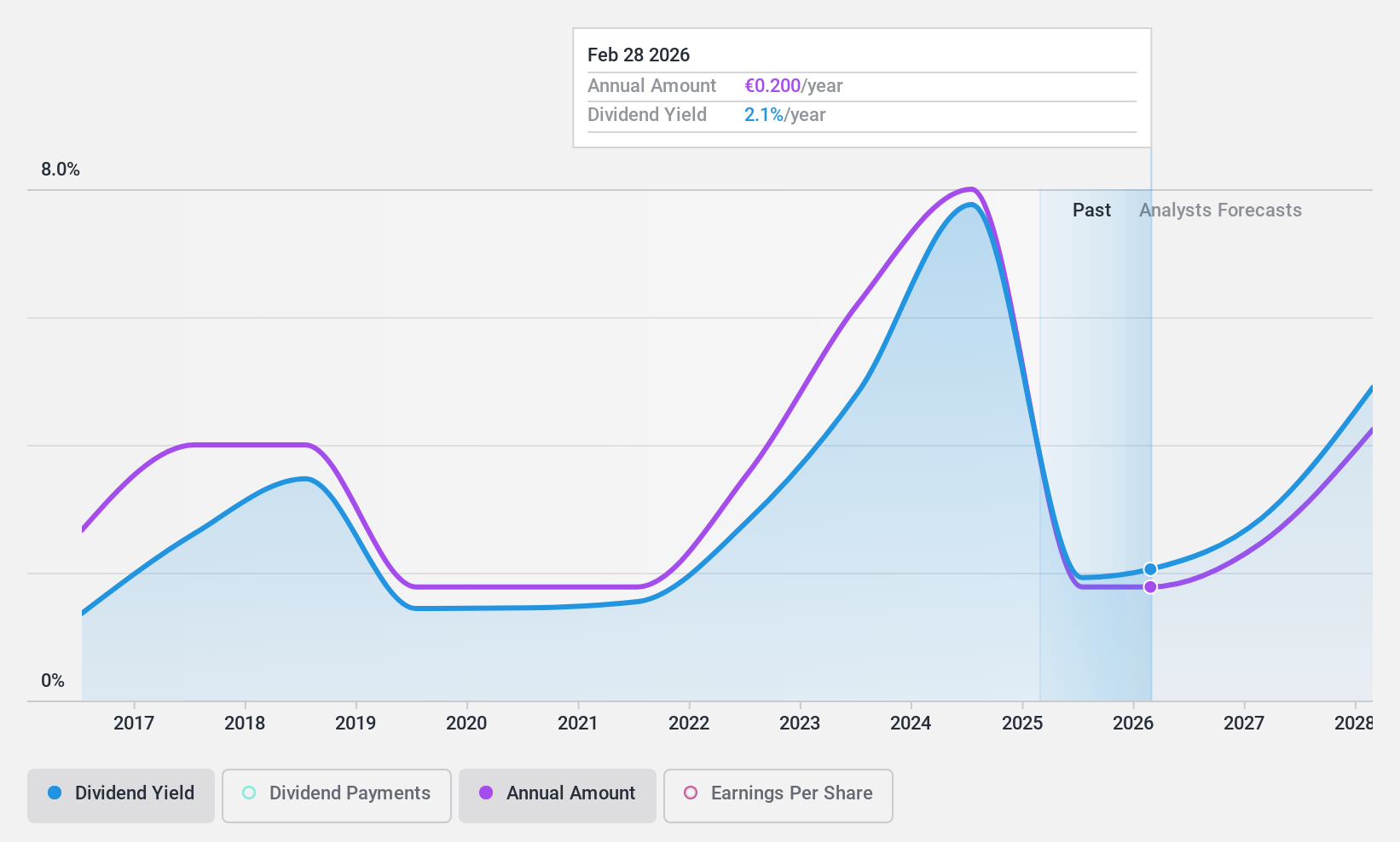

Dividend Yield: 3.2%

Technotrans SE has displayed a volatile dividend history with inconsistent growth over the past decade, despite a reasonable payout ratio of 64.7% and cash payout ratio of 37.5%, suggesting dividends are covered by earnings and cash flows. The company's dividend yield at 3.2% is below the top quartile in Germany (4.68%). Recent financials show a decline, with Q1 2024 revenue dropping to €56.04 million from €68.31 million year-over-year, and net income falling to €0.059 million from €2.2 million, indicating potential challenges ahead for sustaining dividends.

- Unlock comprehensive insights into our analysis of technotrans stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of technotrans shares in the market.

Summing It All Up

- Click through to start exploring the rest of the 29 Top Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade technotrans, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TTR1

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives