- Germany

- /

- Industrials

- /

- XTRA:SIE

Siemens (XTRA:SIE): Unpacking Current Valuation After Recent Share Price Move

Reviewed by Simply Wall St

If you have been watching Siemens (XTRA:SIE) lately, a recent shift in the stock might have caught your eye. While there was no headline-making event driving this move, moments like this can prompt investors to pause and ask if something is stirring beneath the surface. Is the market signaling a bigger change, or is this simply another blip that resets the stock’s valuation conversation?

Taking a broader view, Siemens has shown steady upward movement over the past year, climbing 43% and consistently outpacing broader indexes. Momentum has been positive through much of the year, with a slightly softer patch this month, but the broader trend remains one of strength. With consistent annual revenue and net income growth near 6%, Siemens sits comfortably among capital goods peers looking for growth and resilience, though there have been no major corporate shifts to impact its trajectory recently.

All of this raises the classic investing question: with Siemens now well above last year’s levels, does the market see more gains ahead, or is everything already priced in?

Most Popular Narrative: 6.2% Undervalued

The prevailing narrative suggests Siemens is trading below its estimated fair value, with analysts pointing to continued digitalization and operational efficiency as central catalysts for future performance.

Sustained, accelerating demand for electrification and data center infrastructure, especially from hyperscaler clients, is driving strong top-line growth in the Smart Infrastructure segment. This supports recurring revenues and capacity-based margin expansion over multiple quarters.

How did analysts land on their price target? There is a bold forecast at the heart of this valuation. It rests on ambitious revenue growth, a bump in profitability, and a future profit multiple that some usually associate with high-growth sectors. What’s the catch? The real story lies in the specific assumptions backing this number, such as rising margins and strong order books. Want to see how these projections come together (and which numbers might surprise you)? Dive into the full narrative to find out what’s really fueling this undervaluation call.

Result: Fair Value of €243.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unpredictable global demand swings or intensifying competition in automation could quickly challenge the bullish outlook and put pressure on the future performance of Siemens.

Find out about the key risks to this Siemens narrative.Another View: Multiples Tell a Different Story

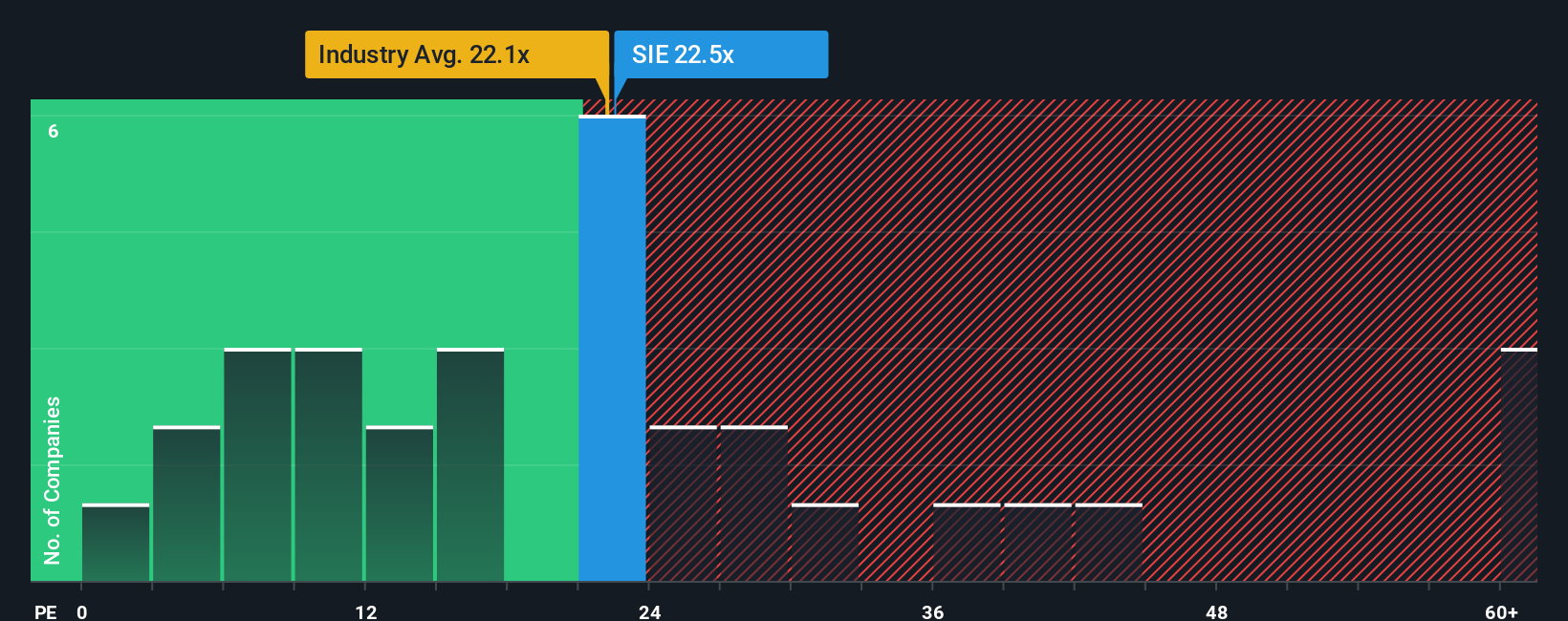

While the analyst fair value projection is upbeat, looking at Siemens through a market comparison lens gives a less optimistic impression. In this view, the company appears a bit more expensive than the wider European sector. Which approach gets you closer to reality?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Siemens to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Siemens Narrative

If you think there’s more to unpack or want to run your own numbers, you can build a personal Siemens story in just a few minutes, your way. Do it your way.

A great starting point for your Siemens research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not stop at one opportunity. Expand your horizons today and find your next winning stock with Simply Wall Street’s brilliant screeners. Don’t let breakthrough opportunities slip by!

- Uncover high-potential small caps shaking up the market by checking out penny stocks with strong financials, making waves with strong financials and bold innovations.

- Target tomorrow’s health leaders by exploring healthcare AI stocks, where cutting-edge medical tech meets artificial intelligence to revolutionize patient care.

- Earn more from your portfolio by tapping into dividend stocks with yields > 3%, connecting you with companies offering steady income and yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SIE

Siemens

A technology company, focuses in the areas of automation and digitalization in Europe, Commonwealth of Independent States, Africa, the Middle East, the Americas, Asia, and Australia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives