- Germany

- /

- Aerospace & Defense

- /

- XTRA:RHM

Rheinmetall (XTRA:RHM): Reassessing Valuation After Record Order Backlog and Bold Defence Expansion Plans

Reviewed by Simply Wall St

Rheinmetall (XTRA:RHM) just paired strong sales growth with a record €64 billion order backlog, powered by fresh NATO and European ammunition deals. This puts its long term defence expansion plans firmly in the spotlight.

See our latest analysis for Rheinmetall.

Those blockbuster defence orders arrive after a sharp run up in the shares, with a year to date share price return of around 151%. However, the 3 month share price return is currently negative, while the 5 year total shareholder return of roughly 1,961% shows how powerful the longer term momentum has been.

If Rheinmetall’s surge has you rethinking your defence exposure, this could be a good moment to explore other opportunities across aerospace and defense stocks for potential candidates.

With sales jumping, a vast order book and management targeting much higher long term output, the valuation is racing ahead too. So is Rheinmetall still undervalued, or is the market already pricing in years of defence growth?

Most Popular Narrative Narrative: 81.1% Undervalued

According to EUinvestor’s narrative, Rheinmetall’s fair value of €8,052 per share sits far above the last close at €1,519, framing an aggressive upside path.

450% in 5 years

On April 17, 2025, Armin Papperger, Rheinmetall's CEO, said he expects orders to grow 450% by 2030.

Source: https://finance.yahoo.com/news/rheinmetall-ceo-expects-order-book-113644072.html

Price 8,052 EUR

The share price at the time of this information on 17/04/2025 was 1,464 EUR

Price estimate for 2030: 1,464 + 450% = 8,052 EUR

NATO spending in Europe

17/04/2025 The results of the NATO Summit held 24-26 June 2025 in The Hague, where it was agreed to increase defence spending to 3.5% of GDP and transport and IT infrastructure spending at 1.5% each year until 2035, were not yet known.

Source: https://www.nato.int/cps/en/natohq/official_texts_236705.htm

But there is one discrepancy: while the official NATO report talks about this budget increase to 3.5% + 1.5% annually, the European media talks about 3.5% + 1.5% as a target to be gradually reached by 2030-2035.

Want to see what kind of revenue surge and profit scaling could justify that price path? The narrative leans on bold compounding assumptions and elevated future margins.

Result: Fair Value of €8,052 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including potential US tariffs on EU goods and any rapid de-escalation in Ukraine that could cool defence spending expectations.

Find out about the key risks to this Rheinmetall narrative.

Another View Paying Up For Momentum

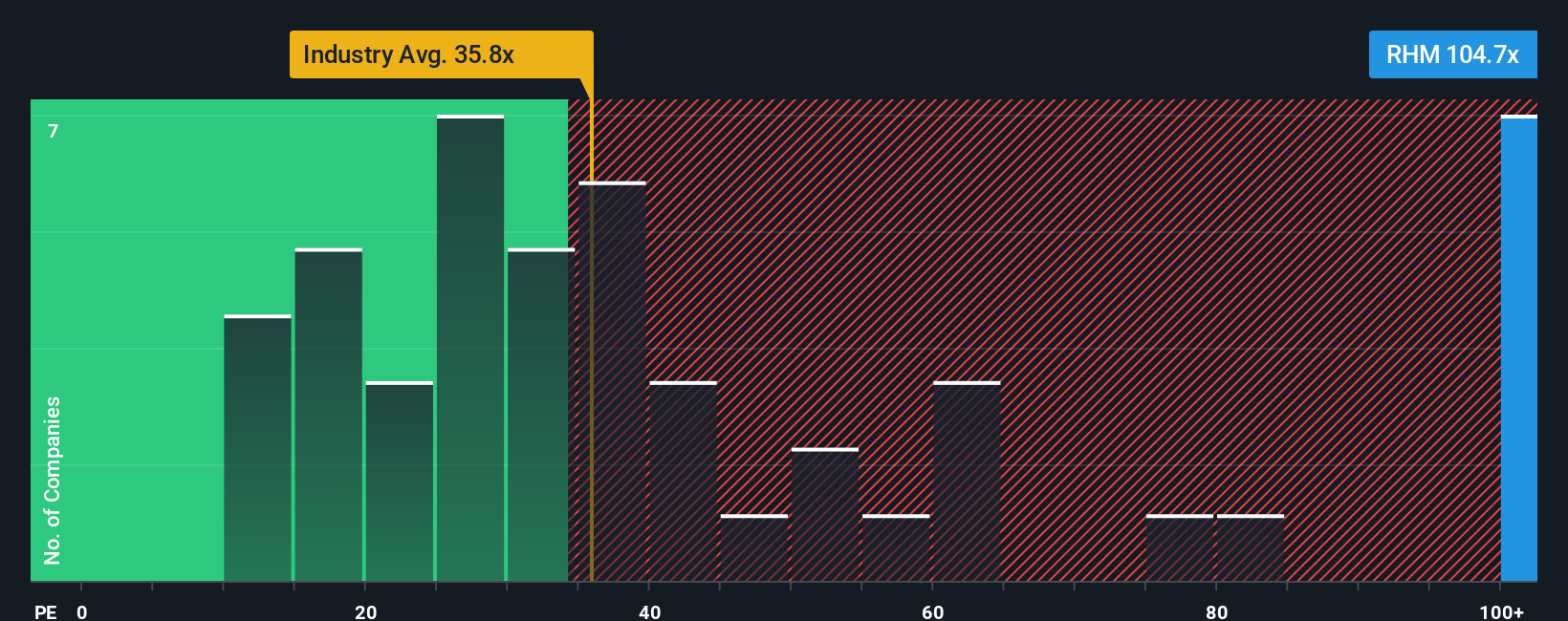

Our valuation checks using the price to earnings ratio paint a far cooler picture. Rheinmetall trades on 80.9 times earnings, compared with about 30.9 times for the wider European aerospace and defense sector and 42.7 times for close peers, while our fair ratio sits nearer 51.2 times.

That gap suggests investors are already paying a steep premium for growth and visibility, which could amplify any downside if orders or margins disappoint from here, even if the long term story still looks strong.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rheinmetall Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a tailored narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Rheinmetall.

Looking for more investment ideas?

Before you move on, lock in your next moves by scanning fresh opportunities on Simply Wall St’s Screener so you are not relying on one story alone.

- Capture potential mispricings by targeting companies screened as compelling value using these 916 undervalued stocks based on cash flows that may offer stronger upside than today’s headline names.

- Capitalize on thematic growth by focusing on innovators at the intersection of medicine and algorithms with these 30 healthcare AI stocks shaping the next decade of healthcare.

- Position for asymmetric outcomes by filtering for early stage names through these 3573 penny stocks with strong financials where small price moves can translate into outsized portfolio impact.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RHM

Rheinmetall

Provides mobility and security technologies in Germany, Rest of Europe, North, Middle, and South America, Asia and the Near East, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026