- Germany

- /

- Aerospace & Defense

- /

- XTRA:RHM

The Bull Case For Rheinmetall (XTRA:RHM) Could Change Following Record Backlog And NATO-Focused Expansion Plans - Learn Why

Reviewed by Sasha Jovanovic

- Rheinmetall recently reported strong sales growth and a record order backlog of roughly €64.00 billion, supported by new NATO-linked contracts for HERO loitering munitions and large ammunition orders across Europe.

- By pairing this very large backlog with plans to expand production capacity within NATO countries and refocus on pure-play defence, the company is aiming to convert surging demand into higher margins and stronger cash generation over the coming years.

- Next, we'll examine how Rheinmetall's record €64.00 billion order backlog and capacity expansion plans influence its existing investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Rheinmetall Investment Narrative Recap

To own Rheinmetall, you need to believe that elevated European and NATO defence spending will stay supportive long enough for the company to turn its record €64.00 billion backlog into sustained earnings and cash flow. The latest contracts reinforce the near term demand catalyst, but they do not remove the key risk that rapid capacity expansion, new technologies and M&A could strain execution and weigh on margins if projects slip or costs run ahead of expectations.

Among recent announcements, the series of large European ammunition and NATO HERO loitering munition orders looks most relevant, because it directly feeds that backlog and underpins Rheinmetall’s decision to expand production capacity within NATO countries. For investors, the question is less about demand existing and more about whether management can scale facilities, secure inputs and manage working capital efficiently enough to convert these multi year orders into the higher margins and stronger free cash generation it is targeting.

Yet the same capacity build out that underpins this growth story also introduces execution risk that investors should be aware of...

Read the full narrative on Rheinmetall (it's free!)

Rheinmetall's narrative projects €26.4 billion revenue and €3.4 billion earnings by 2028. This requires 35.3% yearly revenue growth and roughly a €2.6 billion earnings increase from €845.0 million today.

Uncover how Rheinmetall's forecasts yield a €2174 fair value, a 46% upside to its current price.

Exploring Other Perspectives

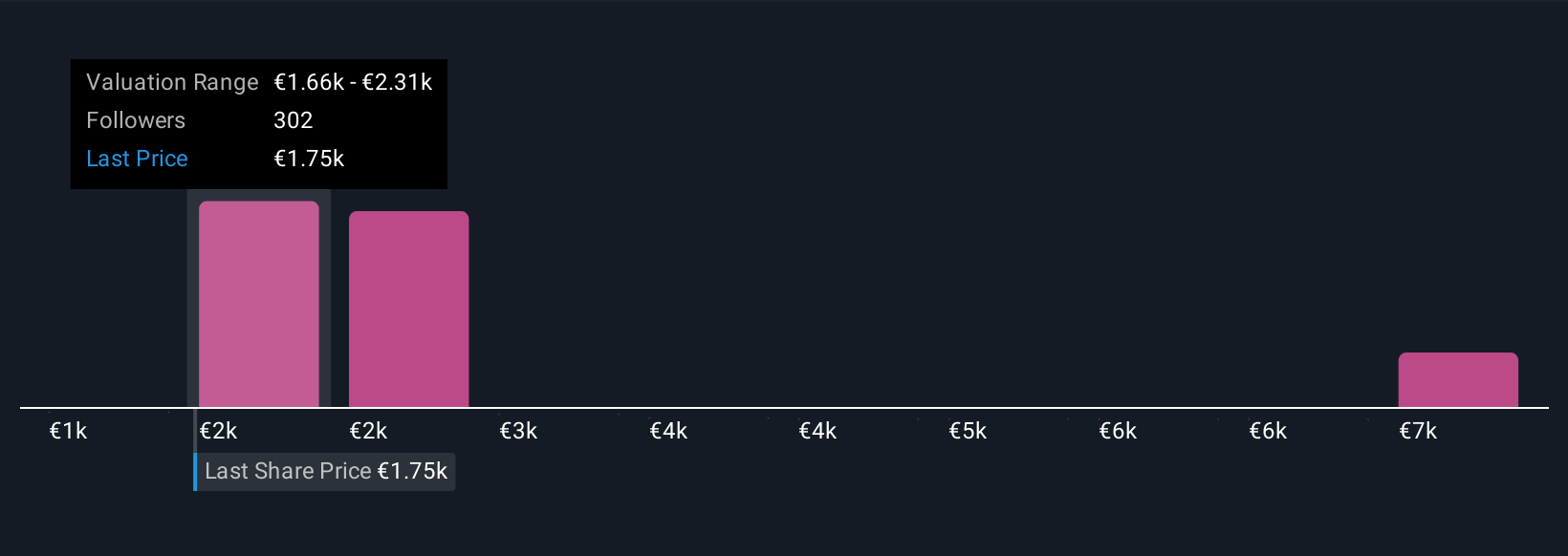

Thirty three fair value estimates from the Simply Wall St Community span a wide range, from €1,686.81 to €8,050, highlighting sharply different views on Rheinmetall’s upside. Against that backdrop, the company’s rapid capacity expansion to service its €64.00 billion order backlog could either reinforce confidence in its long term earnings power or amplify concerns about execution risk and margin pressure, so it is worth weighing several of these perspectives side by side.

Explore 33 other fair value estimates on Rheinmetall - why the stock might be worth just €1687!

Build Your Own Rheinmetall Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rheinmetall research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Rheinmetall research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rheinmetall's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RHM

Rheinmetall

Provides mobility and security technologies in Germany, Rest of Europe, North, Middle, and South America, Asia and the Near East, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026