- Germany

- /

- Industrials

- /

- XTRA:SIE

It Looks Like Shareholders Would Probably Approve Siemens Aktiengesellschaft's (ETR:SIE) CEO Compensation Package

Key Insights

- Siemens' Annual General Meeting to take place on 8th of February

- CEO Roland Busch's total compensation includes salary of €1.77m

- The overall pay is comparable to the industry average

- Siemens' EPS grew by 27% over the past three years while total shareholder return over the past three years was 33%

The performance at Siemens Aktiengesellschaft (ETR:SIE) has been quite strong recently and CEO Roland Busch has played a role in it. Coming up to the next AGM on 8th of February, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

Check out our latest analysis for Siemens

How Does Total Compensation For Roland Busch Compare With Other Companies In The Industry?

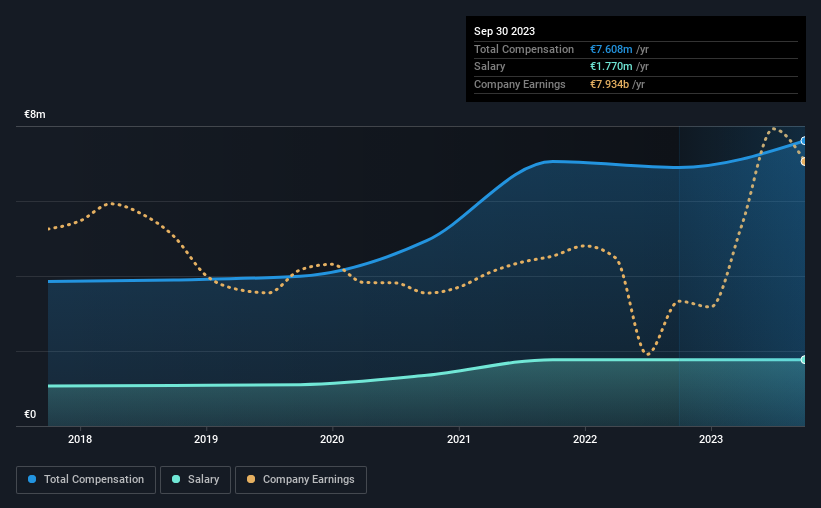

According to our data, Siemens Aktiengesellschaft has a market capitalization of €131b, and paid its CEO total annual compensation worth €7.6m over the year to September 2023. We note that's an increase of 10% above last year. While we always look at total compensation first, our analysis shows that the salary component is less, at €1.8m.

For comparison, other companies in the Germany Industrials industry with market capitalizations above €7.4b, reported a median total CEO compensation of €6.6m. From this we gather that Roland Busch is paid around the median for CEOs in the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €1.8m | €1.8m | 23% |

| Other | €5.8m | €5.1m | 77% |

| Total Compensation | €7.6m | €6.9m | 100% |

Speaking on an industry level, nearly 56% of total compensation represents salary, while the remainder of 44% is other remuneration. Siemens sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Siemens Aktiengesellschaft's Growth Numbers

Siemens Aktiengesellschaft's earnings per share (EPS) grew 27% per year over the last three years. In the last year, its revenue is up 8.0%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Siemens Aktiengesellschaft Been A Good Investment?

We think that the total shareholder return of 33%, over three years, would leave most Siemens Aktiengesellschaft shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Siemens that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:SIE

Siemens

A technology company, focuses in the areas of automation and digitalization in Europe, Commonwealth of Independent States, Africa, the Middle East, the Americas, Asia, and Australia.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives