Ringmetall SE (ETR:HP3A) Might Not Be As Mispriced As It Looks

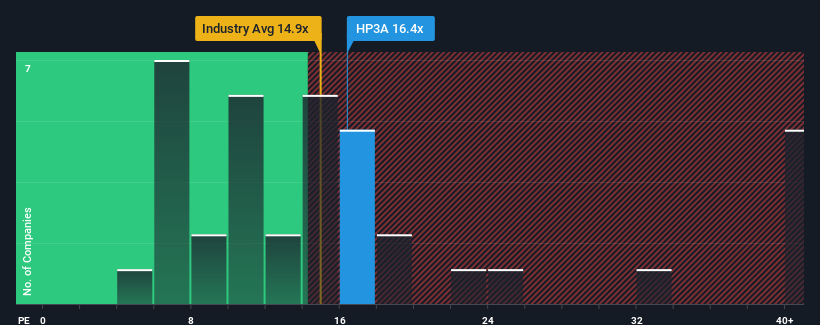

There wouldn't be many who think Ringmetall SE's (ETR:HP3A) price-to-earnings (or "P/E") ratio of 16.4x is worth a mention when the median P/E in Germany is similar at about 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Ringmetall could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Ringmetall

How Is Ringmetall's Growth Trending?

In order to justify its P/E ratio, Ringmetall would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 62%. Still, the latest three year period has seen an excellent 144% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 26% each year as estimated by the sole analyst watching the company. That's shaping up to be materially higher than the 14% per annum growth forecast for the broader market.

With this information, we find it interesting that Ringmetall is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Ringmetall's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ringmetall currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 3 warning signs for Ringmetall that you need to take into consideration.

Of course, you might also be able to find a better stock than Ringmetall. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HP3A

Ringmetall

Develops, produces, and markets packaging solutions for industrial drums in Germany and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives