- Germany

- /

- Aerospace & Defense

- /

- XTRA:RHM

Rheinmetall (XTRA:RHM) Valuation in Focus After Bold Strategic Shift Toward Full-Spectrum European Defence

Reviewed by Simply Wall St

If you’re watching Rheinmetall (XTRA:RHM), the latest pivot from management should be on your radar. The CEO has signaled a sweeping change: Rheinmetall will sell its civilian businesses in early 2026 and move into shipbuilding, aiming to become Europe’s go-to partner for all things land, sea, and air defence. That means the business is doubling down on military tech at a time when European defence demand is front and center, and investors are wondering what this transformation means for the stock’s future path.

The shift arrives after a solid stretch for Rheinmetall’s shares, which have climbed nearly 3% over the past year and more than doubled so far in 2024. The company has posted steady revenue and profit growth, while new partnerships and expanded capabilities have kept momentum building behind the stock. With plans to spin off civilian operations and a push into new defence domains, investors are now weighing if this is the start of a new growth chapter, or if heightened expectations are already baked into the share price.

With all these moves in play, the big question is whether Rheinmetall is now undervalued, or if the market has already priced in its future growth prospects.

Most Popular Narrative: 75% Undervalued

According to the most widely discussed narrative, Rheinmetall could be trading well below its estimated fair value, positioning it as one of the most undervalued large-cap defense stocks in Europe right now.

If European NATO members would raise their military spending to around 3% of their GDP, this would mean a combined yearly spending of over 500 billion euros. Rheinmetall management assumed on 12th March 2025 that 20% to 25% of the entire military spending could be spent with Rheinmetall. In my point of view, it seems likely as it would be difficult to spend such a large amount anywhere else but with Rheinmetall. I do see a risk in that asymmetrical tactics and technology might become more important and that Rheinmetall would not be the leader in that area. Also, Rheinmetall would need to quickly expand its production and its supply chain would have to keep up. For the immediate future, the most important factor is the change of the German constitution until the end of March in order to expand military spending in Germany. This depends on some intricate politics and is time critical since the new majorities from April 2025 would not allow a change of the German constitution anymore. In its most optimistic scenario I see yearly revenue rise to over 100 billion euros, based on 500 billion euros defense spending multiplied by 20%, and thus a fair value of over 7,000 euros per share while assuming a 20% profit margin, as Rheinmetall management assumed.

Want to see what’s behind this eye-popping valuation? The narrative hinges on massive projected revenue and profit margins, with bold forecasts for defense contract wins. Find out which once-unthinkable growth targets are driving this calculation. Curious about how high the ceiling could be for Rheinmetall? Explore the full narrative for the details insiders are buzzing about.

Result: Fair Value of €7,569.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the optimism faces hurdles, such as potential delays to Germany’s defense spending reforms and the challenge of swiftly increasing Rheinmetall's production capacity.

Find out about the key risks to this Rheinmetall narrative.Another View: Market-Based Comparison

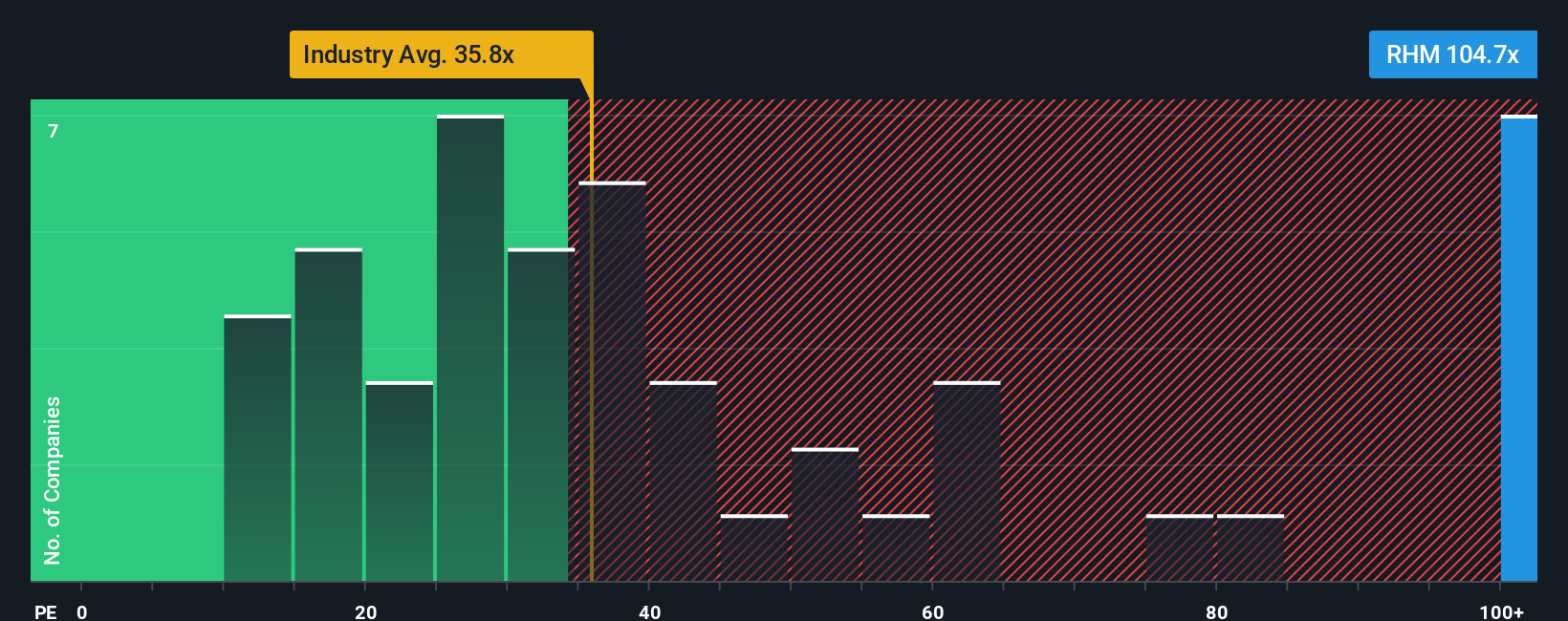

Taking a look from a different angle, a basic market comparison suggests that Rheinmetall is currently expensive compared to rivals in the broader European industry. Does this challenge the optimism behind those bold growth forecasts, or is there more to the story?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Rheinmetall to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Rheinmetall Narrative

Not convinced by these perspectives, or keen to dig into the numbers yourself? You can shape your own narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Rheinmetall.

Looking for More Smart Investment Ideas?

Don’t let a single opportunity slip through your fingers. Turn market shifts to your advantage by exploring other hand-picked stocks poised for outperformance. Simply Wall Street’s unique collection of screeners connects you directly to market trends and high-potential sectors, helping you get ahead before the crowd catches on.

- Capture growth in cutting-edge healthcare by using healthcare AI stocks to find medical innovators pioneering AI-powered treatment and diagnostics breakthroughs.

- Unlock fresh income streams by spotting dividend stocks with yields > 3% offering attractive yields and consistent payers ready to reward shareholders.

- Ride the momentum of future tech by tapping into quantum computing stocks to uncover the most promising quantum computing stocks on the rise.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RHM

Rheinmetall

Provides mobility and security technologies in Germany; the rest of Europe; North, Middle, and South America; Asian regions, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives