- Germany

- /

- Electrical

- /

- XTRA:ENR

Pharma Mar And 2 Other Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

In the current volatile global market environment, characterized by fluctuating corporate earnings and geopolitical tensions, investors are increasingly on the lookout for opportunities that may be trading below their estimated value. Amidst these conditions, undervalued stocks can present potential opportunities for those seeking to capitalize on price discrepancies, as they often offer a chance to invest in companies with solid fundamentals at a reduced cost.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.00 | NT$527.67 | 50% |

| Brookline Bancorp (NasdaqGS:BRKL) | US$12.06 | US$24.01 | 49.8% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥101.01 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK170.60 | SEK340.70 | 49.9% |

| Elekta (OM:EKTA B) | SEK64.60 | SEK128.36 | 49.7% |

| Kinaxis (TSX:KXS) | CA$171.05 | CA$340.41 | 49.8% |

| AeroEdge (TSE:7409) | ¥1733.00 | ¥3445.33 | 49.7% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥25.94 | 49.7% |

| QuinStreet (NasdaqGS:QNST) | US$23.71 | US$47.35 | 49.9% |

| Equifax (NYSE:EFX) | US$267.52 | US$531.27 | 49.6% |

Let's dive into some prime choices out of the screener.

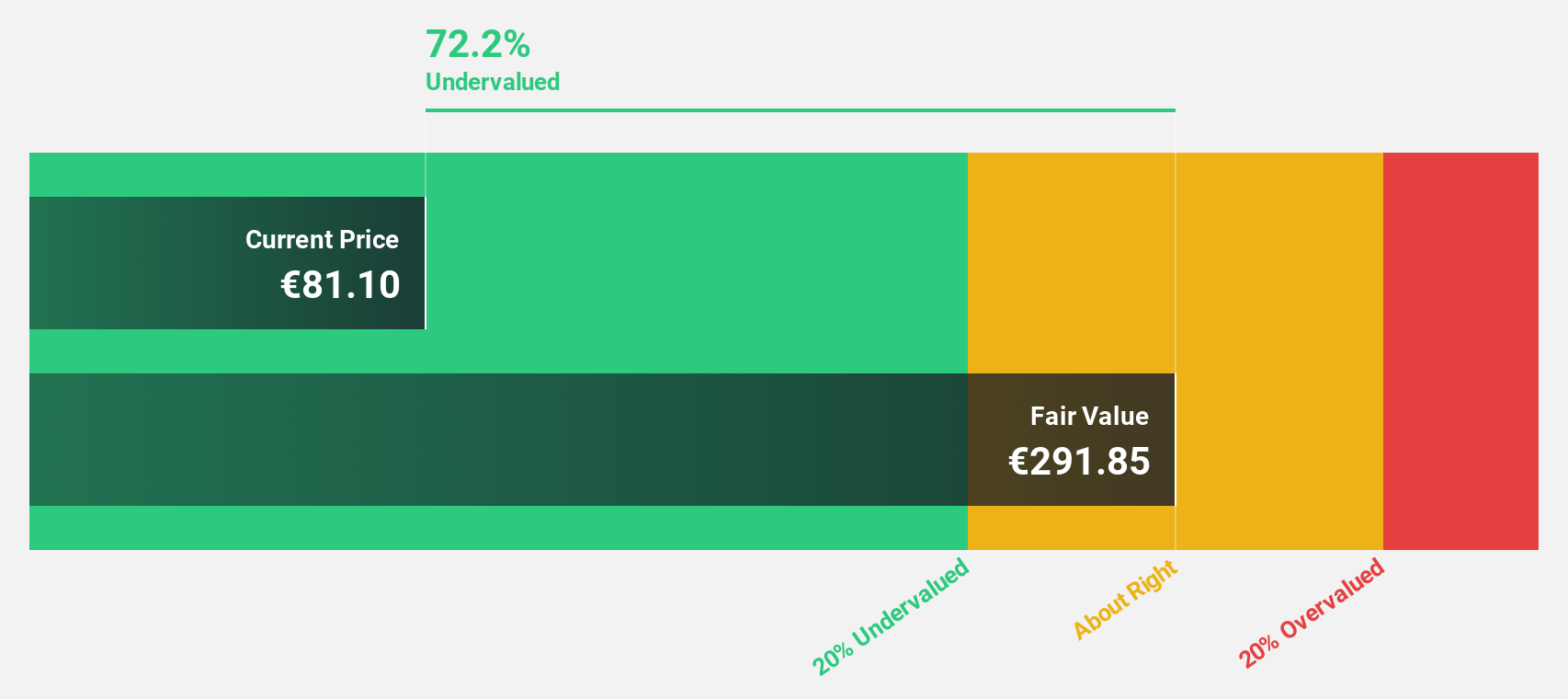

Pharma Mar (BME:PHM)

Overview: Pharma Mar, S.A. is a biopharmaceutical company focused on researching, developing, producing, and commercializing bio-active principles for oncology across various countries including Spain, Italy, Germany, Ireland, France, the rest of the European Union, and the United States; it has a market cap of €1.61 billion.

Operations: The company generates revenue primarily from its oncology segment, which amounts to €154.75 million.

Estimated Discount To Fair Value: 45%

Pharma Mar is trading at €91.05, significantly below its estimated fair value of €165.58, highlighting its undervaluation based on cash flows. Despite a volatile share price and reduced profit margins from 8.3% to 0.4%, earnings are forecasted to grow substantially at 44.74% annually over the next three years, outpacing the Spanish market's growth rate of 8.6%. Revenue growth is also expected to be robust at 23.2% per year, surpassing market averages.

- Our comprehensive growth report raises the possibility that Pharma Mar is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Pharma Mar.

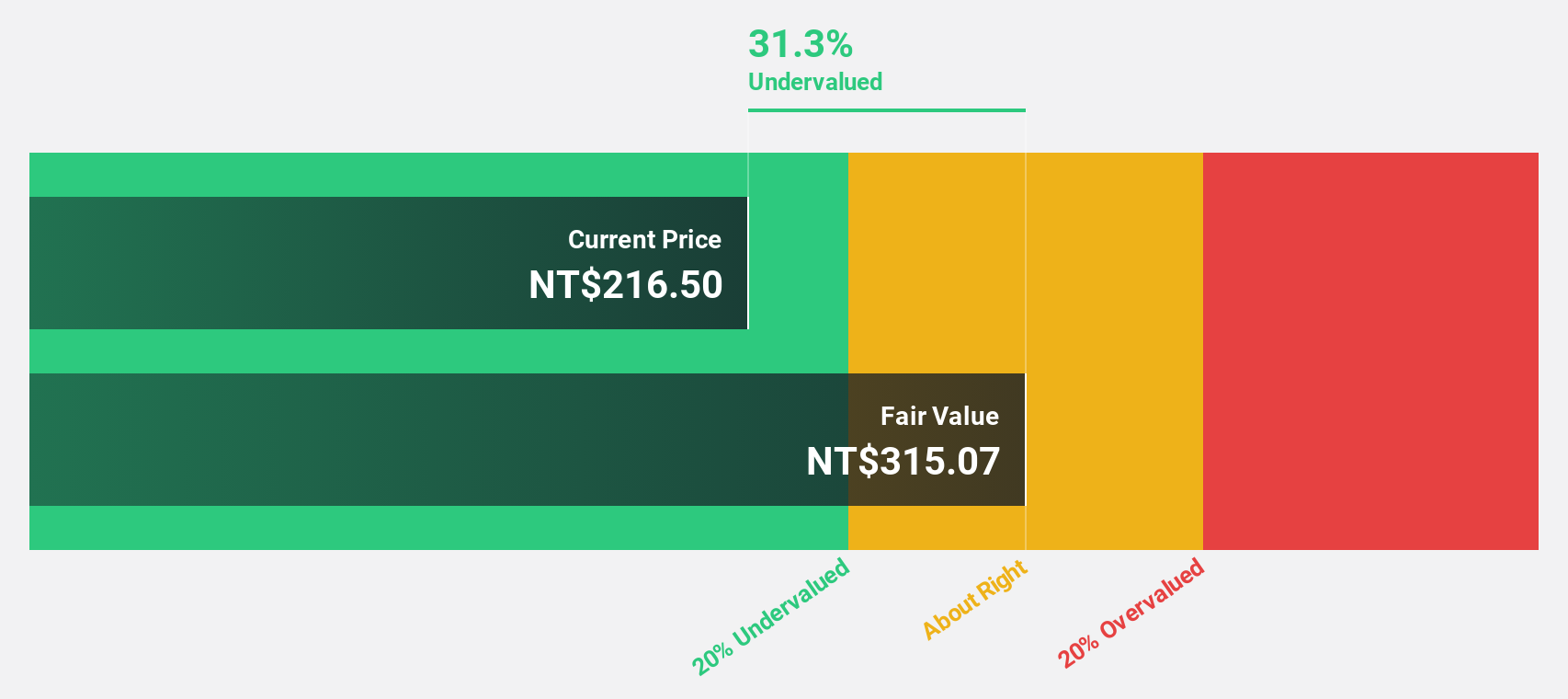

E Ink Holdings (TPEX:8069)

Overview: E Ink Holdings Inc. researches, develops, manufactures, and sells electronic paper display panels worldwide with a market cap of NT$330.02 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, totaling NT$28.32 billion.

Estimated Discount To Fair Value: 16.3%

E Ink Holdings is trading at NT$288, below its estimated fair value of NT$343.88, suggesting potential undervaluation based on cash flows. Despite a recent decline in net income, earnings are projected to grow significantly at 39.8% annually over the next three years, surpassing the Taiwan market's growth rate of 17.7%. Revenue is also expected to rise robustly at 29% per year. The company's collaboration with Cream Guitars showcases innovative applications and commitment to sustainability.

- Our expertly prepared growth report on E Ink Holdings implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of E Ink Holdings here with our thorough financial health report.

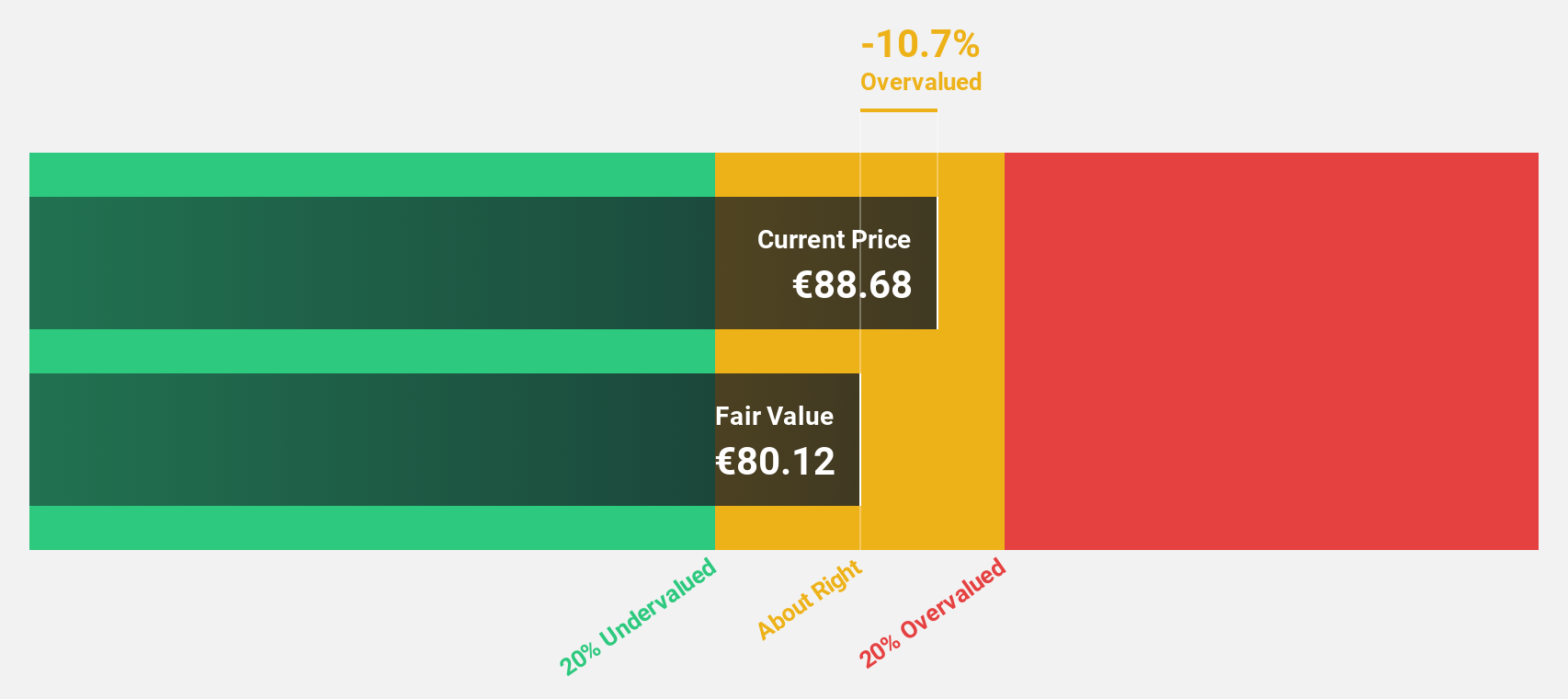

Siemens Energy (XTRA:ENR)

Overview: Siemens Energy AG is a global energy technology company with a market cap of approximately €45.70 billion.

Operations: The company's revenue is primarily derived from its Gas Services segment at €10.80 billion, Siemens Gamesa at €10.01 billion, Grid Technologies at €9.28 billion, and Transformation of Industry at €5.11 billion.

Estimated Discount To Fair Value: 14.5%

Siemens Energy is trading at €55.48, below its estimated fair value of €64.87, indicating potential undervaluation based on cash flows. The company recently returned to profitability with a net income of €1.18 billion for the year, compared to a loss previously. Earnings are forecasted to grow significantly at 26% annually over the next three years, outpacing the German market's growth rate and supported by expected revenue growth faster than the market average.

- Our growth report here indicates Siemens Energy may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Siemens Energy stock in this financial health report.

Turning Ideas Into Actions

- Discover the full array of 913 Undervalued Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ENR

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives