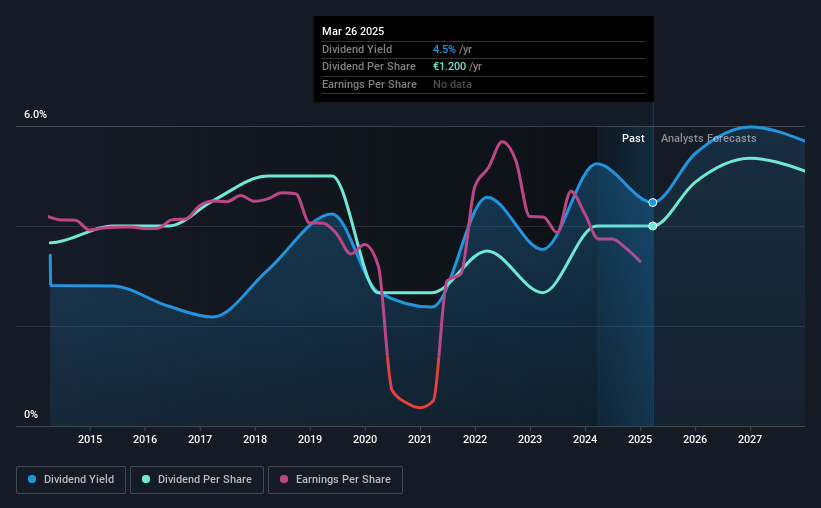

INDUS Holding AG (ETR:INH) will pay a dividend of €1.20 on the 30th of May. This makes the dividend yield 4.5%, which will augment investor returns quite nicely.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that INDUS Holding's stock price has increased by 35% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

INDUS Holding's Projected Earnings Seem Likely To Cover Future Distributions

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, INDUS Holding was quite comfortably earning enough to cover the dividend. This indicates that quite a large proportion of earnings is being invested back into the business.

Looking forward, earnings per share is forecast to rise by 71.8% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 32%, which is in the range that makes us comfortable with the sustainability of the dividend.

Check out our latest analysis for INDUS Holding

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2015, the dividend has gone from €1.10 total annually to €1.20. Its dividends have grown at less than 1% per annum over this time frame. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Over the past five years, it looks as though INDUS Holding's EPS has declined at around 2.9% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about INDUS Holding's payments, as there could be some issues with sustaining them into the future. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 3 warning signs for INDUS Holding that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:INH

INDUS Holding

A private equity firm specializing in mergers and acquisitions and corporate spin-offs.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026