- Germany

- /

- Diversified Financial

- /

- XTRA:CHG

CHAPTERS Group And Two Additional Stocks On The German Exchange That Might Be Undervalued

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, Germany's DAX index recently experienced a notable decline, shedding 3.07% as trade tensions and economic uncertainties persist. This environment may present opportunities to identify potentially undervalued stocks that could be poised for recovery or growth as market conditions evolve. In this context, understanding the intrinsic value and resilience of companies becomes crucial in pinpointing those stocks that might outperform within the challenging landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Stabilus (XTRA:STM) | €43.70 | €79.64 | 45.1% |

| Allgeier (XTRA:AEIN) | €17.05 | €26.14 | 34.8% |

| technotrans (XTRA:TTR1) | €17.00 | €29.23 | 41.8% |

| ecotel communication ag (XTRA:E4C) | €12.65 | €19.93 | 36.5% |

| Stratec (XTRA:SBS) | €42.00 | €81.52 | 48.5% |

| CHAPTERS Group (XTRA:CHG) | €24.20 | €43.35 | 44.2% |

| MTU Aero Engines (XTRA:MTX) | €247.70 | €420.53 | 41.1% |

| R. STAHL (XTRA:RSL2) | €18.40 | €29.14 | 36.8% |

| Your Family Entertainment (DB:RTV) | €2.48 | €4.55 | 45.5% |

| Dr. Hönle (XTRA:HNL) | €17.50 | €34.64 | 49.5% |

Here's a peek at a few of the choices from the screener.

CHAPTERS Group (XTRA:CHG)

Overview: CHAPTERS Group AG operates primarily in the DACH region, offering software solutions with a market capitalization of approximately €0.47 billion.

Operations: The company generates revenue primarily through its data processing segment, totaling €70.77 million.

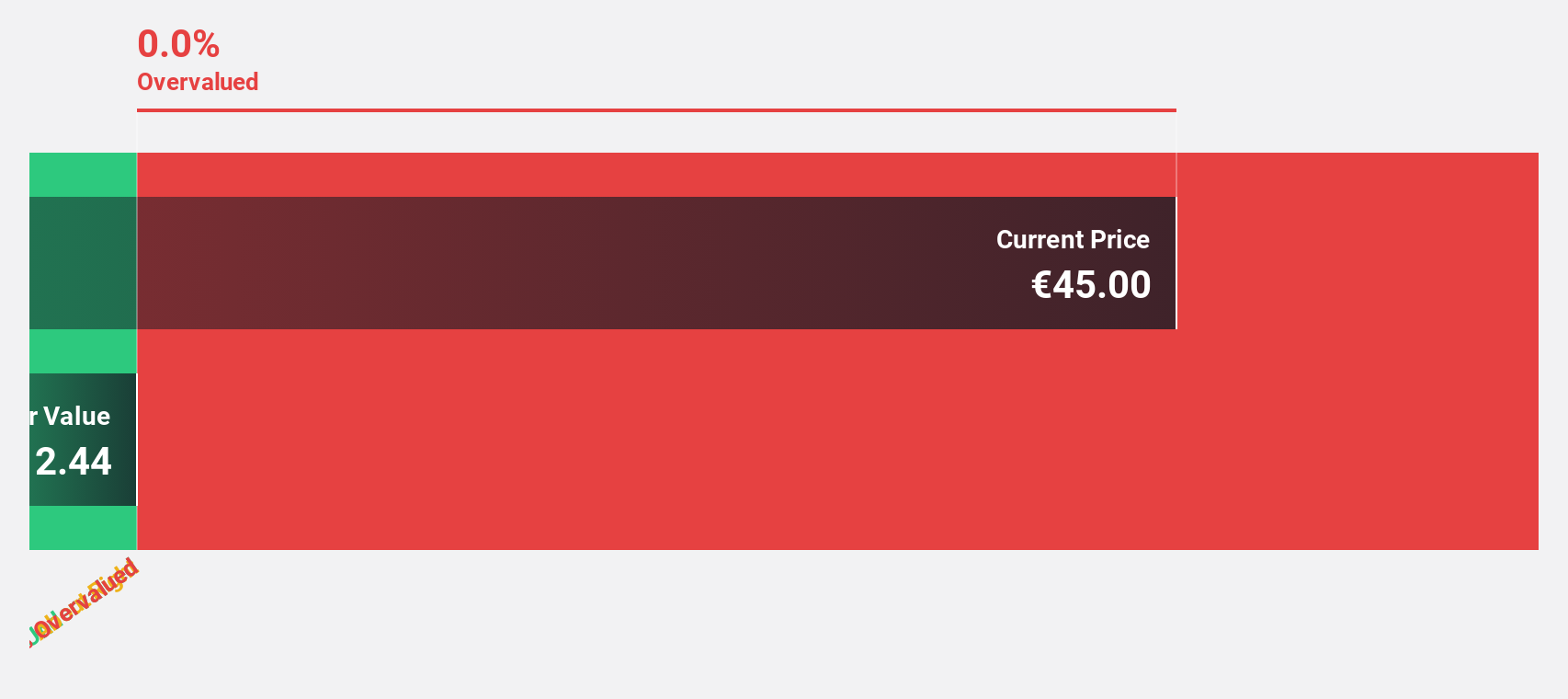

Estimated Discount To Fair Value: 44.2%

CHAPTERS Group, priced at €24.2, is significantly undervalued with a trading value 44.2% below the estimated fair value of €43.35. Despite recent shareholder dilution and a low forecasted Return on Equity at 13%, the company shows strong potential with revenue growth expected at 20.8% annually, outpacing the German market's average of 5.2%. Additionally, CHAPTERS is anticipated to turn profitable within three years, supported by robust earnings growth projected at 73.41% per year.

- According our earnings growth report, there's an indication that CHAPTERS Group might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of CHAPTERS Group.

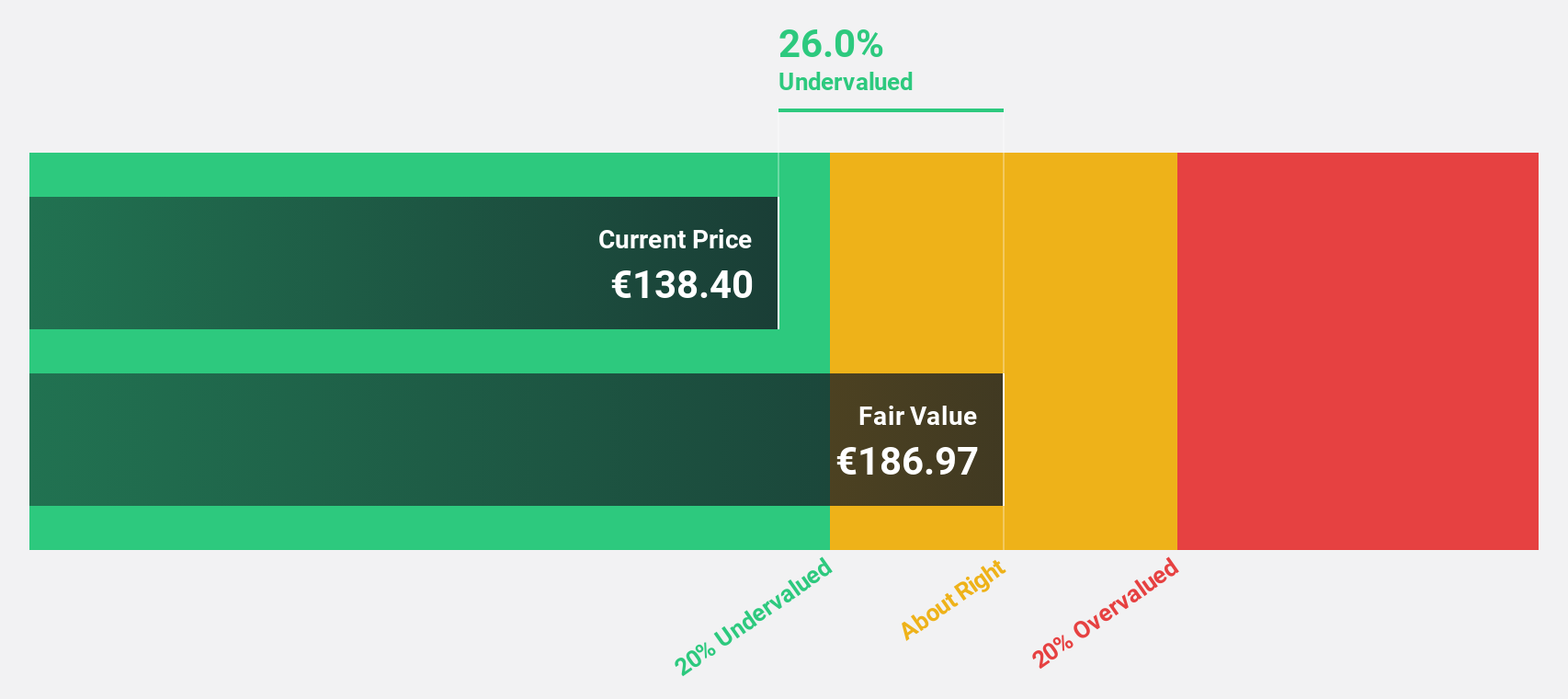

MBB (XTRA:MBB)

Overview: MBB SE is a German-based company that specializes in acquiring and managing medium-sized businesses in the technology and engineering sectors, with a market capitalization of approximately €0.61 billion.

Operations: MBB SE generates revenue through three primary segments: Consumer Goods (€94.23 million), Technical Applications (€378.50 million), and Service & Infrastructure (€487.10 million).

Estimated Discount To Fair Value: 13.4%

MBB, priced at €107, is undervalued by 13.4% compared to its fair value of €123.6. While the company's revenue growth forecast of 7.3% per year is modest, it outpaces the German market average of 5.2%. MBB has demonstrated strong earnings growth, with a past year increase of 63.9% and an expected annual growth rate of 33.45%. However, its Return on Equity is projected to be low at 9.6% in three years' time.

- Upon reviewing our latest growth report, MBB's projected financial performance appears quite optimistic.

- Dive into the specifics of MBB here with our thorough financial health report.

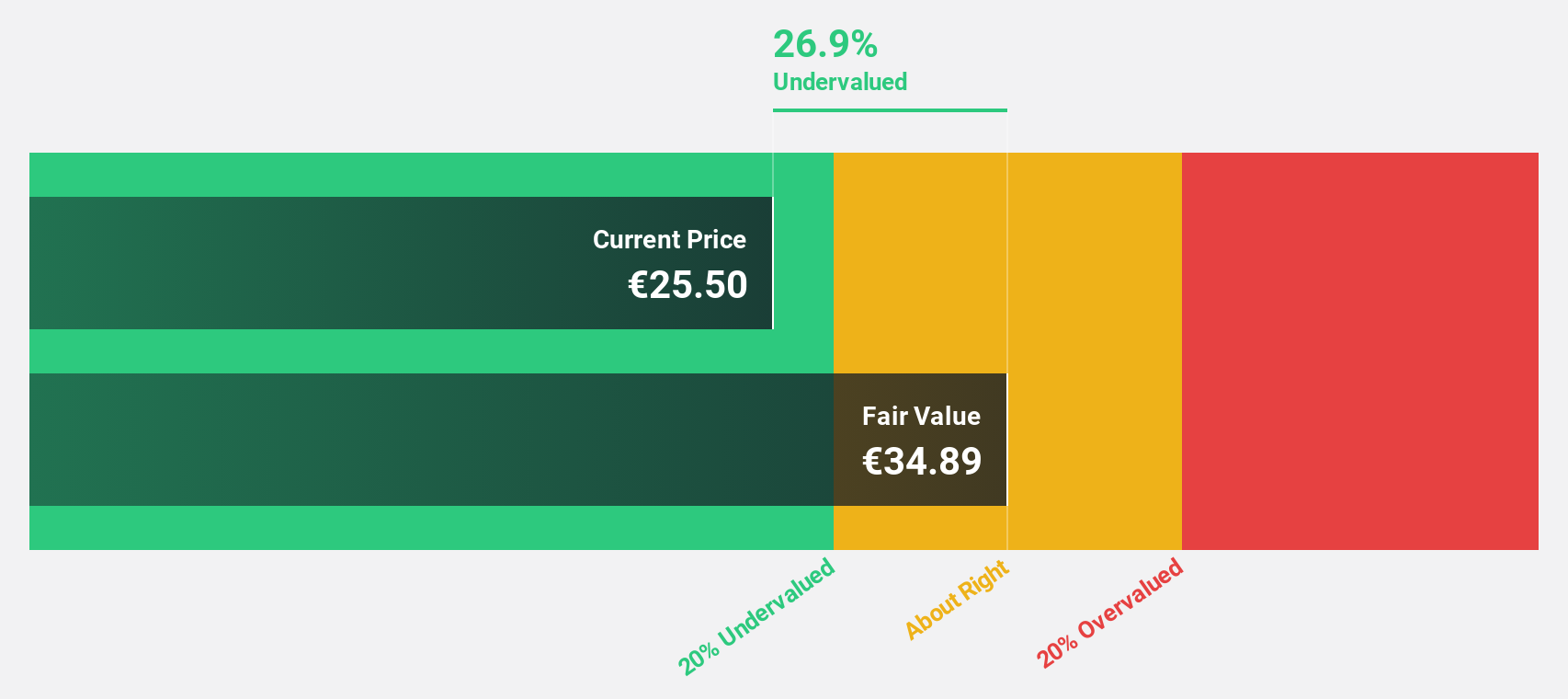

Kontron (XTRA:SANT)

Overview: Kontron AG specializes in providing Internet of Things (IoT) solutions both in Austria and globally, with a market capitalization of approximately €1.24 billion.

Operations: Kontron's revenue is segmented into Europe (€971.03 million), Global (€269.17 million), and Software + Solutions (€306.81 million).

Estimated Discount To Fair Value: 34.6%

Kontron, with a current price of €20.14, appears undervalued based on DCF analysis, suggesting a fair value of €30.8. This pricing discrepancy highlights potential in the stock amidst recent strategic moves including a partnership with Microsoft for IoT solutions and an active share buyback program. Analysts predict substantial growth in earnings (21.11% annually) and revenue (12.9% annually), outpacing the German market forecasts of 18.9% and 5.2%, respectively, although concerns about its low forecasted Return on Equity at 17.2% persist.

- Our comprehensive growth report raises the possibility that Kontron is poised for substantial financial growth.

- Navigate through the intricacies of Kontron with our comprehensive financial health report here.

Turning Ideas Into Actions

- Embark on your investment journey to our 26 Undervalued German Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CHG

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives